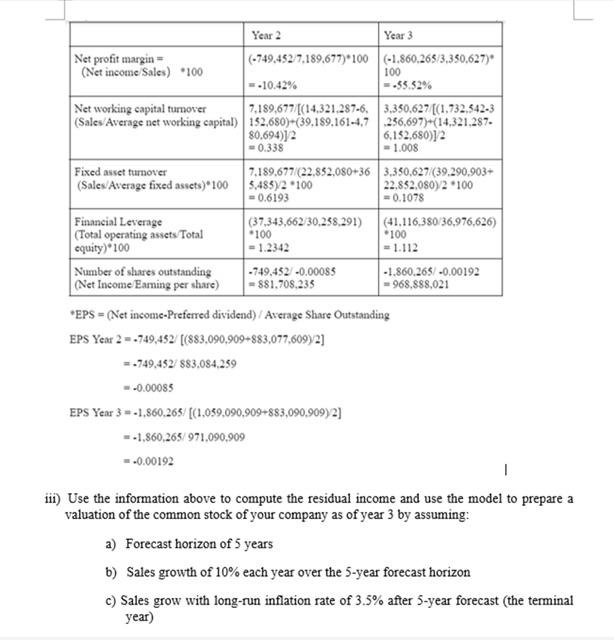

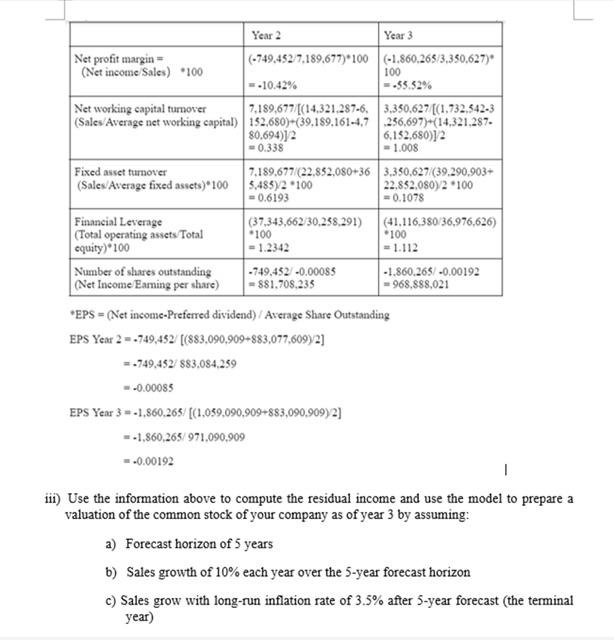

Year 2 Year 3 (-749,452/7,189,677) 100 (-1.860.265/3,350,627) Net profit margin- (Net income Sales) *100 100 --55.52% = -10.42% Net working capital turnover (Sales/Average net working capital) 7,189,677/[(14,321,287-6, 152,680)+(39.189.161-4,7 80.694)1/2 = 0.338 3,350,627/[(1,732,542-3 256,697)+(14,321,287- 6,152,680)1/2 = 1.008 Fixed asset turnover 7,189,677/(22,852,080+36 (Sales/Average fixed assets)*100 5,485)/2*100 =0.6193 3,350,627/(39.290,903+ 22,852,080)/2*100 -0.1078 Financial Leverage (37,343,662/30,258,291) (Total operating assets/Total equity)*100 *100 = 1.2342 (41,116,380/36,976,626) *100 =1.112 Number of shares outstanding (Net Income Earning per share) -749,452/-0.00085 =881.708,235 -1.860.265/-0.00192 -968,888,021 *EPS= (Net income-Preferred dividend) / Average Share Outstanding EPS Year 2=-749,452/ [(883,090,909+883,077,609)/2] =-749,452/ 883,084,259 -0.00085 EPS Year 3 = -1,860.265/ [(1.059,090,909+883,090,909)/2] =-1,860,265/971,090,909 = -0.00192 I iii) Use the information above to compute the residual income and use the model to prepare a valuation of the common stock of your company as of year 3 by assuming: a) Forecast horizon of 5 years b) Sales growth of 10% each year over the 5-year forecast horizon c) Sales grow with long-run inflation rate of 3.5% after 5-year forecast (the terminal year) Year 2 Year 3 (-749,452/7,189,677) 100 (-1.860.265/3,350,627) Net profit margin- (Net income Sales) *100 100 --55.52% = -10.42% Net working capital turnover (Sales/Average net working capital) 7,189,677/[(14,321,287-6, 152,680)+(39.189.161-4,7 80.694)1/2 = 0.338 3,350,627/[(1,732,542-3 256,697)+(14,321,287- 6,152,680)1/2 = 1.008 Fixed asset turnover 7,189,677/(22,852,080+36 (Sales/Average fixed assets)*100 5,485)/2*100 =0.6193 3,350,627/(39.290,903+ 22,852,080)/2*100 -0.1078 Financial Leverage (37,343,662/30,258,291) (Total operating assets/Total equity)*100 *100 = 1.2342 (41,116,380/36,976,626) *100 =1.112 Number of shares outstanding (Net Income Earning per share) -749,452/-0.00085 =881.708,235 -1.860.265/-0.00192 -968,888,021 *EPS= (Net income-Preferred dividend) / Average Share Outstanding EPS Year 2=-749,452/ [(883,090,909+883,077,609)/2] =-749,452/ 883,084,259 -0.00085 EPS Year 3 = -1,860.265/ [(1.059,090,909+883,090,909)/2] =-1,860,265/971,090,909 = -0.00192 I iii) Use the information above to compute the residual income and use the model to prepare a valuation of the common stock of your company as of year 3 by assuming: a) Forecast horizon of 5 years b) Sales growth of 10% each year over the 5-year forecast horizon c) Sales grow with long-run inflation rate of 3.5% after 5-year forecast (the terminal year)