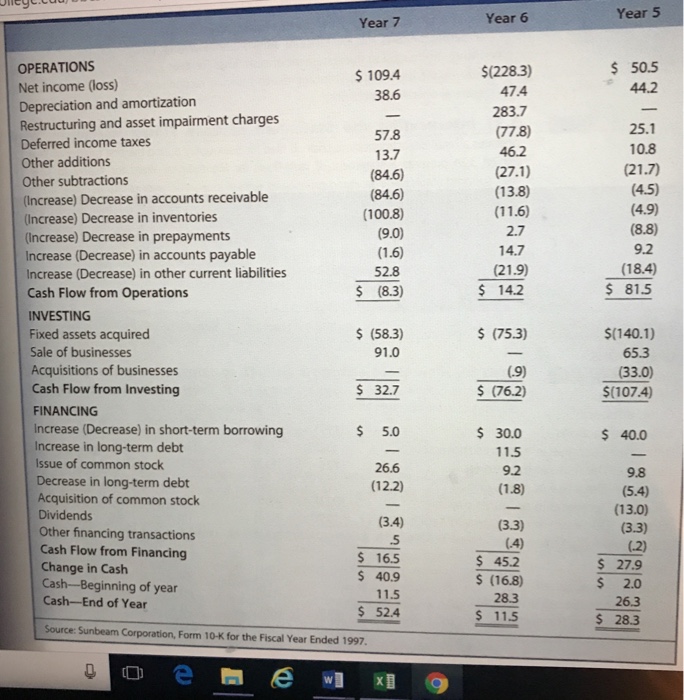

Year 6 Year 5 Year 7 OPERATIONS Net income (loss) 50.5 44.2 $(228.3) 47.4 283.7 77.8) 46.2 109.4 38.6 Depreciation and amortization Restructuring and asset impairment charges 25.1 10.8 57.8 13.7 (84.6) (84.6) (100.8) (9.0) Deferred income taxes Other additions Other subtractions (Increase) Decrease in accounts receivable (Increase) Decrease in inventories (Increase) Decrease in prepayments Increase (Decrease) in accounts payable Increase (Decrease) in other current liabilities Cash Flow from Operations INVESTING Fixed assets acquired Sale of businesses Acquisitions of businesses Cash Flow from Investing (4.5) (4.9) (8.8) 9.2 (18.4) (13.8) 2.7 14.7 (21.9) S 14.2 52.8 s (8.3) 81.5 $ (75.3) $(58.3) 91.0 $(140.1) 65.3 (33.0) $(107.4) 32.7 (76.2) FINANCING Increase (Decrease) in short-term borrowing Increase in long-term debt $ 5.0 $ 30.0 11.5 9.2 S 40.0 Issue of common stock Decrease in long-term debt Acquisition of common stock Dividends Other financing transactions Cash Flow from Financing Change in Cash Cash-Beginning of year Cash-End of Year 26.6 9.8 (5.4) (13.0) (3.3) (12.2) (3.4) .5 (3.3) 5 16.5 $ 45.2 (16.8) 28.3 s 11.5 S 27.9 $ 2.0 S 40.9 11.5 $ 52.4 26.3 $ 28.3 Source: Sunbeam Corporation, Form 10-K for the Fiscal Year Ended 1997 oe Year 6 Year 5 Year 7 OPERATIONS Net income (loss) 50.5 44.2 $(228.3) 47.4 283.7 77.8) 46.2 109.4 38.6 Depreciation and amortization Restructuring and asset impairment charges 25.1 10.8 57.8 13.7 (84.6) (84.6) (100.8) (9.0) Deferred income taxes Other additions Other subtractions (Increase) Decrease in accounts receivable (Increase) Decrease in inventories (Increase) Decrease in prepayments Increase (Decrease) in accounts payable Increase (Decrease) in other current liabilities Cash Flow from Operations INVESTING Fixed assets acquired Sale of businesses Acquisitions of businesses Cash Flow from Investing (4.5) (4.9) (8.8) 9.2 (18.4) (13.8) 2.7 14.7 (21.9) S 14.2 52.8 s (8.3) 81.5 $ (75.3) $(58.3) 91.0 $(140.1) 65.3 (33.0) $(107.4) 32.7 (76.2) FINANCING Increase (Decrease) in short-term borrowing Increase in long-term debt $ 5.0 $ 30.0 11.5 9.2 S 40.0 Issue of common stock Decrease in long-term debt Acquisition of common stock Dividends Other financing transactions Cash Flow from Financing Change in Cash Cash-Beginning of year Cash-End of Year 26.6 9.8 (5.4) (13.0) (3.3) (12.2) (3.4) .5 (3.3) 5 16.5 $ 45.2 (16.8) 28.3 s 11.5 S 27.9 $ 2.0 S 40.9 11.5 $ 52.4 26.3 $ 28.3 Source: Sunbeam Corporation, Form 10-K for the Fiscal Year Ended 1997 oe