Question

Year 1 2 3 4 5 Free Cash Flow $21 million $25 million $30 million $31 million $34 million XYZ Industries is expected to

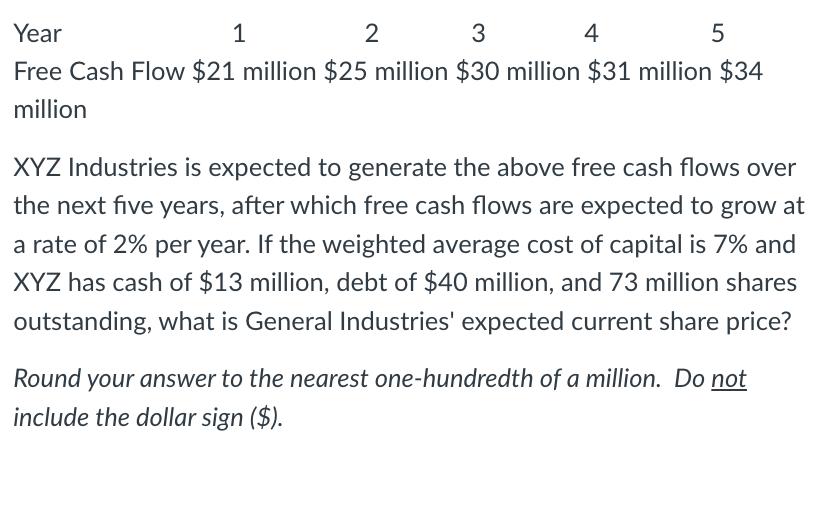

Year 1 2 3 4 5 Free Cash Flow $21 million $25 million $30 million $31 million $34 million XYZ Industries is expected to generate the above free cash flows over the next five years, after which free cash flows are expected to grow at a rate of 2% per year. If the weighted average cost of capital is 7% and XYZ has cash of $13 million, debt of $40 million, and 73 million shares outstanding, what is General Industries' expected current share price? Round your answer to the nearest one-hundredth of a million. Do not include the dollar sign ($).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

An Introduction To Statistical Methods And Data Analysis

Authors: R. Lyman Ott, Micheal T. Longnecker

7th Edition

1305269470, 978-1305465527, 1305465520, 978-1305269477

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App