Question

Yah Yah Corporations (YY) issues a bond that pays 10% semi-annual coupon, have a $1,000 face value, and mature in 10 years. If YY

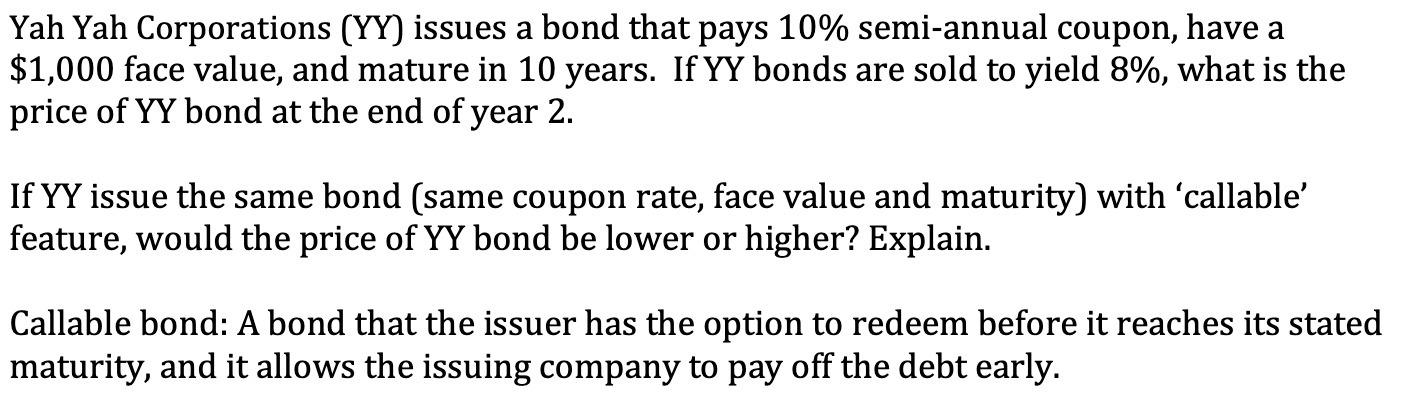

Yah Yah Corporations (YY) issues a bond that pays 10% semi-annual coupon, have a $1,000 face value, and mature in 10 years. If YY bonds are sold to yield 8%, what is the price of YY bond at the end of year 2. If YY issue the same bond (same coupon rate, face value and maturity) with 'callable' feature, would the price of YY bond be lower or higher? Explain. Callable bond: A bond that the issuer has the option to redeem before it reaches its stated maturity, and it allows the issuing company to pay off the debt early.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer tdescribes a callable bond issued by Yah Yah Corporations YY The bond has a 10 semiannual cou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Contemporary Engineering Economics

Authors: Chan S. Park

5th edition

136118488, 978-8120342095, 8120342097, 978-0136118480

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App