Answered step by step

Verified Expert Solution

Question

1 Approved Answer

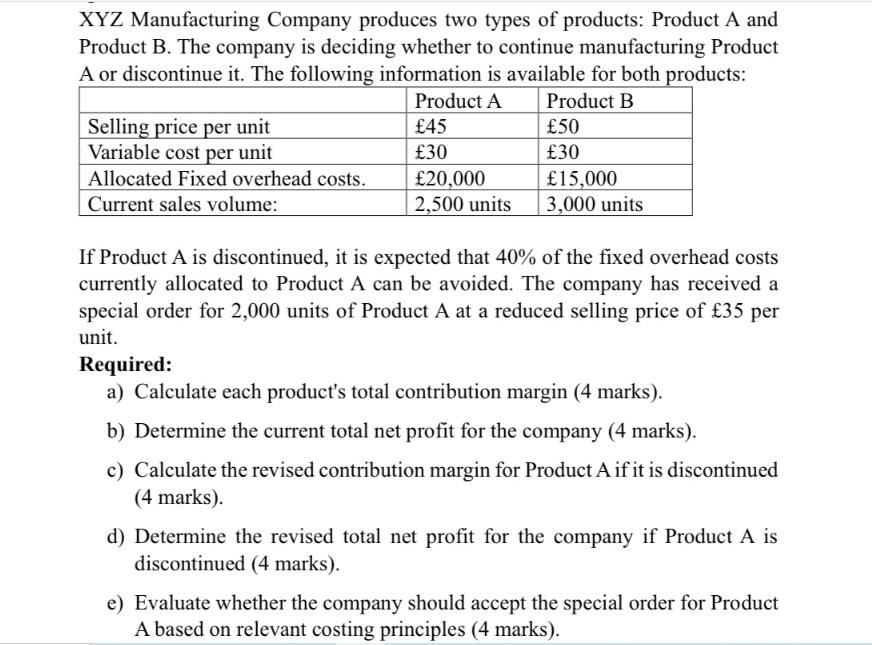

XYZ Manufacturing Company produces two types of products: Product A and Product B. The company is deciding whether to continue manufacturing Product A or

XYZ Manufacturing Company produces two types of products: Product A and Product B. The company is deciding whether to continue manufacturing Product A or discontinue it. The following information is available for both products: Product A Product B Selling price per unit 45 50 Variable cost per unit 30 30 Allocated Fixed overhead costs. 20,000 15,000 Current sales volume: 2,500 units 3,000 units If Product A is discontinued, it is expected that 40% of the fixed overhead costs currently allocated to Product A can be avoided. The company has received a special order for 2,000 units of Product A at a reduced selling price of 35 per unit. Required: a) Calculate each product's total contribution margin (4 marks). b) Determine the current total net profit for the company (4 marks). c) Calculate the revised contribution margin for Product A if it is discontinued (4 marks). d) Determine the revised total net profit for the company if Product A is discontinued (4 marks). e) Evaluate whether the company should accept the special order for Product A based on relevant costing principles (4 marks).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started