Question

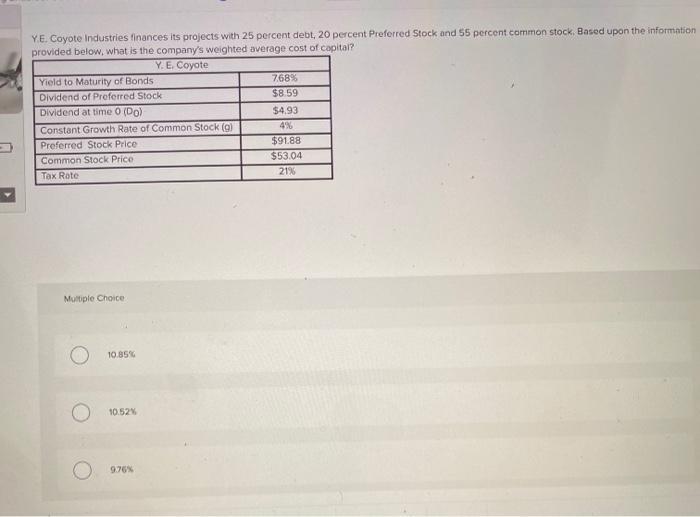

YE. Coyote Industries finances its projects with 25 percent debt, 20 percent Preferred Stock and 55 percent common stock, Based upon the information provided

YE. Coyote Industries finances its projects with 25 percent debt, 20 percent Preferred Stock and 55 percent common stock, Based upon the information provided below, what is the company's weighted average cost of capital? Y. E. Coyote 768% Yield to Maturity of Bonds Dividend of Preferred Stock $8.59 Dividend at time O (Do) $4.93 4% Constant Growth Rate of Common Stock (g) $91.88 Preferred Stock Price $53.04 Common Stock Price 21% Tax Rote Multiple Choice 10.85% 10.52% 976%

Step by Step Solution

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 kd Before tax cost of debt 1tax rate Kp Preferred Dividend Pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Economics Today

Authors: Roger LeRoy Miller

16th edition

132554615, 978-0132554619

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App