Answered step by step

Verified Expert Solution

Question

1 Approved Answer

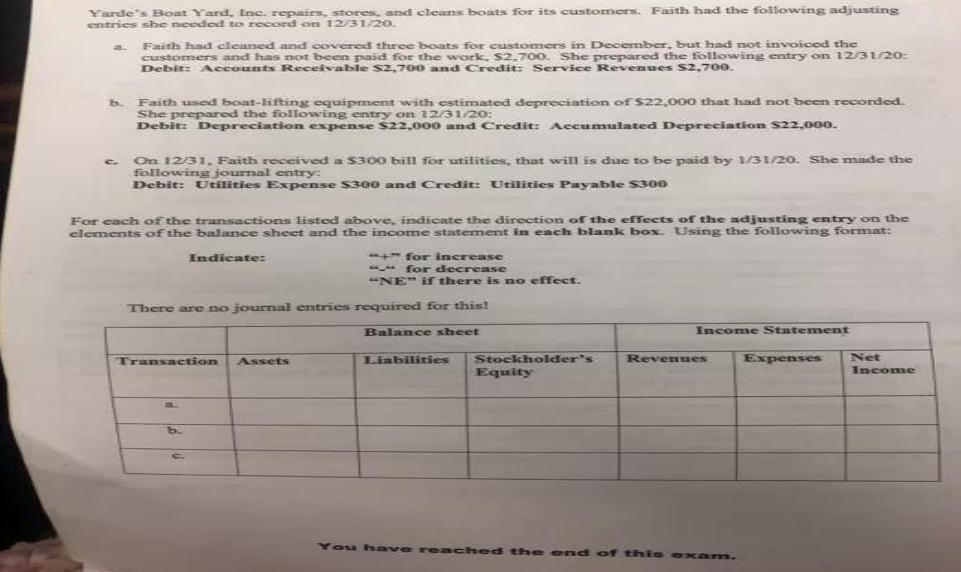

Yarde's Boat Yard, nc. repairs stores, and cleans boats for its customers. entries sbe needed to record on 12/31/20. Faith had the foilowing adjusting

Yarde's Boat Yard, nc. repairs stores, and cleans boats for its customers. entries sbe needed to record on 12/31/20. Faith had the foilowing adjusting Faith had cleaned and covered three boats for customers in December, but had not invoiced the customers and has not been paid for the work, S2,700. She prepared the following entry on 12/31/20: Debit: Accounts Receivable S2,700 and Credit: Service Revenues S2,700. b. Faith used boat-liRing equipment with estimated depreciation of $22,000 that had not been recorded. She prepared the following entry on 12/31/20: Debit: Depreciation expense $22,000 and Credit: Accumulated Depreciation S22,000. On 1231, Faith received a S300 bill for utilities, that will is due to be paid by 1/31/20. She made the following journal entry: Debit: Utilities Expense S300 and Credit: Utilities Payable S300 For each of the transactions listed above, indicate the direction of the effects of the adjusting entry on the edements of the balance sheet and the income statement in each blank box. Using the following format: for increase for decrease Indicate: "NE" if there is no effect. There are no jourmal entries required for this! Balance sheet Income Statement Net Stockholder's Equity Transaction Assets Liabilities Revenues Expenses Income b. You h ave re ached the e nd of this e xam.

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

answer BALANCE SHEET INCOME STATEMENT Transactions Asset Li...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started