Question

XYZ Ltd. has issued two classes of preference shares: i) The first class was issued at a fair value of $50 million. These shares give

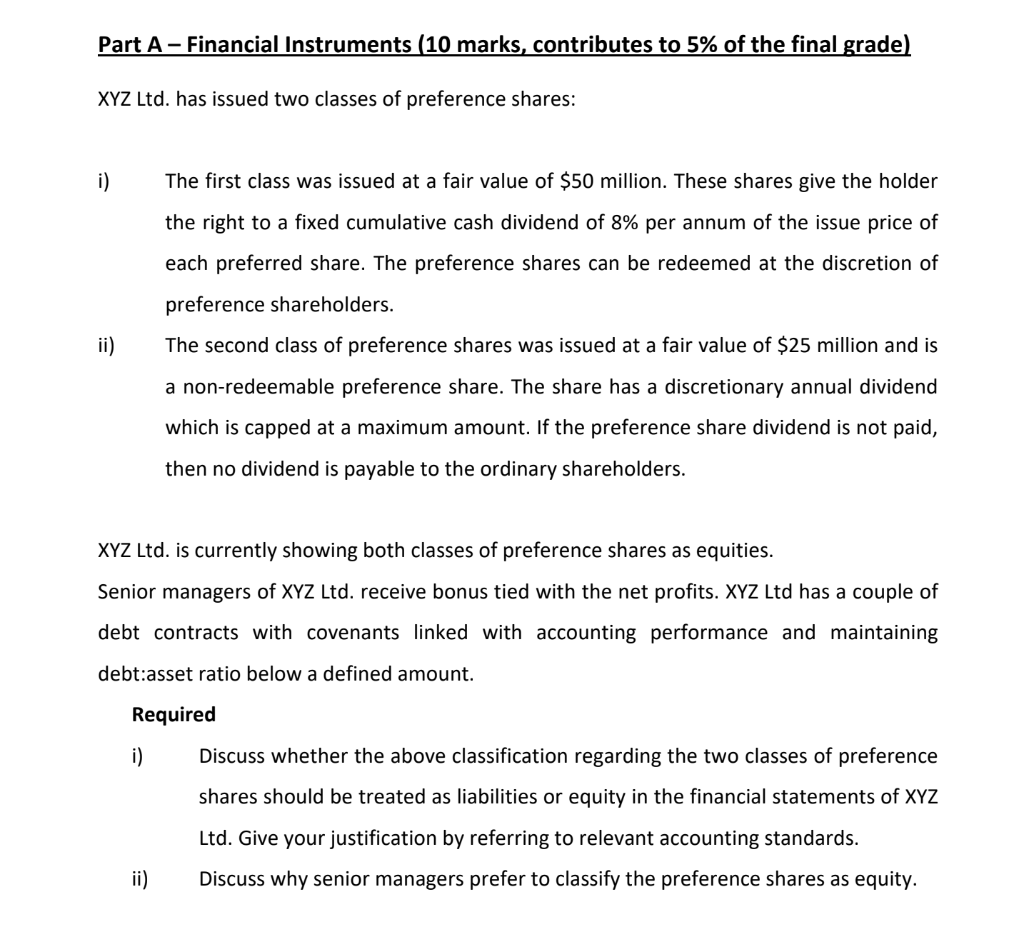

XYZ Ltd. has issued two classes of preference shares:

i) The first class was issued at a fair value of $50 million. These shares give the holder the right to a fixed cumulative cash dividend of 8% per annum of the issue price of each preferred share. The preference shares can be redeemed at the discretion of preference shareholders. ii) The second class of preference shares was issued at a fair value of $25 million and is a non-redeemable preference share. The share has a discretionary annual dividend which is capped at a maximum amount. If the preference share dividend is not paid, then no dividend is payable to the ordinary shareholders.

XYZ Ltd. is currently showing both classes of preference shares as equities. Senior managers of XYZ Ltd. receive bonus tied with the net profits. XYZ Ltd has a couple of debt contracts with covenants linked with accounting performance and maintaining debt:asset ratio below a defined amount.

Required i) Discuss whether the above classification regarding the two classes of preference shares should be treated as liabilities or equity in the financial statements of XYZ  Ltd. Give your justification by referring to relevant accounting standards. ii) Discuss why senior managers prefer to classify the preference shares as equity.

Ltd. Give your justification by referring to relevant accounting standards. ii) Discuss why senior managers prefer to classify the preference shares as equity.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started