1. XYZ Ltd. (XYZ) yesterday issued a $1,000 par value 5 year bond (the Bond), In evaluating any capital budgeting proposal, XYZ has, historically, utilized

1. XYZ Ltd. ("XYZ") yesterday issued a $1,000 par value 5 year bond ("the Bond"),

In evaluating any capital budgeting proposal, XYZ has, historically, utilized a Required Rate of Return of 25%.

As a purchaser of the Bond, you know that you will have to report your receipt of investment income of $60 x 2 — $120.00 (Total) each year on your personal income tax return.

You paid $950.00 Cdn for the Bond upon the issuance of the Bond..

Your analysis of the Equity Markets leads you to conclude that:

- The yield on a common share of XYZ is 10%;

- the Beta of a common share of XYZ is 2.1, and,

- The Yield on a preferred share of XYZ is 14%.

Required:

- What Yield did you use for the purchase of the Bond. Show ALL necessary supporting calculations! (8 Marks Total)

- Explain, in "bullet point" form, why the Bond sold at $950.00 (2 Marks Total)

2. XYZ Inc. operates a "gaming" operation. XYZ utilizes a RRR of 14% in evaluating its long-term capital investment decisions.

On January 1, 2023, XYZ offered a $200,000.00 "Maga Bucks Bingo" under the following terms and conditions.

The winner of the Bingo has to choose from two mutually exclusive Options:

Option # 1:

The winner will receive $200,000 at the end of Year 10.

Option 2:

The winner will receive $120,000.00 on January 1, 2023.

Required:

- Assuming you are the winner and that you have a RRR of 8%, what Option would you choose and why? [3.5 Marks]

- At what approximate RRR would you be indifferent to relative to Both Options? Why?

- 3.

- 4. ABC Manufacturing Co. ("ABC") is considering expanding into a new product line ("the Project") for the production of Widgets.

Jim, the CEO of ABC, has asked you to (i) evaluate the Project, utilizing appropriate quantitative analysis, and (ii) advise him accordingly.

You have accumulated the following background information relative to the Project:

- The Project will terminate at the end of 5 years;

- Jim owns 90% of the shares of ABC. Jim is the sole Director of ABC;

- The Project will require $2,000,000 in capital equipment at the start of the Project;

- ABC has a corporate income tax rate of 15%;

- Total sales revenue in Year I are projected to be $3,000,000. In each year thereafter, sales price per unit is budgeted to grow at a rate of 10% over the prior year sales price per unit;

- Jim advises that, based on his previous business experience, he expects to "garbage" all equipment at the end of the Project;

- Each widget will sell at $100.00;

- The variable cost be widget will be $30.00;

- The annual Fixed Costs will be $120,000;

- Jim likes "straight-line" depreciation...makes it very easy for him to understand depreciation expense;

- Roger, Jim's brother, owns 10% of the shares of ABC;

- Historically, ABC has always used a RRR of 8% in evaluating capital investment decisions;

- ABC has ample cash in the bank. Thus, no new debt or new equity will be issued to finance the Project;

- Jim gets paid $100,000 per year in Dividends from ABC;

- The Government of Canada T-Bill rate is 2%;

- The Project will require a one-time initial investment in Net Working Capital of $500,000 at the start of the Project;

- The Project will rely heavily on customers on Eastern Ukraine;

- Therefore, the number of units sold each year will remain constant during the duration of the Project.

Required:

- Undertake a complete and thorough quantitative analysis of the Project. ( 10 marks]

- Advise Jim accordingly. Use bullet point format.

- 5. You are considering the purchase of a common share of Toys R U Inc. Your investment timeline is 1 year.

Your research leads you to conclude the following:

l. Your RRR of 6% is a proper discount rate to be utilized in evaluating the share. ll. The share will sell at $100.00 at the end of Year l;

Ill. You expect the share will pay a fixed Dividend of $2.5/share at the end of Year l, and,

Required: Given the above information, how much would you be willing to pay for the share today? (i.e. Day 1 of Year l).

part B

Bingo Inc. recently financed a capital project with the issuance of ten (10) $1,000 par value Bonds and the issuance of 1,000 shares of equity.

The Bonds priced at 96% of par value. The shares were issued for $2.00 each.

The yield on the Debt was 12%, and the yield on the shares was 4%.

Required:

- What was the Debt/Equity ratio associated with the financing? [2.5 Marks]

- What are the proportional weights to be utilized in the calculation of the WACC for the project?

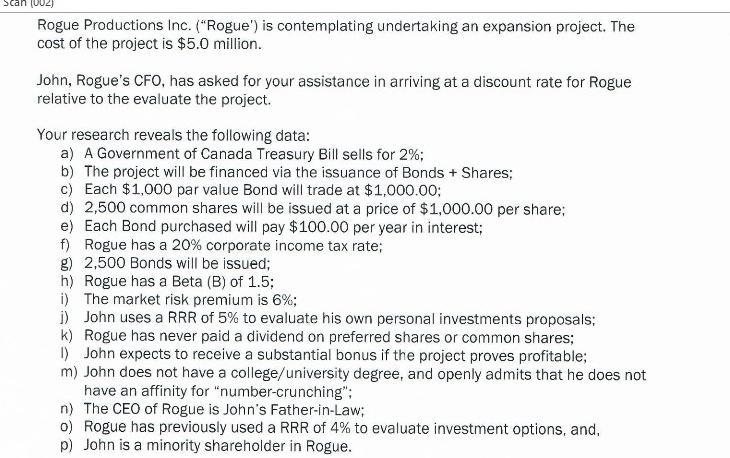

(002) Rogue Productions Inc. ("Rogue') is contemplating undertaking an expansion project. The cost of the project is $5.0 million. John, Rogue's CFO, has asked for your assistance in arriving at a discount rate for Rogue relative to the evaluate the project. Your research reveals the following data: a) A Government of Canada Treasury Bill sells for 2%; b) The project will be financed via the issuance of Bonds + Shares; c) Each $1,000 par value Bond will trade at $1,000.00; d) 2,500 common shares will be issued at a price of $1,000.00 per share; e) Each Bond purchased will pay $100.00 per year in interest; f) Rogue has a 20% corporate income tax rate; g) 2,500 Bonds will be issued; h) Rogue has a Beta (B) of 1.5; i) The market risk premium is 6%; i) John uses a RRR of 5% to evaluate his own personal investments proposals; k) Rogue has never paid a dividend on preferred shares or common shares; 1) John expects to receive a substantial bonus if the project proves profitable; m) John does not have a college/university degree, and openly admits that he does not have an affinity for "number-crunching": n) The CEO of Rogue is John's Father-in-Law; o) Rogue has previously used a RRR of 4% to evaluate investment options, and, p) John is a minority shareholder in Rogue.

Step by Step Solution

3.46 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

1 Yield Calculation for the Bond To calculate the yield on the bond we need to determine the annual coupon payment and the purchase price of the bond Given Par value of the bond face value 1000 Coupon ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started