Answered step by step

Verified Expert Solution

Question

1 Approved Answer

XYZ Ltd operate two production lines. One was installed in April 2018 at a cost of 200,000. The other was installed in February 2020

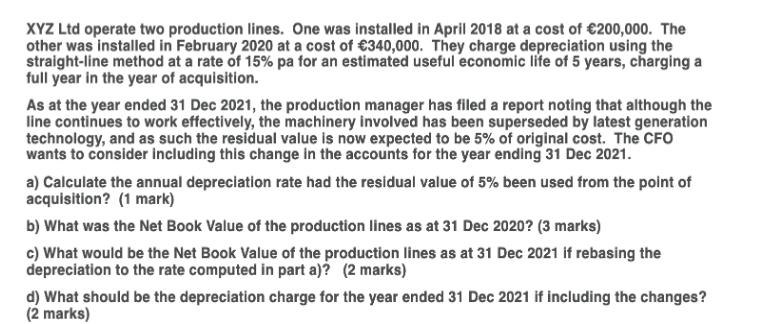

XYZ Ltd operate two production lines. One was installed in April 2018 at a cost of 200,000. The other was installed in February 2020 at a cost of 340,000. They charge depreciation using the straight-line method at a rate of 15% pa for an estimated useful economic life of 5 years, charging a full year in the year of acquisition. As at the year ended 31 Dec 2021, the production manager has filed a report noting that although the line continues to work effectively, the machinery involved has been superseded by latest generation technology, and as such the residual value is now expected to be 5% of original cost. The CFO wants to consider including this change in the accounts for the year ending 31 Dec 2021. a) Calculate the annual depreciation rate had the residual value of 5% been used from the point of acquisition? (1 mark) b) What was the Net Book Value of the production lines as at 31 Dec 2020? (3 marks) c) What would be the Net Book Value of the production lines as at 31 Dec 2021 if rebasing the depreciation to the rate computed in part a)? (2 marks) d) What should be the depreciation charge for the year ended 31 Dec 2021 if including the changes? (2 marks)

Step by Step Solution

★★★★★

3.55 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

a Cost of assets 10000 Less Residual value 500 Depreciable value 9500 Useful life in years ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started