Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Year 2021 Sheniqua, a single taxpayer, had taxable income of $92,551. Her employer withheld $16,118 in federal income tax from her paychecks throughout the year.

Year 2021

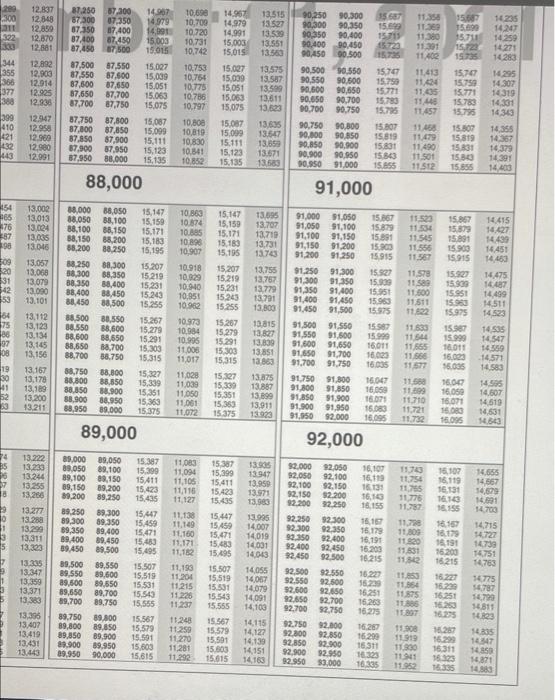

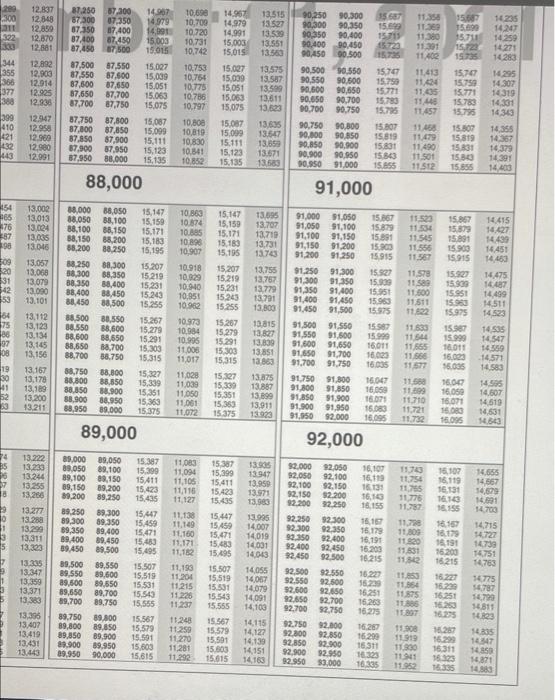

Sheniqua, a single taxpayer, had taxable income of $92,551. Her employer withheld $16,118 in federal income tax from her paychecks throughout the year. What is the amount of refund would Sheniqua receive or additional tax she would pay? Note: Input your answer as a positive number. Use the appropriate Tax Tables 12.837 12.848 12,850 12.570 299 300 11 22 30 344 355 366 377 388 14.907 14 ) 14.091 15,003 15.015 15,027 15,000 15.051 15.063 15.075 37,250 67,200 87.300 07.350 87.350 87,400 87.400 87.450 87,450 Bee 87,500 87.550 87,550 87.600 87.500 87,650 87.650 87,700 87,700 87,750 87,750 87,800 87.800 87,850 7,49,900 87.900 87.950 87,950 88.000 10,690 10,700 10.720 10,731 10.742 10.753 10.754 10.775 10.786 10.797 |||-- IT - 11.380 11.301 11.402 11.413 15.63 5 11 15,72 15.735 12,892 12.903 12.014 12.925 12.836 12.947 12.958 12.989 12.900 12.991 14.967 14.979 14.991 15,003 15 15.027 15,009 15.051 15.050 15,075 15.087 15.000 15.111 15.123 15.135 90,250 90.300 90,300 90.350 90,350 90,400 90,400 90.450 1500 90.500 90.550 90,550 90,500 90,650 90.650 90,700 00700 90.750 13.515 131.527 13.50 13.551 13.560 13.575 13.537 13.500 13,611 13.23 13,635 13.547 13.850 13.671 13.580 15,707 15.750 356 15.6 15715 15723 15 15707 15,759 15771 15.789 15.795 15.807 15.831 15.843 14235 14.247 14259 14271 14280 14295 14.307 14319 14.301 14343 15.783 15.796 399 410 421 132 15,087 15.099 15.111 15.123 15.135 10.800 10,819 10.830 10.541 10852 10 90.000 90.850 90.850 90,900 90.900 90,950 90.950 91.000 11.05 11.45 TAG: 118 11.479 11490 11.501 11.12 443 15.30 15319 15.831 15.885 14367 16373 14.391 14.400 88,000 91,000 154 15,147 15,159 13.002 13.013 13,024 13.035 13. CH 15.1067 15.879 15.091 15.900 15.915 76 97 98 9 20 31 15,867 15.373 15,891 11 523 11.534 11.545 11.556 11.567 13.057 13.068 13.079 13.090 13.101 15.183 15,195 15.207 15.219 15231 15.243 15.255 10 863 10374 in - 10.898 10,907 10918 10.329 10,940 10.951 10.962 10.973 10.984 10.995 11.000 11017 15.915 15.927 88,000 88,050 88,050 38.100 88,100 88,150 88,150 or 88,200 88.250 38.250 88,300 38.300 58,350 88.350 38.400 38,400 88.450 88.450 88,500 88.500 80.550 156 68,600 38,600 88,550 88,650 88,700 88.700 30.750 38,750 38.800 88.800 38.850 88,850 Do 88.900 88.950 88,950 89.000 50 164 75 80 97 08 15.147 15.159 15.171 15.180 15.195 15,207 15.219 15,231 15.243 15.255 15.267 15.279 15.291 15.303 15,315 15,227 15.30 15,351 15,369 15.375 11 589 11.500 11511 1132 13.095 13,707 13799 13,731 1370 13.755 13.767 13.779 13.791 13,800 13.815 The 13.839 13.851 18863 13.875 13.880 13.89 13.911 13923 14.415 14.427 14439 16,451 14.453 14 475 14487 14,499 14.511 14523 14 555 14 547 15.267 15.270 15.291 15.303 91.000 91.050 91,050 91.100 91,100 91.150 91,150 91,200 91.200 91.250 91.250 91,300 91.300 91350 91,350 91400 91.400 91.450 91.450 91,500 91.500 91.550 91,550 91,500 91,600 91.650 91.550 91,700 91.700 91.750 91.750 91.800 , 31.850 91.900 91.900 91.950 91.950 92.000 15.009 15.951 15963 15.975 15 15.990 16.011 16.023 13.112 13,123 13.134 13.145 13.156 13.167 13.170 13,189 13.200 13.211 15.975 159 15.999 18.011 15.315 14571 14.583 19 30 11 15.327 15,339 15,351 15.30 15.375 11,028 11 039 11.050 11 001 1, 11.530 11544 11.555 11.566 1150 11.699 11.710 11.721 11.732 16,047 16.00 16.071 15.08 18.095 56.005 16.00 16.05 16.071 160RB 16096 14.596 14.607 14.619 14,531 14.33 89,000 92,000 774 5 16.107 16,113 14,655 13.305 13.947 13.959 13971 13,980 15.387 15,399 15,411 15.423 15,435 15,447 15.450 15.471 15,480 15.495 1 11083 11,094 11,105 11.118 11 127 11.130 11.149 11.160 11.171 11.182 13.222 13.233 13.244 13.255 13.266 13.277 13.20 13.290 13.311 13,323 13.335 13.347 13,359 13,371 13,383 13,396 13.407 13.419 13:43 13.443 15.107 16.119 16.131 161 15387 15,399 15,411 15423 15:435 15,447 15.459 15,471 15.483 15.95 1 3 5 89.000 89,050 89.100 89.100 89,150 89,150 19,200 89,200 89,250 89.250 89,300 89.300 89 350 89,350 89.400 89.400 89,450 89.450 89.500 89,500 89.550 89.550 89,600 89.500 89,650 89,650 89,700 89,700 89.750 89.750 06 89,800 89,850 89,850 89.900 89.900 89,950 29.950 90.000 13.995 14.007 14,019 14091 14.043 14055 14,067 14.079 14,091 14,100 92.000 92,050 92.050 92.100 92.100 92.150 92.150 92.200 92.200 92.250 92,250 92,300 92.300 92.350 32.350 92.400 92.400 92.450 92,450 92.500 92.500 92.550 92.550 92.500 52.600 92.650 92.650 92.700 92.700 92,750 92.750 2.000 92.800 92.850 92.850 92.000 92.900 92.950 12.950 3,000 1970 11754 11,75 11,787 11.738 11.800 11.920 11.831 11.12 11.550 11.554 54,500 14700 14,715 14727 14739 14.751 14763 11.199 18.179 16191 16.200 16.215 1 3 11.2014 11215 11226 11.23 15,507 15,519 15,531 15.543 15,555 15.567 15.579 15.501 15,603 15.615 16.10 16.155 16.10 16.179 16.191 16 203 16.215 16.222 16.29 16.251 16.263 16:273 16.287 16.299 16.311 16303 16335 16.227 16220 16.251 15,519 15.331 15.543 15.555 15.367 15.579 15,501 15.500 15.615 54787 14799 14811 14.03 14335 24 11.259 11.270 11.281 11.293 14.115 14,122 14,739 14151 14169 11897 11.08 11.919 11.330 119 11.952 18287 16.299 16 311 16.123 16 14850 371

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started