Answered step by step

Verified Expert Solution

Question

1 Approved Answer

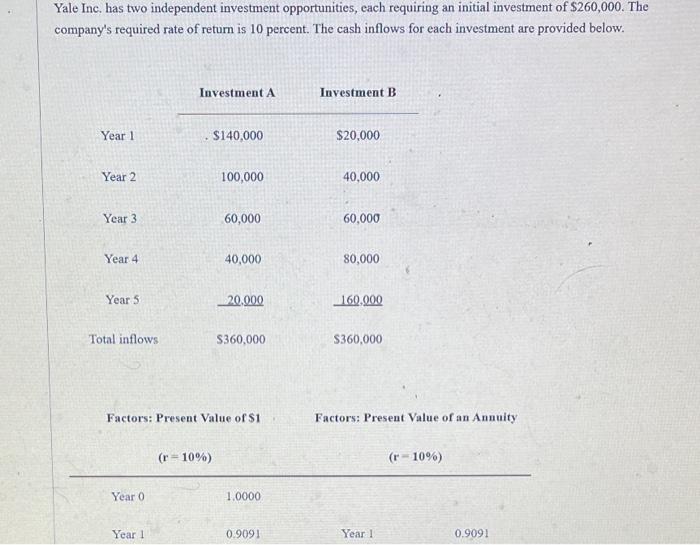

Yale Inc. has two independent inyvestment opportunities, each requiring an initial investment of $260,000. The company's required rate of return is 10 percent. The

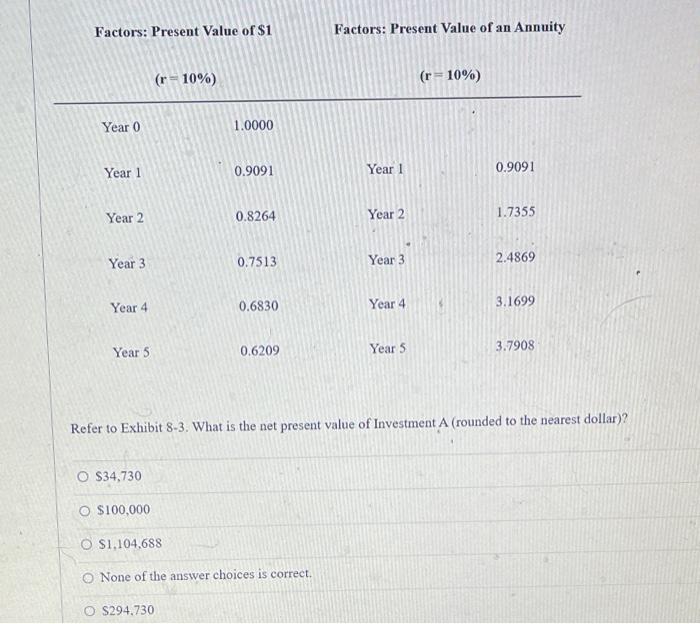

Yale Inc. has two independent inyvestment opportunities, each requiring an initial investment of $260,000. The company's required rate of return is 10 percent. The cash inflows for each investment are provided below. Investment A Investment B Year 1 $140,000 $20,000 Year 2 100,000 40,000 Year 3 60,000 60,000 Year 4 40,000 80,000 Year 5 20.000 160.000 Total inflows S360,000 S360,000 Factors: Present Value of S1 Factors: Present Value of an Annuity (r = 10%) (r- 10%) Year 0 1.0000 Year 1 0.9091 Year 1 0,9091 Factors: Present Value of $1 Factors: Present Value of an Annuity (r= 10%) (r= 10%) Year 0 1.0000 Year 1 0.9091 Year 1 0.9091 Year 2 0.8264 Year 2 1.7355 Year 3 0.7513 Year 3 2.4869 Year 4 0.6830 Year 4 3.1699 0.6209 Year 5 3.7908 Year 5 Refer to Exhibit 8-3. What is the net present value of Investment A (rounded to the nearest dollar)? O 34,730 O S100,000 O S1,104,688 O None of the answer choices is correct. O S294.730

Step by Step Solution

★★★★★

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

PRESENT VALUE year investment A investment B PV 10 investment A investment B 260000 14000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started