Question

XYZ ltd has identified 2 projects for investment, A and B. Both projects would last for 2 years. The company pays a corporate tax rate

XYZ ltd has identified 2 projects for investment, A and B. Both projects would last for 2 years. The company pays a corporate tax rate of 35% on its cash flow. It can have a 100% first year capital allowance on all forms of capital spending, and is allowed to carry forward but not backward. XYZ ltd has a fixed income of 50,000 every year. The prevailing annual discount rate is 10%.

Project A requires an initial investment of 150,000 and will generate 200,000 and 250,000 respectively at the end of each year. Project B requires an initial investment of 300,000 and will generate 500,000 at the end of the project.

(a) Which project(s) the company should invest? Explain your reasoning and show all the necessary calculations.

(b) Do you agree with the following statement? Briefly discuss your reasoning. The Net Present Value method generally is the best method to evaluate investment projects and to help firms with capital budget decision. It tells how much added value a firm may have by carrying out the project. The decision rule is simply. Firms should accept a project with a positive NPV and reject one with a negative NPV.

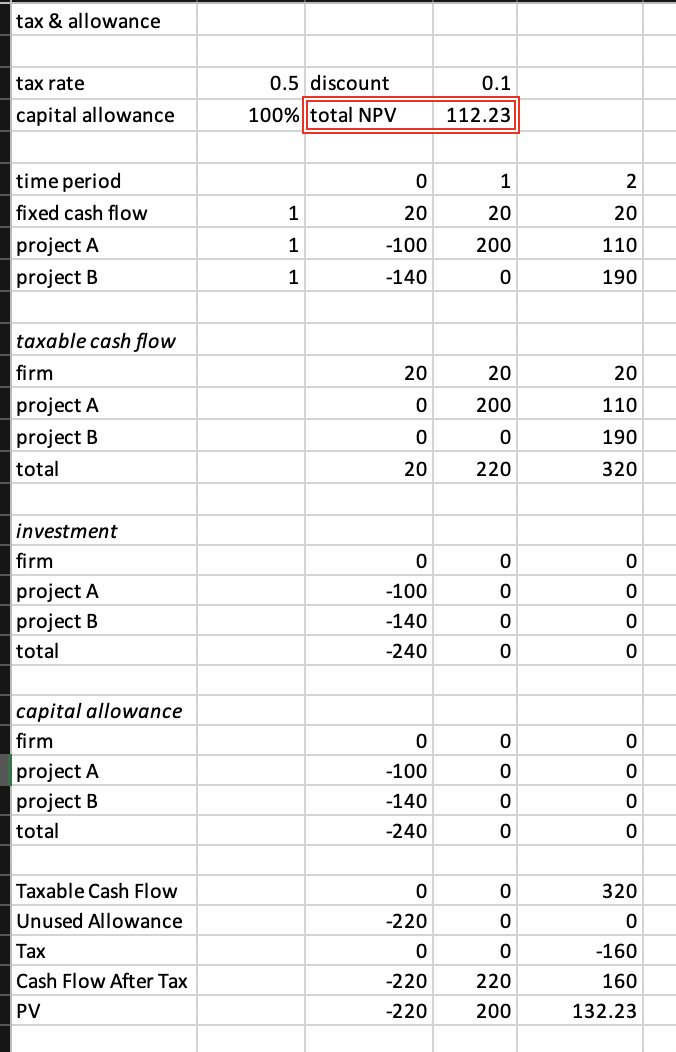

Please could you lay it out in this format

tax & allowance tax rate 0.1 0.5 discount 100%total NPV capital allowance 112.23 0 1 2 1 20 20 20 time period fixed cash flow project A project B 1 -100 200 110 1 -140 0 190 20 20 20 taxable cash flow firm project A project B total 0 200 110 0 0 190 20 220 320 0 0 investment firm project A project B total -100 0 Oo oo -140 -240 O 0 capital allowance firm project A project B total -100 O O O O 0 -140 -240 0 0 320 -220 0 Taxable Cash Flow Unused Allowance Tax Cash Flow After Tax PV 0 -160 0 0 160 -220 -220 220 200 132.23

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started