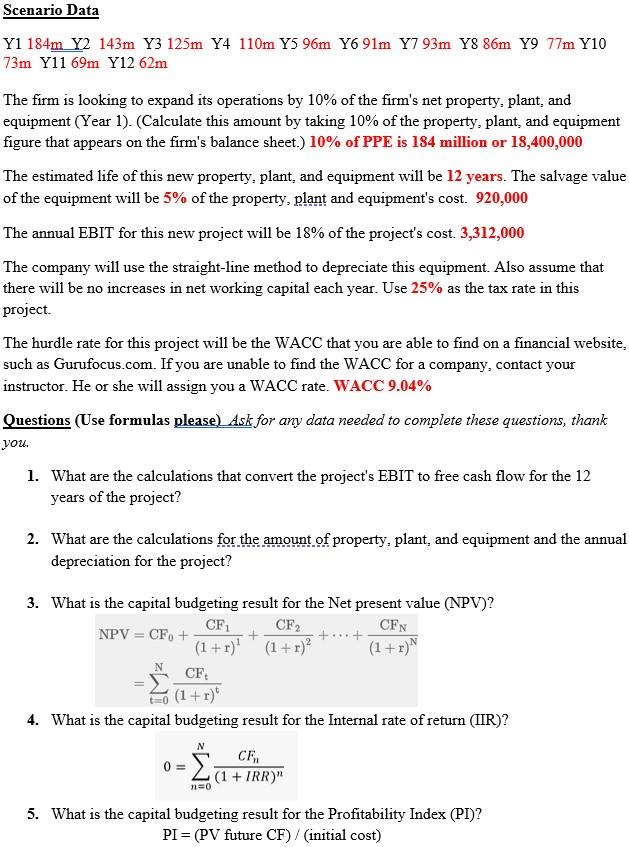

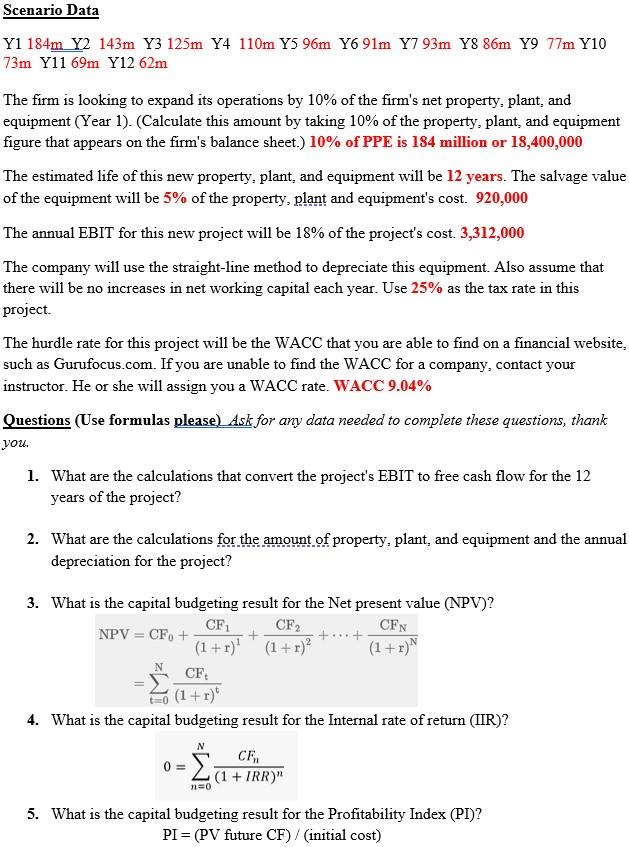

Y1184m Y2 143mY3125mY4110mY596mY691mY793m Y8 86m Y 77mY10 The firm is looking to expand its operations by 10% of the firm's net property, plant, and equipment (Year 1). (Calculate this amount by taking 10% of the property, plant, and equipment figure that appears on the firm's balance sheet.) 10% of PPE is 184 million or 18,400,000 The estimated life of this new property, plant, and equipment will be 12 years. The salvage value of the equipment will be 5% of the property, plant and equipment's cost. 920,000 The annual EBIT for this new project will be 18% of the project's cost. 3,312,000 The company will use the straight-line method to depreciate this equipment. Also assume that there will be no increases in net working capital each year. Use 25% as the tax rate in this project. The hurdle rate for this project will be the WACC that you are able to find on a financial website, such as Gurufocus.com. If you are unable to find the WACC for a company, contact your instructor. He or she will assign you a WACC rate. WACC 9.04% Questions (Use formulas please) Ask for any data needed to complete these questions, thank you. 1. What are the calculations that convert the project's EBIT to free cash flow for the 12 years of the project? 2. What are the calculations for the amount of property, plant, and equipment and the annual depreciation for the project? 3. What is the capital budgeting result for the Net present value (NPV)? NPV=CF0+(1+r)1CF1+(1+r)2CF2++(1+r)NCFN=t=0N(1+r)tCFt 4. What is the capital budgeting result for the Internal rate of return (IIR)? 0=n=0N(1+IRR)nCFn 5. What is the capital budgeting result for the Profitability Index (PI)? PI=(PV future CF)/ (initial cost) Y1184m Y2 143mY3125mY4110mY596mY691mY793m Y8 86m Y 77mY10 The firm is looking to expand its operations by 10% of the firm's net property, plant, and equipment (Year 1). (Calculate this amount by taking 10% of the property, plant, and equipment figure that appears on the firm's balance sheet.) 10% of PPE is 184 million or 18,400,000 The estimated life of this new property, plant, and equipment will be 12 years. The salvage value of the equipment will be 5% of the property, plant and equipment's cost. 920,000 The annual EBIT for this new project will be 18% of the project's cost. 3,312,000 The company will use the straight-line method to depreciate this equipment. Also assume that there will be no increases in net working capital each year. Use 25% as the tax rate in this project. The hurdle rate for this project will be the WACC that you are able to find on a financial website, such as Gurufocus.com. If you are unable to find the WACC for a company, contact your instructor. He or she will assign you a WACC rate. WACC 9.04% Questions (Use formulas please) Ask for any data needed to complete these questions, thank you. 1. What are the calculations that convert the project's EBIT to free cash flow for the 12 years of the project? 2. What are the calculations for the amount of property, plant, and equipment and the annual depreciation for the project? 3. What is the capital budgeting result for the Net present value (NPV)? NPV=CF0+(1+r)1CF1+(1+r)2CF2++(1+r)NCFN=t=0N(1+r)tCFt 4. What is the capital budgeting result for the Internal rate of return (IIR)? 0=n=0N(1+IRR)nCFn 5. What is the capital budgeting result for the Profitability Index (PI)? PI=(PV future CF)/ (initial cost)