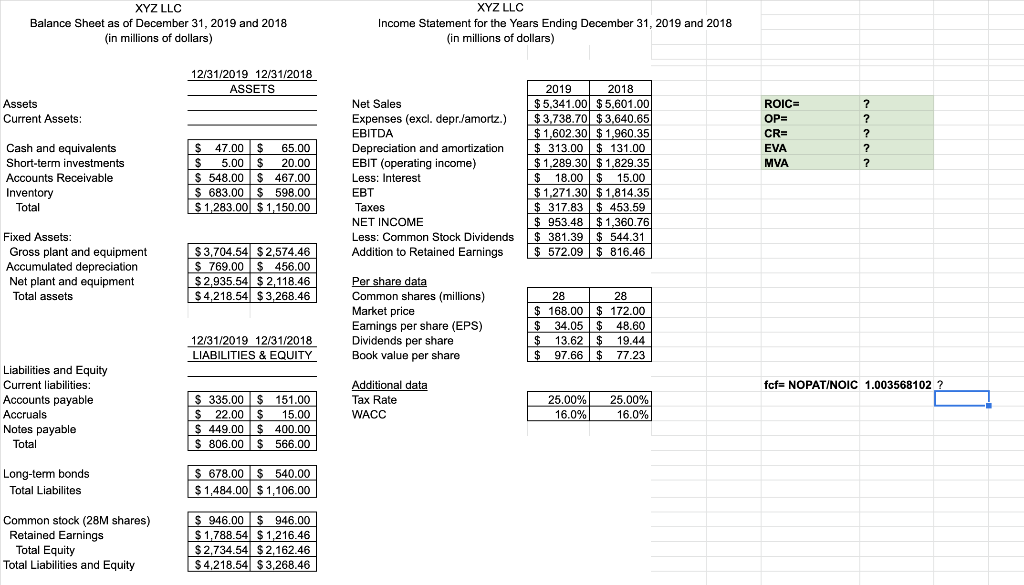

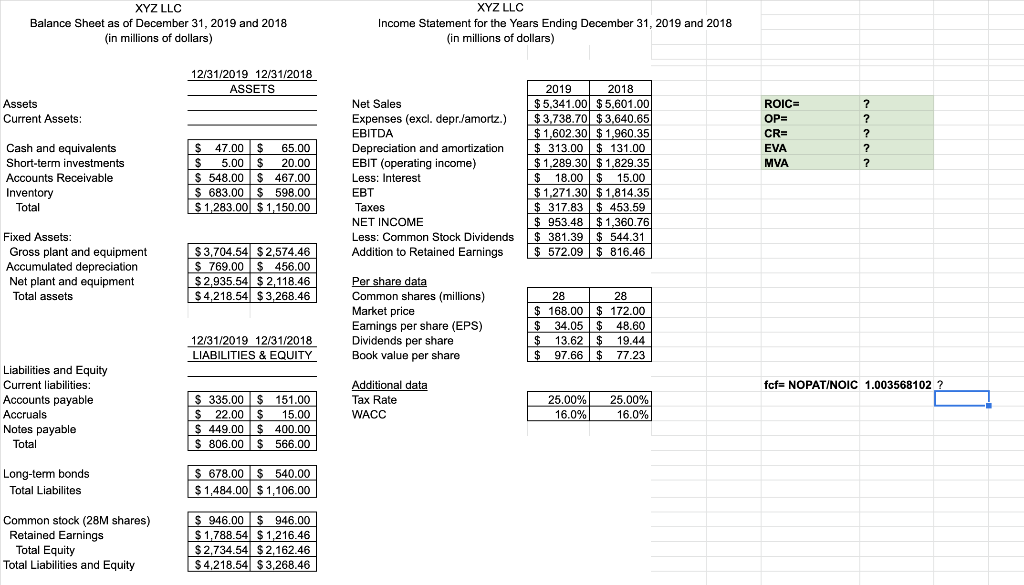

XYZ LLC Balance Sheet as of December 31, 2019 and 2018 (in millions of dollars) XYZ LLC Income Statement for the Years Ending December 31, 2019 and 2018 (in millions of dollars) 12/31/2019 12/31/2018 ASSETS Assets Current Assets: ROIC= OP= CR- EVA MVA ? ? ? ? ? Cash and equivalents Short-term investments Accounts Receivable Inventory Total $ 47.00 $ 65.00 $ 5.00 $ 20.00 $ 548.00 $ 467.00 $ 683.00 $ 598.00 $ 1,283.00 $ 1,150.00 Net Sales Expenses (excl. depr./amortz.) EBITDA Depreciation and amortization EBIT (operating income) Less: Interest EBT Taxes NET INCOME Less: Common Stock Dividends Addition to Retained Earnings 2019 2018 $5,341.00 $ 5,601.00 $ 3.738.70 $3,640.65 $ 1,602.30 $ 1,960.35 $ 313.00 $ 131.00 $ 1.289.30 $ 1,829.35 $ 18.00 $ 15.00 $1,271.30 $ 1,814.35 $ 317.83 $ 453.59 $ 953.48 $ 1,360.76 $ 381.39 $ 544.31 $ 572.09 $ 816.46 Fixed Assets: Gross plant and equipment Accumulated depreciation Net plant and equipment Total assets $ 3,704.54 $ 2,574.46 $ 769.00 $ 456.00 $ 2,935.54 $ 2,118.46 $4,218.54 $3,268.46 Per share data Common shares (millions) Market price Eamnings per share (EPS) Dividends per share Book value per share 28 28 $ 168.00 $ 172.00 $ 34.05 $ 48.60 $ 13.62 $ 19.44 $ 97.66 $ 77.23 12/31/2019 12/31/2018 LIABILITIES & EQUITY fcf= NOPAT/NOIC 1.003568102 ? Liabilities and Equity Current liabilities: Accounts payable Accruals Notes payable Total Additional data Tax Rate WACC 25.00% 16.0% 25.00% 16.0% $ 335.00 $ 151.00 $ $ 22.00 $ 15.00 $ 449.00 $ 400.00 $ 806.00 $ 566.00 Long-term bonds Total Liabilites $ 678.00 $ 540.00 $ 1,484.00 $ 1,106.00 Common stock (28M shares) Retained Earnings Total Equity Total Liabilities and Equity $ 946.00 $ 946.00 $ 1,788.54 $1,216.46 $ 2,734.54 $2,162.46 $ 4,218.54 $3,268.46 XYZ LLC Balance Sheet as of December 31, 2019 and 2018 (in millions of dollars) XYZ LLC Income Statement for the Years Ending December 31, 2019 and 2018 (in millions of dollars) 12/31/2019 12/31/2018 ASSETS Assets Current Assets: ROIC= OP= CR- EVA MVA ? ? ? ? ? Cash and equivalents Short-term investments Accounts Receivable Inventory Total $ 47.00 $ 65.00 $ 5.00 $ 20.00 $ 548.00 $ 467.00 $ 683.00 $ 598.00 $ 1,283.00 $ 1,150.00 Net Sales Expenses (excl. depr./amortz.) EBITDA Depreciation and amortization EBIT (operating income) Less: Interest EBT Taxes NET INCOME Less: Common Stock Dividends Addition to Retained Earnings 2019 2018 $5,341.00 $ 5,601.00 $ 3.738.70 $3,640.65 $ 1,602.30 $ 1,960.35 $ 313.00 $ 131.00 $ 1.289.30 $ 1,829.35 $ 18.00 $ 15.00 $1,271.30 $ 1,814.35 $ 317.83 $ 453.59 $ 953.48 $ 1,360.76 $ 381.39 $ 544.31 $ 572.09 $ 816.46 Fixed Assets: Gross plant and equipment Accumulated depreciation Net plant and equipment Total assets $ 3,704.54 $ 2,574.46 $ 769.00 $ 456.00 $ 2,935.54 $ 2,118.46 $4,218.54 $3,268.46 Per share data Common shares (millions) Market price Eamnings per share (EPS) Dividends per share Book value per share 28 28 $ 168.00 $ 172.00 $ 34.05 $ 48.60 $ 13.62 $ 19.44 $ 97.66 $ 77.23 12/31/2019 12/31/2018 LIABILITIES & EQUITY fcf= NOPAT/NOIC 1.003568102 ? Liabilities and Equity Current liabilities: Accounts payable Accruals Notes payable Total Additional data Tax Rate WACC 25.00% 16.0% 25.00% 16.0% $ 335.00 $ 151.00 $ $ 22.00 $ 15.00 $ 449.00 $ 400.00 $ 806.00 $ 566.00 Long-term bonds Total Liabilites $ 678.00 $ 540.00 $ 1,484.00 $ 1,106.00 Common stock (28M shares) Retained Earnings Total Equity Total Liabilities and Equity $ 946.00 $ 946.00 $ 1,788.54 $1,216.46 $ 2,734.54 $2,162.46 $ 4,218.54 $3,268.46