Answered step by step

Verified Expert Solution

Question

1 Approved Answer

XYZ Mortgage REIT is contemplating different leverage schemes. XYZ has $100,000,000 of cash that it would like to deploy into buying mortgages that yield

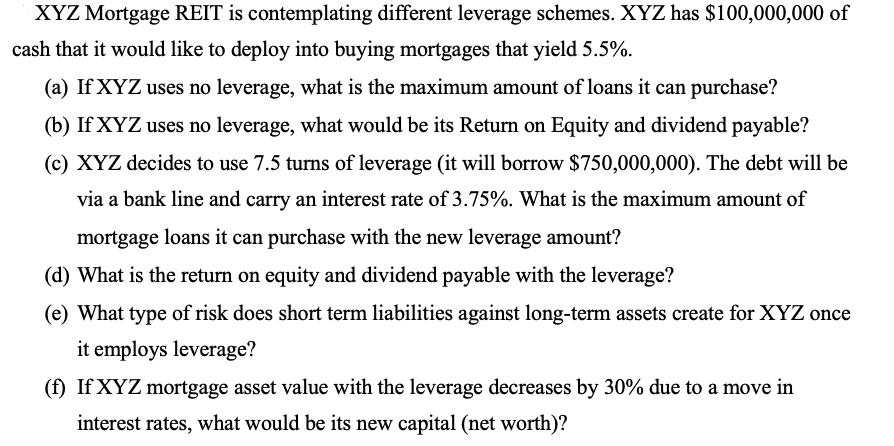

XYZ Mortgage REIT is contemplating different leverage schemes. XYZ has $100,000,000 of cash that it would like to deploy into buying mortgages that yield 5.5%. (a) If XYZ uses no leverage, what is the maximum amount of loans it can purchase? (b) If XYZ uses no leverage, what would be its Return on Equity and dividend payable? (c) XYZ decides to use 7.5 turns of leverage (it will borrow $750,000,000). The debt will be via a bank line and carry an interest rate of 3.75%. What is the maximum amount of mortgage loans it can purchase with the new leverage amount? (d) What is the return on equity and dividend payable with the leverage? (e) What type of risk does short term liabilities against long-term assets create for XYZ once it employs leverage? (f) If XYZ mortgage asset value with the leverage decreases by 30% due to a move in interest rates, what would be its new capital (net worth)?

Step by Step Solution

★★★★★

3.48 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

a It can purchase 100000000 worth on loans b Dividends payab...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started