Answered step by step

Verified Expert Solution

Question

1 Approved Answer

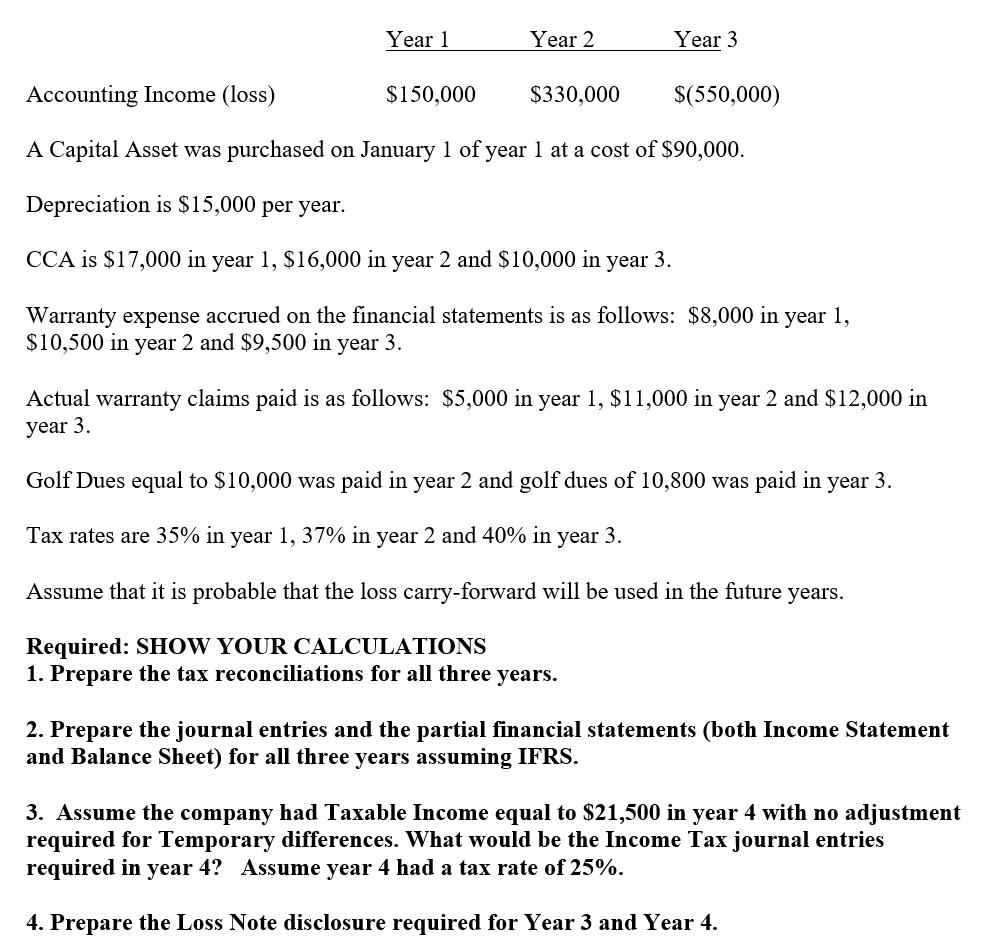

Year 1 Year 2 Year 3 Accounting Income (loss) $150,000 $330,000 $(550,000) A Capital Asset was purchased on January 1 of year 1 at

Year 1 Year 2 Year 3 Accounting Income (loss) $150,000 $330,000 $(550,000) A Capital Asset was purchased on January 1 of year 1 at a cost of $90,000. Depreciation is $15,000 per year. CCA is $17,000 in year 1, $16,000 in year 2 and $10,000 in year 3. Warranty expense accrued on the financial statements is as follows: $8,000 in year 1, $10,500 in year 2 and $9,500 in year 3. Actual warranty claims paid is as follows: $5,000 in year 1, $11,000 in year 2 and $12,000 in year 3. Golf Dues equal to $10,000 was paid in year 2 and golf dues of 10,800 was paid in year 3. Tax rates are 35% in year 1, 37% in year 2 and 40% in year 3. Assume that it is probable that the loss carry-forward will be used in the future years. Required: SHOW YOUR CALCULATIONS 1. Prepare the tax reconciliations for all three years. 2. Prepare the journal entries and the partial financial statements (both Income Statement and Balance Sheet) for all three years assuming IFRS. 3. Assume the company had Taxable Income equal to $21,500 in year 4 with no adjustment required for Temporary differences. What would be the Income Tax journal entries required in year 4? Assume year 4 had a tax rate of 25%. 4. Prepare the Loss Note disclosure required for Year 3 and Year 4.

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started