Answered step by step

Verified Expert Solution

Question

1 Approved Answer

year. 3. Assuming that the capitalization rate will remain constant, develop an estimate of the property's market value at the end of the projected

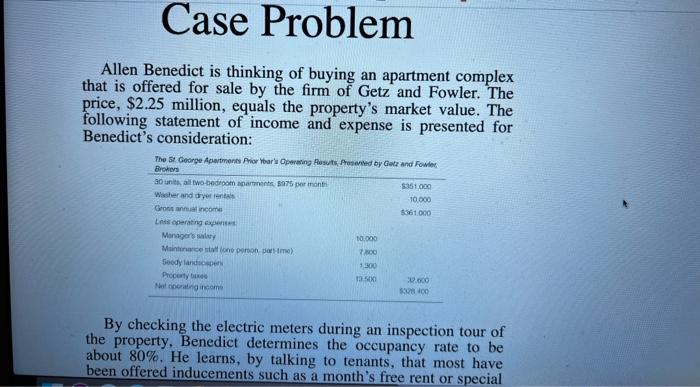

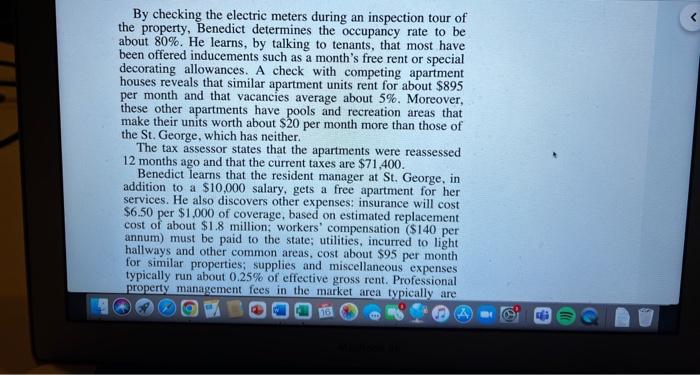

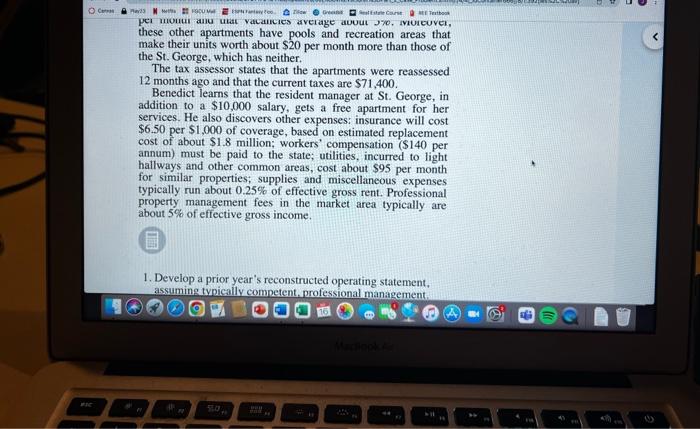

year. 3. Assuming that the capitalization rate will remain constant, develop an estimate of the property's market value at the end of the projected holding period. Case Problem Allen Benedict is thinking of buying an apartment complex that is offered for sale by the firm of Getz and Fowler. The price, $2.25 million, equals the property's market value. The following statement of income and expense is presented for Benedict's consideration: The St. George Apartments Prior Year's Operating Results, Presented by Getz and Fowler Brokers 30 units, all two-bedroom apartments 8975 per month Washer and dryer rentals $351,000 Gross annual income 10,000 $361.000 Less operating expenses Manager's salary 10.000 Maintenance staff (one person, part-time) 7,800 Seedy landscapers 1.300 Property 13.500 Net operating income 32.000 5328400 By checking the electric meters during an inspection tour of the property, Benedict determines the occupancy rate to be about 80%. He learns, by talking to tenants, that most have been offered inducements such as a month's free rent or special By checking the electric meters during an inspection tour of the property, Benedict determines the occupancy rate to be about 80%. He learns, by talking to tenants, that most have been offered inducements such as a month's free rent or special decorating allowances. A check with competing apartment houses reveals that similar apartment units rent for about $895 per month and that vacancies average about 5%. Moreover, these other apartments have pools and recreation areas that make their units worth about $20 per month more than those of the St. George, which has neither. The tax assessor states that the apartments were reassessed 12 months ago and that the current taxes are $71,400. Benedict learns that the resident manager at St. George, in addition to a $10,000 salary, gets a free apartment for her services. He also discovers other expenses: insurance will cost $6.50 per $1,000 of coverage, based on estimated replacement cost of about $1.8 million; workers' compensation ($140 per annum) must be paid to the state; utilities, incurred to light hallways and other common areas, cost about $95 per month for similar properties; supplies and miscellaneous expenses typically run about 0.25% of effective gross rent. Professional property management fees in the market area typically are OC Great Estate Course Textbook per monui anu utat vacancies average about 370. IVIoIeuver, these other apartments have pools and recreation areas that make their units worth about $20 per month more than those of the St. George, which has neither. The tax assessor states that the apartments were reassessed 12 months ago and that the current taxes are $71,400. Benedict learns that the resident manager at St. George, in addition to a $10,000 salary, gets a free apartment for her services. He also discovers other expenses: insurance will cost $6.50 per $1,000 of coverage, based on estimated replacement cost of about $1.8 million; workers' compensation ($140 per annum) must be paid to the state; utilities, incurred to light hallways and other common areas, cost about $95 per month for similar properties; supplies and miscellaneous expenses typically run about 0.25% of effective gross rent. Professional property management fees in the market area typically are about 5% of effective gross income. 1. Develop a prior year's reconstructed operating statement, assuming typically competent, professional management. MacBook A FIC 20 500 4 711 " " " FOR 911

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve this problem we need to reconstruct the operating statement considering typically competent professional management We will also determine th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started