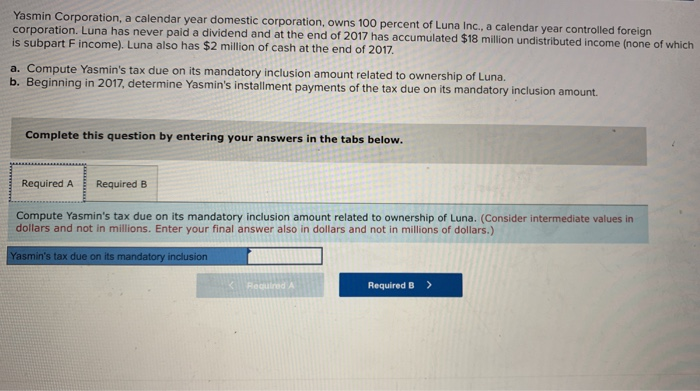

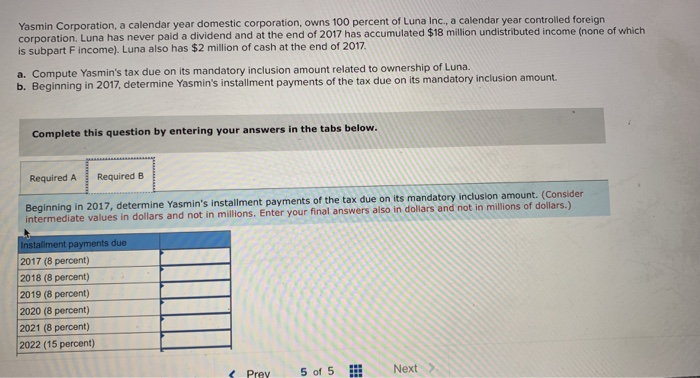

Yasmin Corporation, a calendar year domestic corporation, owns 100 perc corporation. Luna has never paid a dividend and at the end of 2017 has accumulated $18 million undistributed income (none of which is subpart F income). Luna also has $2 million of cash at the end of 2017 ent of Luna Inc., a calendar year controlled foreign a. Compute Yasmin's tax due on its mandatory inclusion amount related to ownership of Luna. b. Beginning in 20 17, determine Yasmin's installment payments of the tax due on its mandatory inclusion amount. Complete this question by entering your answers in the tabs below. Required A Required B Compute Yasmin's tax due on its mandatory inclusion amount related to ownership of Luna. (Consider intermediate values in dollars and not in millions. Enter your final answer also in dollars and not in millions of dollars.) Yasmin's tax due on its Required B> Required A in Corporation, a calendar year domestic corporation, owns 100 percent of Luna Inc., a calendar year controlled foreign corporation. Luna has never paid a dividend and at the end of 2017 has accumulated $18 million undistributed income (none of which is subpart F income). Luna also has $2 million of cash at the end of 2017. Compute Yasmin's tax due on its mandatory inclusion amount related to ownership of Luna. Beginning in 2017, determine Yasmin's installment payments of the tax due on its mandatory inclusion amount a. b. mplete this question by entering your answers in the tabs below Required B Required A Beginning in 2017, determine Yasmin's installment payments of the tax due on its mandatory inclusion amount. (Consid intermediate values in dollars and not in millio ns. Enter your final answers also in dollars and not in millions of dollars.) ts due ment 2017 (8 percent) 2018 (8 percent) 2019 (8 percent) 2020 (8 percent) 2021 (8 percent) 2022 (15 percent) Next s Prey5 of 5 Yasmin Corporation, a calendar year domestic corporation, owns 100 perc corporation. Luna has never paid a dividend and at the end of 2017 has accumulated $18 million undistributed income (none of which is subpart F income). Luna also has $2 million of cash at the end of 2017 ent of Luna Inc., a calendar year controlled foreign a. Compute Yasmin's tax due on its mandatory inclusion amount related to ownership of Luna. b. Beginning in 20 17, determine Yasmin's installment payments of the tax due on its mandatory inclusion amount. Complete this question by entering your answers in the tabs below. Required A Required B Compute Yasmin's tax due on its mandatory inclusion amount related to ownership of Luna. (Consider intermediate values in dollars and not in millions. Enter your final answer also in dollars and not in millions of dollars.) Yasmin's tax due on its Required B> Required A in Corporation, a calendar year domestic corporation, owns 100 percent of Luna Inc., a calendar year controlled foreign corporation. Luna has never paid a dividend and at the end of 2017 has accumulated $18 million undistributed income (none of which is subpart F income). Luna also has $2 million of cash at the end of 2017. Compute Yasmin's tax due on its mandatory inclusion amount related to ownership of Luna. Beginning in 2017, determine Yasmin's installment payments of the tax due on its mandatory inclusion amount a. b. mplete this question by entering your answers in the tabs below Required B Required A Beginning in 2017, determine Yasmin's installment payments of the tax due on its mandatory inclusion amount. (Consid intermediate values in dollars and not in millio ns. Enter your final answers also in dollars and not in millions of dollars.) ts due ment 2017 (8 percent) 2018 (8 percent) 2019 (8 percent) 2020 (8 percent) 2021 (8 percent) 2022 (15 percent) Next s Prey5 of 5