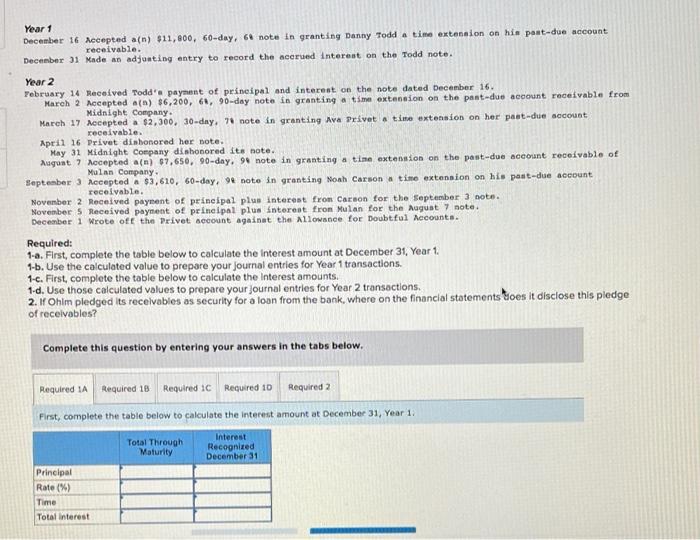

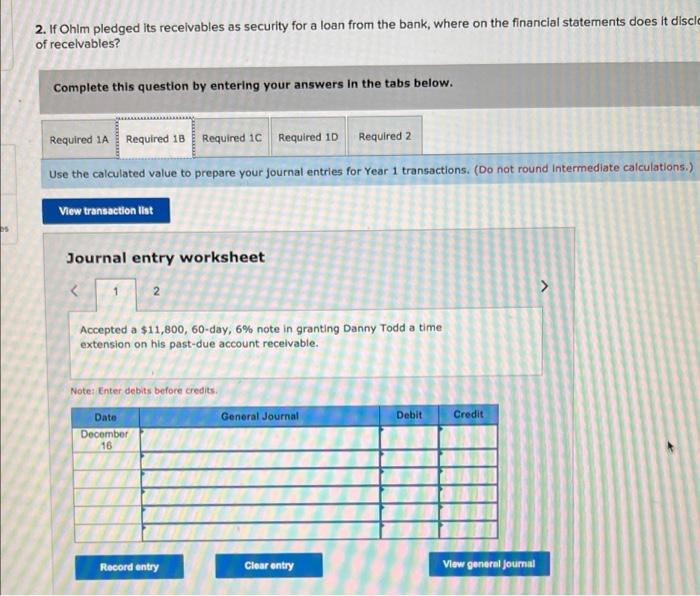

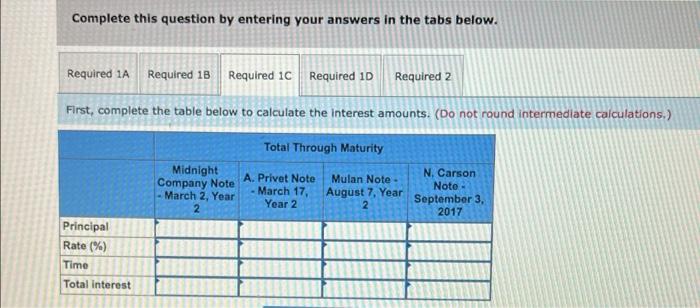

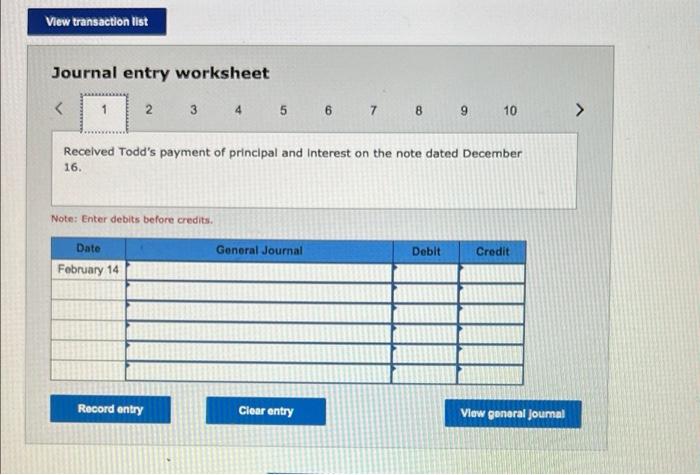

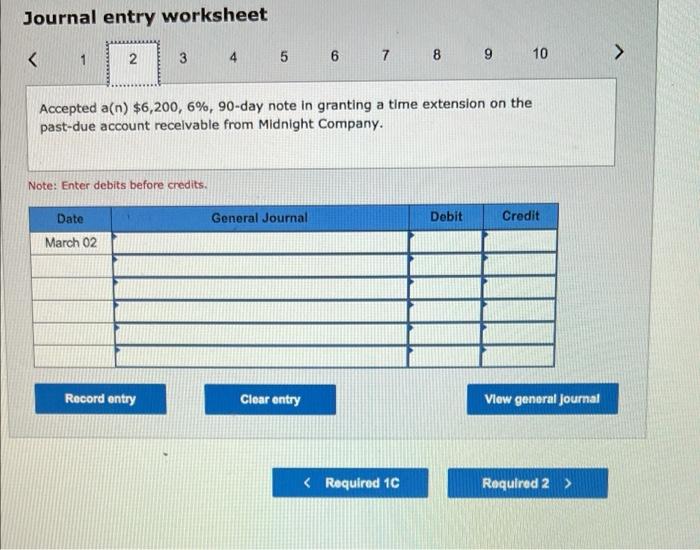

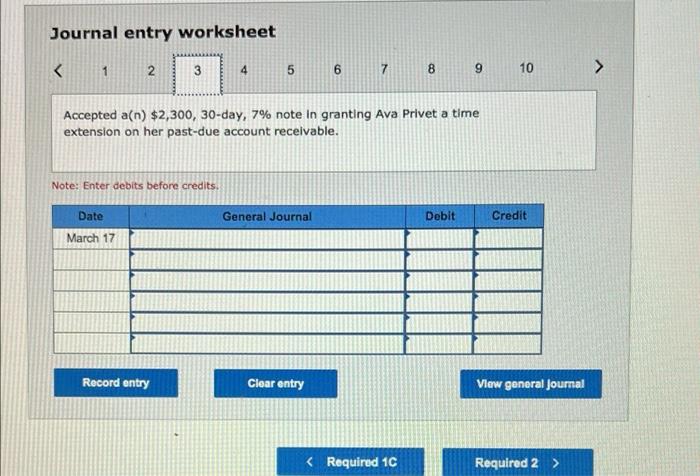

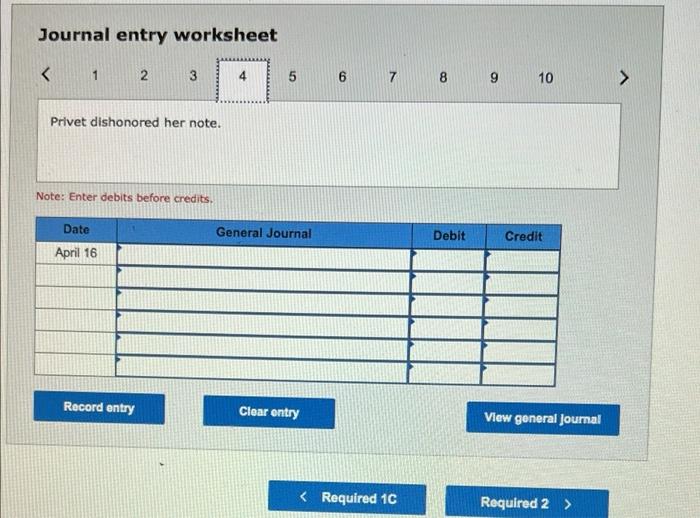

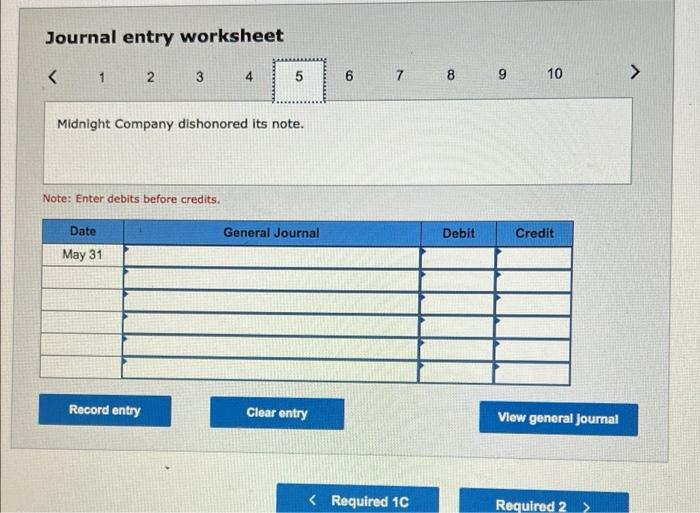

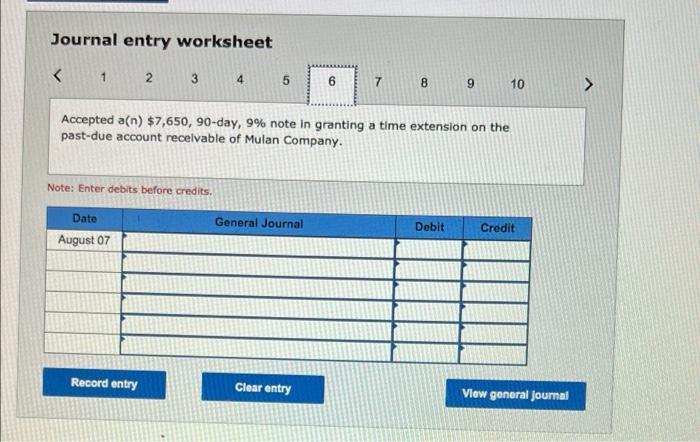

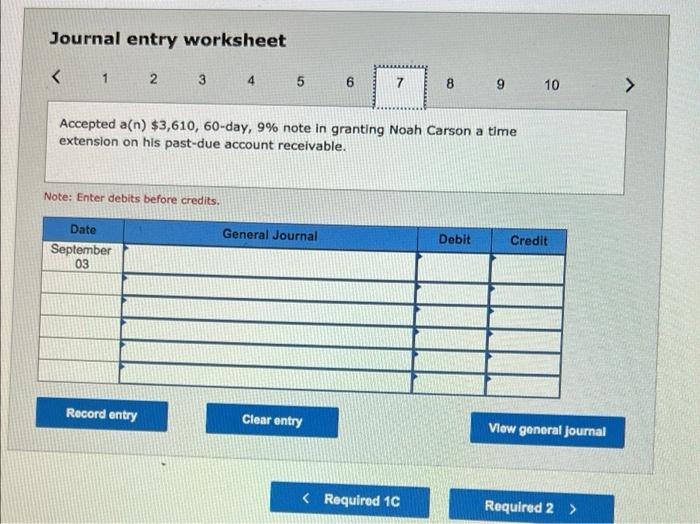

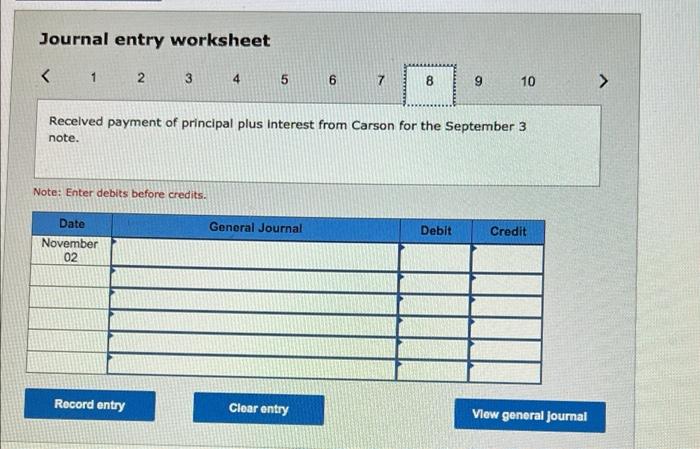

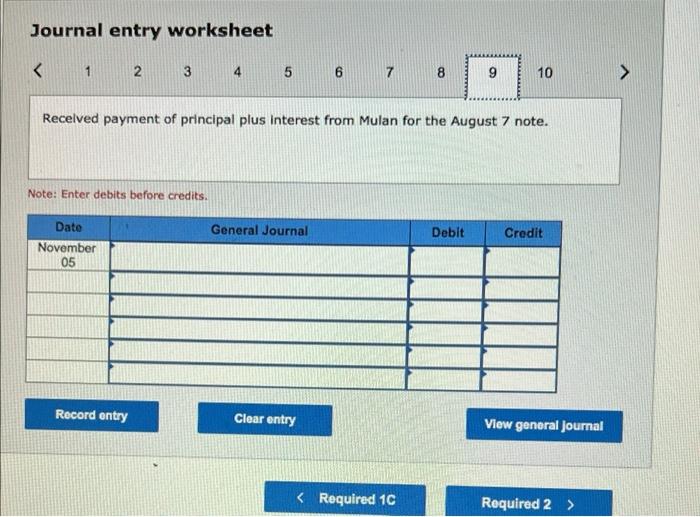

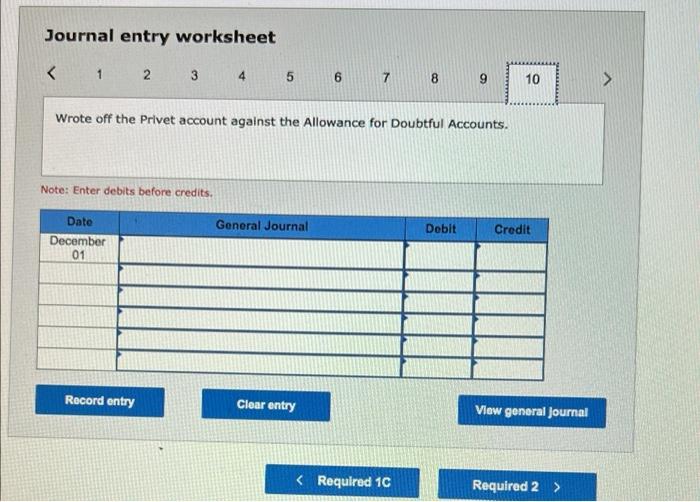

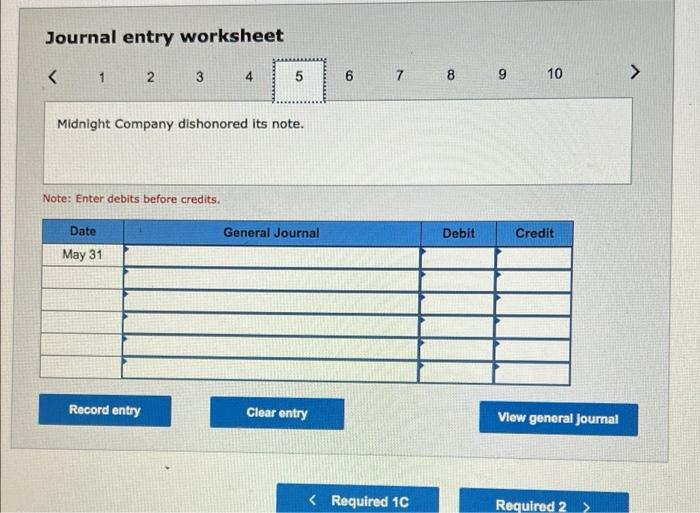

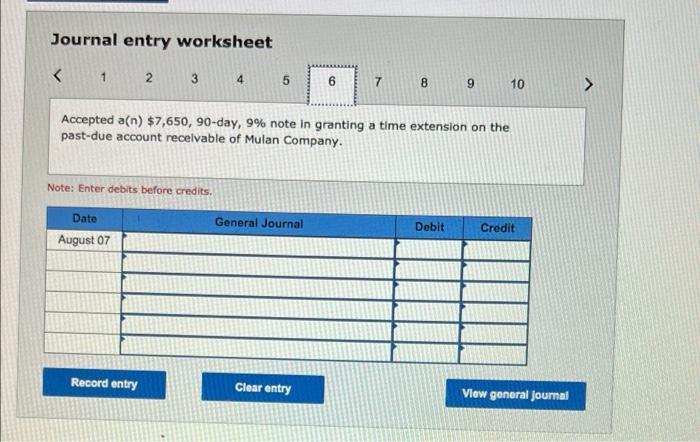

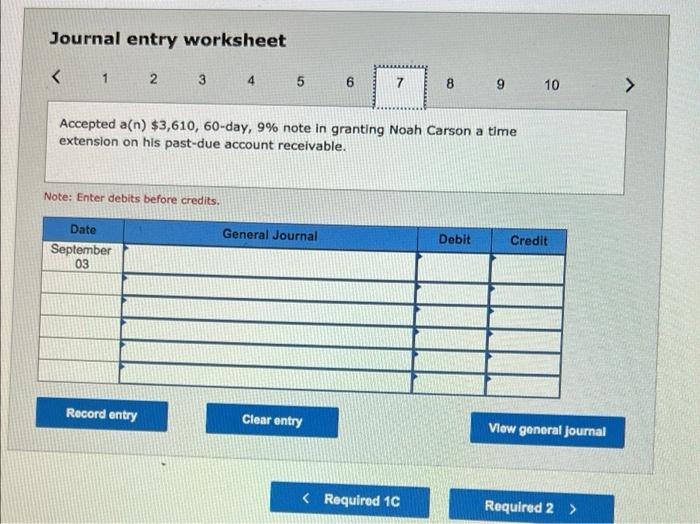

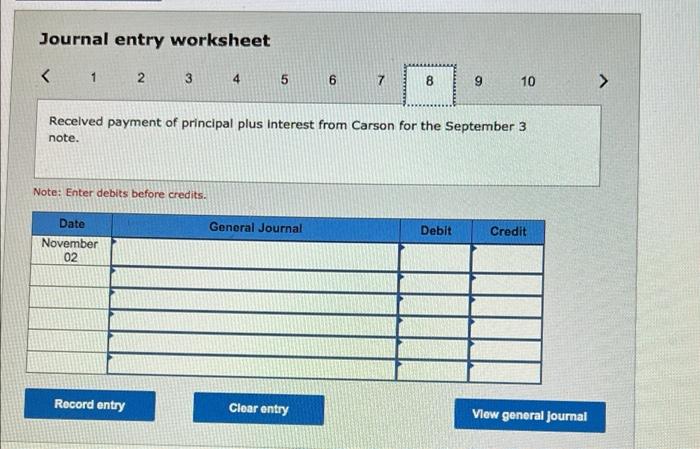

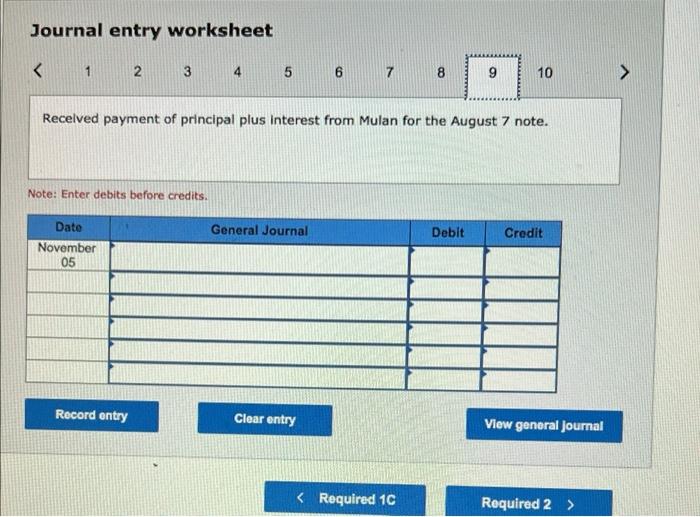

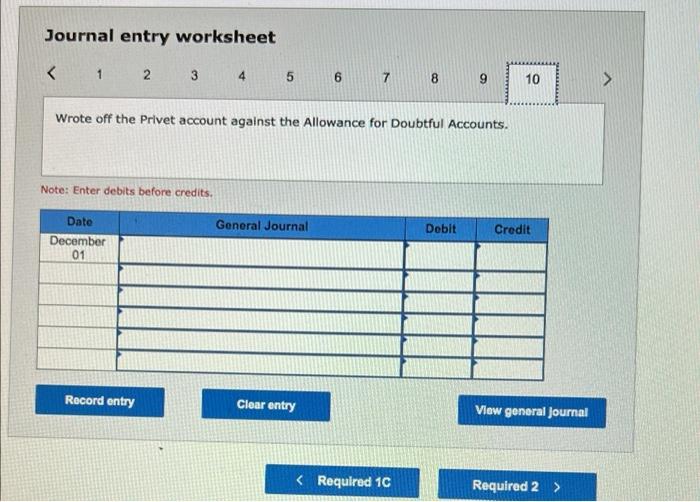

Year 1 December 16 Accepted a(n) $11,800, 60-day, 6 note in granting Danny Todd a time extension on his past-due account receivable. December 31 Made an adjusting entry to record the accrued interest on the Todd note. Year 2 February 14 Received Todd'e payment of principal and interest on the note dated December 16. March 2 Accepted a(a) $6,200, 61, 90-day note in granting a time extension on the post-duo account receivable from Midnight Company. March 17 Accepted a $2,300. 30-day, 7 note in granting Ava Privet a tine extension on her past-due account receivable April 16 Privet dishonored her note. May 31 Midnight Company dishonored ita note. August 7 Accepted a(n) $7,650, 90-day, 9 note in granting a tine extension on the past-dua nccount receivable of Mulan Company September Accepted a $3,610, 60-day, 9 note in granting Noah Carson a time extension on his past due account receivable. November 2 Received payment of principal plus interest from Carson for the September 3 note. November 5 Received payment of principal plus interest fron Mulan for the August 7 note. December 1 Wrote of the Privet account against the Allowance for Doubtful Accounts. Required: 1-a. First, complete the table below to calculate the interest amount at December 31, Year 1. 1-b. Use the calculated value to prepare your journal entries for Year 1 transactions 1-c. First, complete the table below to calculate the Interest amounts. 1-d. Use those calculated values to prepare your journal entries for Year 2 transactions. 2. If Ohim pledged its receivables as security for a loan from the bank, where on the financial statements roes it disclose this pledge of receivables? Complete this question by entering your answers in the tabs below. Required 1A Required 18 Required IC Required 10 Required 2 First, complete the table below to calculate the interest amount at December 31, Year 1. Total Through Maturity Interest Recognized December 31 Principal Rate(%) Time Total interest 2. If Ohlm pledged its receivables as security for a loan from the bank, where on the financial statements does it discia of recelvables? Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 1C Required 1D Required 2 Use the calculated value to prepare your journal entries for Year 1 transactions. (Do not round Intermediate calculations.) View transaction list Journal entry worksheet Accepted a $11,800, 60-day, 6% note in granting Danny Todd a time extension on his past-due account receivable. Note: Enter debits before credits Date General Journal December 16 Debit Credit Record entry Clear entry View general Journal Complete this question by entering your answers in the tabs below. Required 1A Required 1B Required 1C Required 1D Required 2 First, complete the table below to calculate the interest amounts. (Do not round intermediate calculations.) Total Through Maturity Midnight Company Note March 2, Year 2 A. Privet Note March 17, Year 2 Mulan Note August 7. Year 2 N. Carson Note - September 3, 2017 Principal Rate(%) Time Total Interest View transaction list Journal entry worksheet 2 2 3 4 5 6 7 8 9 10 Received Todd's payment of principal and Interest on the note dated December 16. Note: Enter debits before credits. Date General Journal Deblt Credit February 14 Record entry Clear entry View general Journal Journal entry worksheet 2 10 Accepted a(n) $6,200, 6%, 90-day note in granting a time extension on the past-due account recelvable from Midnight Company. Note: Enter debits before credits. General Journal Debit Credit Date March 02 Record entry Clear entry View general Journal Journal entry worksheet Journal entry worksheet Journal entry worksheet Midnight Company dishonored its note. Note: Enter debits before credits. Date General Journal Debit Credit May 31 Record entry Clear entry View general Journal Journal entry worksheet Journal entry worksheet Journal entry worksheet