Question

Year 1 2 3 4 Marketings Dollars Projections $1,000,000 $15,000,000 $40,000,000 $48,000,000 Actual Dollar Sales $11,000,000 $29,000,000 $72,000,000 X 5 6 7 8 $57,600,000 $69,100,000

| Year | 1 | 2 | 3 | 4 |

| Marketings Dollars Projections | $1,000,000 | $15,000,000 | $40,000,000 | $48,000,000 |

| Actual Dollar Sales | $11,000,000 | $29,000,000 | $72,000,000 | X |

| 5 | 6 | 7 | 8 |

| $57,600,000 | $69,100,000 | $82,900,000 | $99,500,000 |

| X | X | X | X |

| Year 1 | Year 2 | Year 3 | |

| Filter Sales | $11,000,000 | $29,000,000 | $72,000,000 |

| Marconil Purchases in Pounds | 5,000 | 13,000 | 32,000 |

| Marconil Purchases in Dollars | $195,000 | $546,000 | $1,408,000 |

| Sales Dollar per Pound of Marconil | $2,200 | $2,230 | $2,250 |

| Sales Dollar per $1 of Marconil | $56.4 | $53.1 | $51.1 |

| Percentage of Sales ($) Committed to Marconil Purchases ($) | 1.77% | 1.88% | 1.96% |

| Manufacturing Cost (28% of Sales) | $3,080,000 | $8,120,000 | $20,160,000 |

| General and Administrative Costs (25% of sales) | $2,750,000 | $7,250,000 | $18,000,000 |

| Profit from Marconil Filters Before Tax | $5,170,000 | $13,630,000 | $33,840,000 |

Is there a way to get a rough estimate on how many pounds of marconil Sabor will need in Year 4? if yes please provide the rough estimate

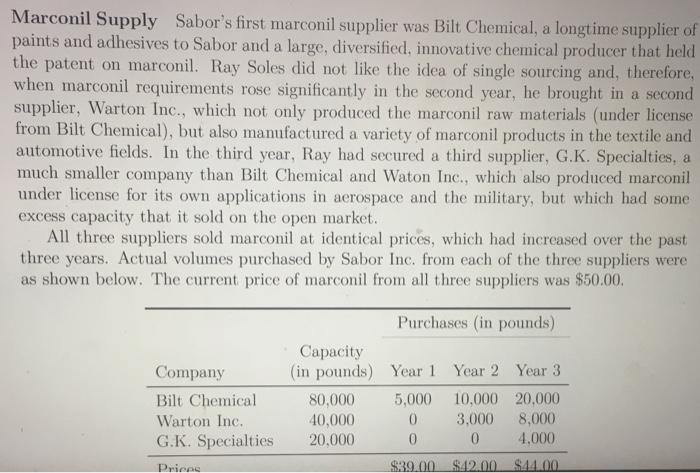

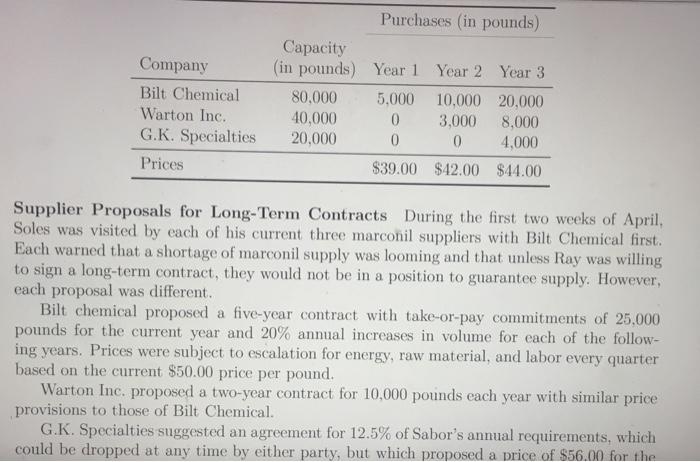

Sabor Inc. In mid-April, Ray Soles, vice president of supply chain management at Sabor Inc. had become increasingly concerned about the potential shortage of supply of marconil, a new high-tech raw material for air filtration. Sabor Inc.'s three suppliers, during the last two weeks, had advised Ray Soles to sign long-term contracts and he was trying to assess the advisability of such commitments. Sabor Inc. Sabor Inc. of Cleveland, Ohio, produced high-quality consumer and industrial air conditioning and heating units. An extensive network of independent and company- owned installation and sales centers serviced customers throughout the North American market. Total company sales last year totaled $800 million. Air Filtration and Marconil Sabor Inc. for decades had sold air humidification and air filtration units along with its prime units in air heating and cooling. Until three years ago, air filtration has accounted for about 7% of total corporate sales and had been sold primarily as add-ons to a new air cooling/heating system. However, with the advent of marconil, air filtration had started to increase significantly as a percentage of total sales. Marconil, a new high-tech product developed as part of the U.S. space effort, had a range of unique properties of high interest to a variety of industries. In the case of air filtration, when processed by a Sabor Inc, developed and patented process, marconil could be transformed into a thin, very light, and extremely fine meshlike sponge material capable of filtering extremely small particles. Given the population's sensitivity to air quality and the increasing number of people with asthma and allergies, the new Sabor filters became popular, not only with new Sabor air system installations but also as retrofits in older air conditioning and heating systems. Moreover, compared to electronic air cleaners that cost about three times as much to in- stall and required monthly cleaning, marconil filters had to be replaced every six months, guaranteeing a continued sales volume of filters for years to come. When combined with an ultraviolet light unit, which killed airborne bacteria, a marconil air cleaning system was considered a huge leap forward in air treatment. The manufacturing cost of a marconil filter accounted for about 28% of its selling price. Air Filtration Sales Along with the marconil filtration system introduction three years ago, Sabor's marketing department had initiated a significant promotional campaign directed at both the industrial and consumer sectors. Marketing's ability to forecast sales accurately has not been impressive, according to Ray Soles. For the first year, marketing had forecast marconil filter sales at $1 million, when in reality they sold $11 million. In the second year, the forecast was for $15 million and actual sales were $29 million, and in the third year, a forecast of $40 million turned into actual sales of $72 million. The marketing department expected sales growth to level off over the next three years to a rate of 20% per year. Marconil Supply Sabor's first marconil supplier was Bilt Chemical, a longtime supplier of paints and adhesives to Sabor and a large, diversified, innovative chemical producer that held the patent on marconil. Ray Soles did not like the idea of single sourcing and, therefore, when marconil requirements rose significantly in the second year, he brought in a second supplier, Warton Inc., which not only produced the marconil raw materials (under license from Bilt Chemical), but also manufactured a variety of marconil products in the textile and automotive fields. In the third year, Ray had secured a third supplier, G.K. Specialties, a much smaller company than Bilt Chemical and Waton Inc., which also produced marconil under license for its own applications in aerospace and the military, but which had some excess capacity that it sold on the open market. All three suppliers sold marconil at identical prices, which had increased over the past three years. Actual volumes purchased by Sabor Inc. from each of the three suppliers were as shown below. The current price of marconil from all three suppliers was $50.00 Purchases (in pounds) Capacity Company in pounds) Year 1 Year 2 Year 3 Bilt Chemical 80,000 5,000 10,000 20,000 Warton Inc. 40,000 3.000 8,000 G.K. Specialties 20.000 0 4.000 $39.00 $42.00 $44.00 0 0 Price Company Bilt Chemical Warton Inc. G.K. Specialties Prices Purchases (in pounds) Capacity (in pounds) Year 1 Year 2 Year 3 80.000 5.000 10,000 20,000 40,000 0 3,000 8.000 20,000 0 0 4,000 $39.00 $42.00 $44.00 Supplier Proposals for Long-Term Contracts During the first two weeks of April, Soles was visited by each of his current three marconil suppliers with Bilt Chemical first. Each warned that a shortage of marconil supply was looming and that unless Ray was willing to sign a long-term contract, they would not be in a position to guarantee supply. However, each proposal was different. Bilt chemical proposed a five-year contract with take-or-pay commitments of 25,000 pounds for the current year and 20% annual increases in volume for each of the follow- ing years. Prices were subject to escalation for energy, raw material, and labor every quarter based on the current $50.00 price per pound. Warton Inc. proposed a two-year contract for 10,000 pounds each year with similar price provisions to those of Bilt Chemical. G.K. Specialties suggested an agreement for 12.5% of Sabor's annual requirements, which could be dropped at any time by either party, but which proposed a price of $56.00 for the current year, to be adjusted semiannually, thereafter based on inflation, energy, labor, and material. Although Ray Soles did not know much about the actual manufacturing process for marconil, he had heard that increases in capacity were expensive. He also understood that two of the three component raw materials for marconil were by-products from industrial processes that were reasonable stable. 2 Since Ray Soles had been able to buy almost all of Sabor's needs on quarterly, semianuual or annual contracts, he was not particularly keen on departing from his current supply practice. He had heard some rumors that in a few years a much lower-cost substitute for marconil might be developed. He suspected that, therefore, his current suppliers were anxious to tie Sabor to a long-term commitment. April 15 On April 15, the Bilt Chemical sales representative sent an email to Ray Soles requesting a meeting on April 22. The email concluded, "I would like to bring my sales manager so that we may discuss our proposal for the marconil with you. We will not be able to guarantee you supply after August 1, if you are unable to commit." Sabor Inc. In mid-April, Ray Soles, vice president of supply chain management at Sabor Inc. had become increasingly concerned about the potential shortage of supply of marconil, a new high-tech raw material for air filtration. Sabor Inc.'s three suppliers, during the last two weeks, had advised Ray Soles to sign long-term contracts and he was trying to assess the advisability of such commitments. Sabor Inc. Sabor Inc. of Cleveland, Ohio, produced high-quality consumer and industrial air conditioning and heating units. An extensive network of independent and company- owned installation and sales centers serviced customers throughout the North American market. Total company sales last year totaled $800 million. Air Filtration and Marconil Sabor Inc. for decades had sold air humidification and air filtration units along with its prime units in air heating and cooling. Until three years ago, air filtration has accounted for about 7% of total corporate sales and had been sold primarily as add-ons to a new air cooling/heating system. However, with the advent of marconil, air filtration had started to increase significantly as a percentage of total sales. Marconil, a new high-tech product developed as part of the U.S. space effort, had a range of unique properties of high interest to a variety of industries. In the case of air filtration, when processed by a Sabor Inc, developed and patented process, marconil could be transformed into a thin, very light, and extremely fine meshlike sponge material capable of filtering extremely small particles. Given the population's sensitivity to air quality and the increasing number of people with asthma and allergies, the new Sabor filters became popular, not only with new Sabor air system installations but also as retrofits in older air conditioning and heating systems. Moreover, compared to electronic air cleaners that cost about three times as much to in- stall and required monthly cleaning, marconil filters had to be replaced every six months, guaranteeing a continued sales volume of filters for years to come. When combined with an ultraviolet light unit, which killed airborne bacteria, a marconil air cleaning system was considered a huge leap forward in air treatment. The manufacturing cost of a marconil filter accounted for about 28% of its selling price. Air Filtration Sales Along with the marconil filtration system introduction three years ago, Sabor's marketing department had initiated a significant promotional campaign directed at both the industrial and consumer sectors. Marketing's ability to forecast sales accurately has not been impressive, according to Ray Soles. For the first year, marketing had forecast marconil filter sales at $1 million, when in reality they sold $11 million. In the second year, the forecast was for $15 million and actual sales were $29 million, and in the third year, a forecast of $40 million turned into actual sales of $72 million. The marketing department expected sales growth to level off over the next three years to a rate of 20% per year. Marconil Supply Sabor's first marconil supplier was Bilt Chemical, a longtime supplier of paints and adhesives to Sabor and a large, diversified, innovative chemical producer that held the patent on marconil. Ray Soles did not like the idea of single sourcing and, therefore, when marconil requirements rose significantly in the second year, he brought in a second supplier, Warton Inc., which not only produced the marconil raw materials (under license from Bilt Chemical), but also manufactured a variety of marconil products in the textile and automotive fields. In the third year, Ray had secured a third supplier, G.K. Specialties, a much smaller company than Bilt Chemical and Waton Inc., which also produced marconil under license for its own applications in aerospace and the military, but which had some excess capacity that it sold on the open market. All three suppliers sold marconil at identical prices, which had increased over the past three years. Actual volumes purchased by Sabor Inc. from each of the three suppliers were as shown below. The current price of marconil from all three suppliers was $50.00 Purchases (in pounds) Capacity Company in pounds) Year 1 Year 2 Year 3 Bilt Chemical 80,000 5,000 10,000 20,000 Warton Inc. 40,000 3.000 8,000 G.K. Specialties 20.000 0 4.000 $39.00 $42.00 $44.00 0 0 Price Company Bilt Chemical Warton Inc. G.K. Specialties Prices Purchases (in pounds) Capacity (in pounds) Year 1 Year 2 Year 3 80.000 5.000 10,000 20,000 40,000 0 3,000 8.000 20,000 0 0 4,000 $39.00 $42.00 $44.00 Supplier Proposals for Long-Term Contracts During the first two weeks of April, Soles was visited by each of his current three marconil suppliers with Bilt Chemical first. Each warned that a shortage of marconil supply was looming and that unless Ray was willing to sign a long-term contract, they would not be in a position to guarantee supply. However, each proposal was different. Bilt chemical proposed a five-year contract with take-or-pay commitments of 25,000 pounds for the current year and 20% annual increases in volume for each of the follow- ing years. Prices were subject to escalation for energy, raw material, and labor every quarter based on the current $50.00 price per pound. Warton Inc. proposed a two-year contract for 10,000 pounds each year with similar price provisions to those of Bilt Chemical. G.K. Specialties suggested an agreement for 12.5% of Sabor's annual requirements, which could be dropped at any time by either party, but which proposed a price of $56.00 for the current year, to be adjusted semiannually, thereafter based on inflation, energy, labor, and material. Although Ray Soles did not know much about the actual manufacturing process for marconil, he had heard that increases in capacity were expensive. He also understood that two of the three component raw materials for marconil were by-products from industrial processes that were reasonable stable. 2 Since Ray Soles had been able to buy almost all of Sabor's needs on quarterly, semianuual or annual contracts, he was not particularly keen on departing from his current supply practice. He had heard some rumors that in a few years a much lower-cost substitute for marconil might be developed. He suspected that, therefore, his current suppliers were anxious to tie Sabor to a long-term commitment. April 15 On April 15, the Bilt Chemical sales representative sent an email to Ray Soles requesting a meeting on April 22. The email concluded, "I would like to bring my sales manager so that we may discuss our proposal for the marconil with you. We will not be able to guarantee you supply after August 1, if you are unable to commitStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started