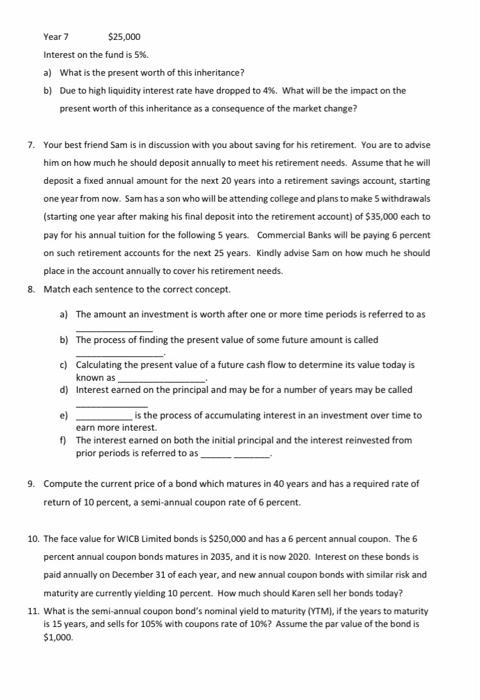

Year 7 $25,000 Interest on the fund is 5% a) What is the present worth of this inheritance? b) Due to high liquidity interest rate have dropped to 4%. What will be the impact on the present worth of this inheritance as a consequence of the market change? 7. Your best friend Sam is in discussion with you about saving for his retirement. You are to advise him on how much he should deposit annually to meet his retirement needs. Assume that he will deposit a fixed annual amount for the next 20 years into a retirement savings account, starting one year from now. Sam has a son who will be attending college and plans to make 5 withdrawals (starting one year after making his final deposit into the retirement account) of $35,000 each to pay for his annual tuition for the following 5 years. Commercial Banks will be paying 6 percent on such retirement accounts for the next 25 years. Kindly advise Sam on how much he should place in the account annually to cover his retirement needs. & Match each sentence to the correct concept. a) The amount an investment is worth after one or more time periods is referred to as b) The process of finding the present value of some future amount is called c) Calculating the present value of a future cash flow to determine its value today is d) Interest earned on the principal and may be for a number of years may be called is the process of accumulating interest in an investment over time to earn more interest. The interest earned on both the initial principal and the interest reinvested from prior periods is referred to as known as e) 9. Compute the current price of a bond which matures in 40 years and has a required rate of return of 10 percent, a semi-annual coupon rate of 6 percent. 10. The face value for WICB Limited bonds is $250,000 and has a 6 percent annual coupon. The 6 percent annual coupon bonds matures in 2035, and it is now 2020. Interest on these bonds is paid annually on December 31 of each year, and new annual coupon bonds with similar risk and maturity are currently vielding 10 percent. How much should Karen sell her bonds today? 11. What is the semi-annual coupon bond's nominal yield to maturity (YTM), if the years to maturity is 15 years, and sells for 105% with coupons rate of 10%? Assume the par value of the bond is $1,000