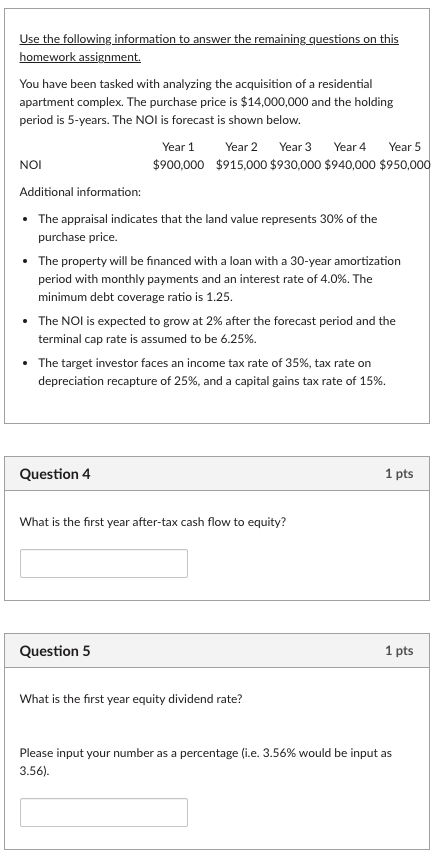

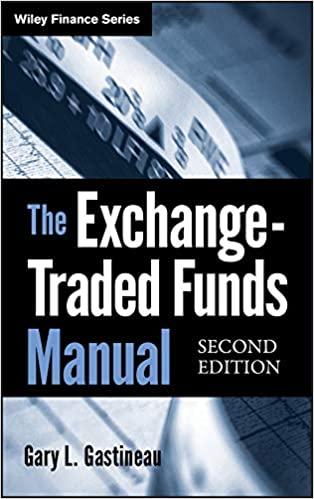

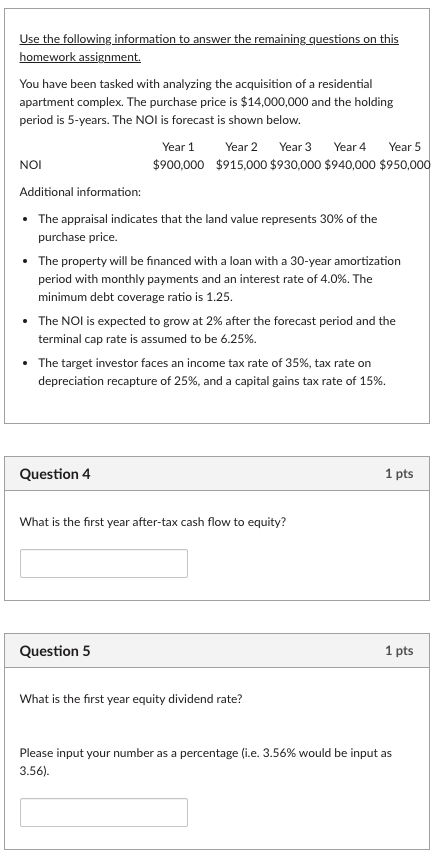

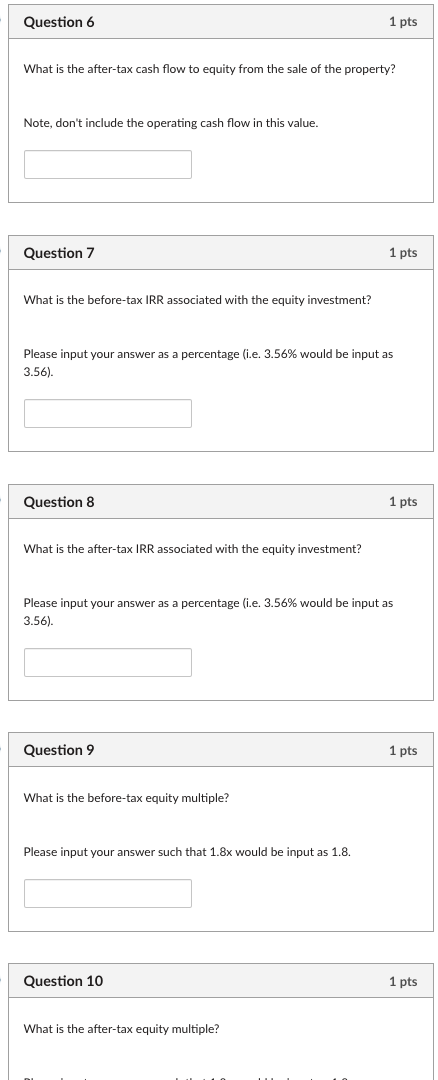

Year 5 Use the following information to answer the remaining questions on this homework assignment You have been tasked with analyzing the acquisition of a residential apartment complex. The purchase price is $14,000,000 and the holding period is 5-years. The NOI is forecast is shown below. Year 1 Year 2 Year 3 Year 4 NOI $900,000 $915,000 $930,000 $940,000 $950,000 Additional information: The appraisal indicates that the land value represents 30% of the purchase price. The property will be financed with a loan with a 30-year amortization period with monthly payments and an interest rate of 4.0%. The minimum debt coverage ratio is 1.25. The Nol is expected to grow at 2% after the forecast period and the terminal cap rate is assumed to be 6.25%. The target investor faces an income tax rate of 35%, tax rate on depreciation recapture of 25%, and a capital gains tax rate of 15%. Question 4 1 pts What is the first year after-tax cash flow to equity? Question 5 1 pts What is the first year equity dividend rate? Please input your number as a percentage (i.e. 3.56% would be input as 3.56). Question 6 1 pts What is the after-tax cash flow to equity from the sale of the property? Note, don't include the operating cash flow in this value. Question 7 1 pts What is the before-tax IRR associated with the equity investment? Please input your answer as a percentage (i.e. 3.56% would be input as 3.56). Question 8 1 pts What is the after-tax IRR associated with the equity investment? Please input your answer as a percentage (i.e. 3.56% would be input as 3.56). Question 1 pts What is the before-tax equity multiple? Please input your answer such that 1.8x would be input as 1.8. Question 10 1 pts What is the after-tax equity multiple? Year 5 Use the following information to answer the remaining questions on this homework assignment You have been tasked with analyzing the acquisition of a residential apartment complex. The purchase price is $14,000,000 and the holding period is 5-years. The NOI is forecast is shown below. Year 1 Year 2 Year 3 Year 4 NOI $900,000 $915,000 $930,000 $940,000 $950,000 Additional information: The appraisal indicates that the land value represents 30% of the purchase price. The property will be financed with a loan with a 30-year amortization period with monthly payments and an interest rate of 4.0%. The minimum debt coverage ratio is 1.25. The Nol is expected to grow at 2% after the forecast period and the terminal cap rate is assumed to be 6.25%. The target investor faces an income tax rate of 35%, tax rate on depreciation recapture of 25%, and a capital gains tax rate of 15%. Question 4 1 pts What is the first year after-tax cash flow to equity? Question 5 1 pts What is the first year equity dividend rate? Please input your number as a percentage (i.e. 3.56% would be input as 3.56). Question 6 1 pts What is the after-tax cash flow to equity from the sale of the property? Note, don't include the operating cash flow in this value. Question 7 1 pts What is the before-tax IRR associated with the equity investment? Please input your answer as a percentage (i.e. 3.56% would be input as 3.56). Question 8 1 pts What is the after-tax IRR associated with the equity investment? Please input your answer as a percentage (i.e. 3.56% would be input as 3.56). Question 1 pts What is the before-tax equity multiple? Please input your answer such that 1.8x would be input as 1.8. Question 10 1 pts What is the after-tax equity multiple