Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Year 1 total cash dividends Year 2 total cash dividends Year 3 total cash dividend's Year 4 total cash dividends $ 20,000 28,000 200,000 350,000

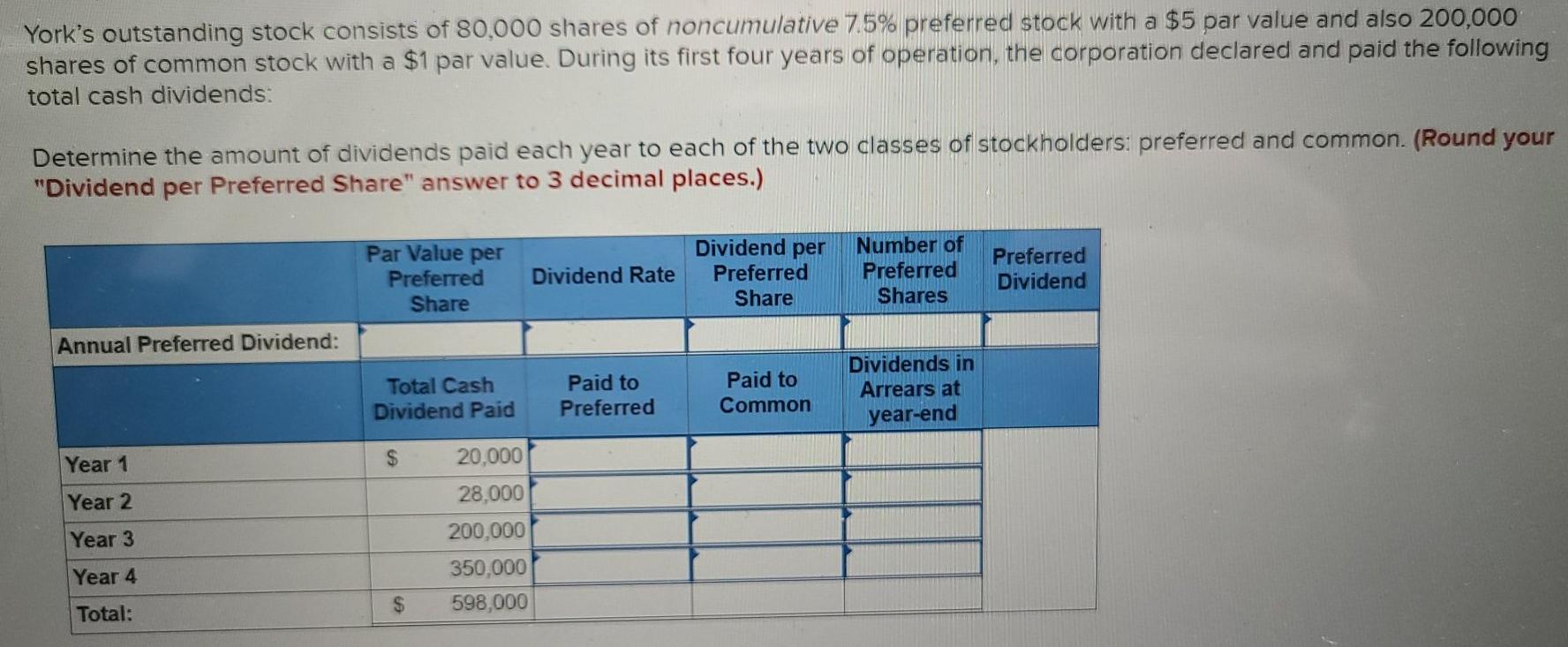

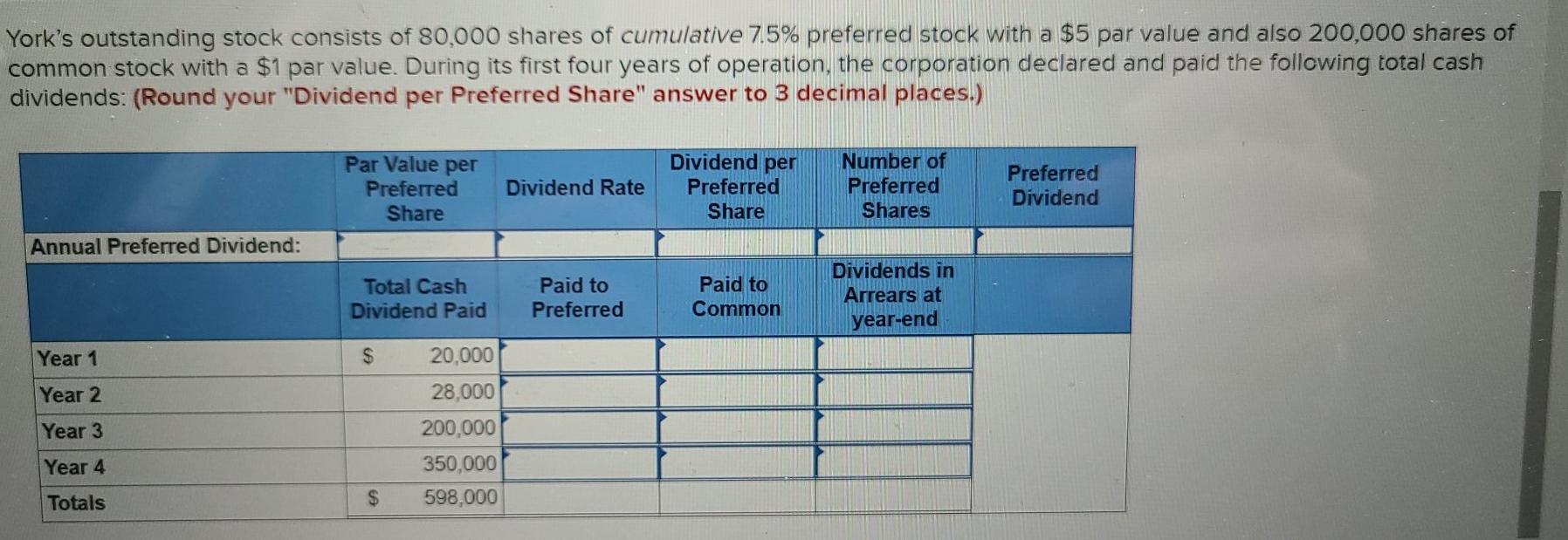

Year 1 total cash dividends Year 2 total cash dividends Year 3 total cash dividend's Year 4 total cash dividends $ 20,000 28,000 200,000 350,000 York's outstanding stock consists of 80,000 shares of noncumulative 7.5% preferred stock with a $5 par value and also 200,000 shares of common stock with a $1 par value. During its first four years of operation, the corporation declared and paid the following total cash dividends: Determine the amount of dividends paid each year to each of the two classes of stockholders: preferred and common. (Round your "Dividend per Preferred Share" answer to 3 decimal places.) Par Value per Preferred Share Dividend Rate Dividend per Preferred Share Number of Preferred Shares Preferred Dividend Annual Preferred Dividend: Total Cash Dividend Paid Paid to Preferred Paid to Common Dividends in Arrears at year-end Year 1 S Year 2 20,000 28,000 200.000 350,000 598,000 Year 3 Year 4 $ Total: York's outstanding stock consists of 80,000 shares of cumulative 7.5% preferred stock with a $5 par value and also 200,000 shares of common stock with a $1 par value. During its first four years of operation, the corporation declared and paid the following total cash dividends: (Round your "Dividend per Preferred Share" answer to 3 decimal places.) Par Value per Preferred Share Dividend Rate Dividend per Preferred Share Number of Preferred Shares Preferred Dividend Annual Preferred Dividend: Total Cash Dividend Paid Paid to Preferred Paid to Common Dividends in Arrears at year-end Year 1 $ Year 2 Year 3 20,000 28,000 200,000 350,000 598,000 Year 4 Totals $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started