Question

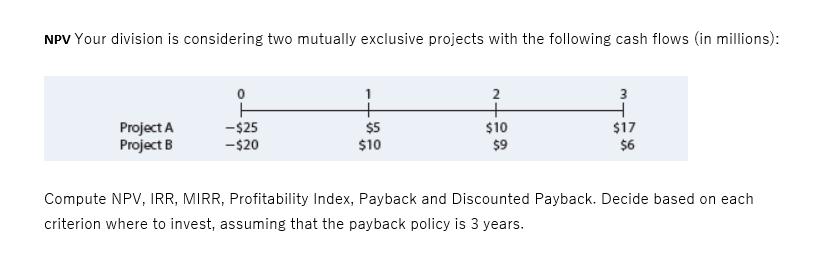

Compute NPV, IRR, MIRR, Profitability Index, Payback and Discounted Payback. Decide based on each criterion where to invest, assuming that the payback policy is 3

Compute NPV, IRR, MIRR, Profitability Index, Payback and Discounted Payback. Decide based on each criterion where to invest, assuming that the payback policy is 3 years.

I need this solved on a piece of paper, with the relevant formula's being used, since tomorrow is my exam. Please do not use any excel sheet, or any direct calculation performed in excel and help me solve this on a piece of paper. Thankyou

It would be great also if all the formula's for NPV,IRR,PI,Payback & DP are shown as further the question is solved. Thankyou

With your financial calculator, enter the following:

N = 23; I/YR = YTM = 11%; PMT = 0.09 ´ 1,000 = 90; FV = 1000; PV = VB = ?

PV = $834.67.

NPV Your division is considering two mutually exclusive projects with the following cash flows (in millions): Project A Project B -$25 -$20 $5 $10 2 + $10 $9 3 $17 $6 Compute NPV, IRR, MIRR, Profitability Index, Payback and Discounted Payback. Decide based on each criterion where to invest, assuming that the payback policy is 3 years.

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Computation of Nov of projects i Required Rate of Return Project Ai yeau L 2 3 1221 cash flows Proj...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started