Answered step by step

Verified Expert Solution

Question

1 Approved Answer

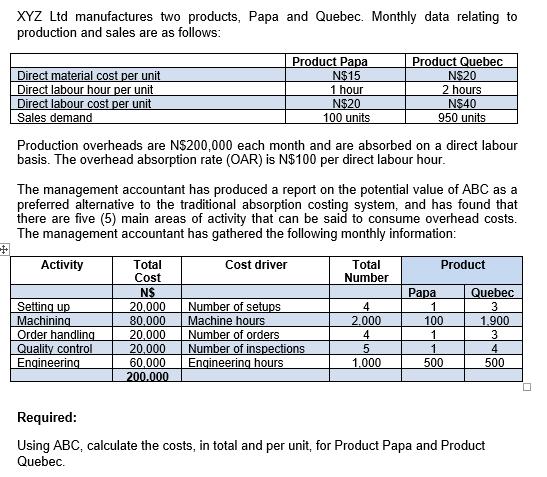

XYZ Ltd manufactures two products, Papa and Quebec. Monthly data relating to production and sales are as follows: Direct material cost per unit Direct

XYZ Ltd manufactures two products, Papa and Quebec. Monthly data relating to production and sales are as follows: Direct material cost per unit Direct labour hour per unit Direct labour cost per unit Sales demand Product Papa N$15 1 hour N$20 100 units Product Quebec N$20 2 hours N$40 950 units Production overheads are N$200,000 each month and are absorbed on a direct labour basis. The overhead absorption rate (OAR) is N$100 per direct labour hour. The management accountant has produced a report on the potential value of ABC as a preferred alternative to the traditional absorption costing system, and has found that there are five (5) main areas of activity that can be said to consume overhead costs. The management accountant has gathered the following monthly information: Activity Total Cost driver Cost Total Number Product NS Papa Quebec Setting up 20,000 Number of setups 4 1 3 Machining 80,000 Machine hours 2,000 100 1.900 Order handling 20,000 Number of orders 4 1 3 Quality control 20,000 Engineering 60,000 Number of inspections Engineering hours 5 1 4 1,000 500 500 200.000 Required: Using ABC, calculate the costs, in total and per unit, for Product Papa and Product Quebec.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started