Answered step by step

Verified Expert Solution

Question

1 Approved Answer

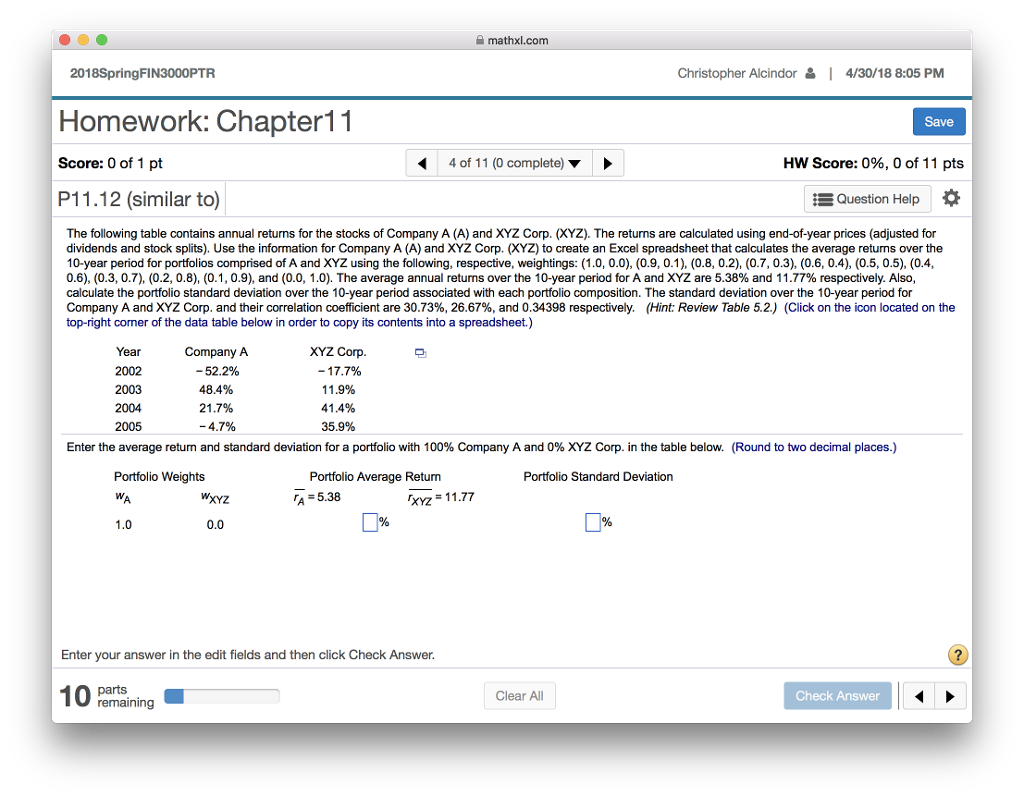

Year Company A XYZ Corp. 2002 -52.2 -17.7 2003 48.4 11.9 2004 21.7 41.4 2005 -4.7 35.9 2006 1.3 31.9 2007 -30.8 21.1 2008 -10.1

Year Company A XYZ Corp. 2002 -52.2 -17.7 2003 48.4 11.9 2004 21.7 41.4 2005 -4.7 35.9 2006 1.3 31.9 2007 -30.8 21.1 2008 -10.1 -43.6 2009 30.5 29.4 2010 27.2 9.8 2011 22.5 -2.4?

? mathxl.com 2018SpringFIN3000PTR Christopher Alcindor ? | 4/30/18 8:05 PM Homework: Chapter11 Save Score: 0 of 1 pt 4 of 11 (0 complete) ? HW Score: 0%, 0 of 1 1 pts P11.12 (similar to) Question Help * The following table contains annual returns for the stocks of Company A (A) and XYZ Corp. (XYZ). The returns are calculated using end-of-year prices (adjusted for dividends and stock splits). Use the information for Company A (A) and XYZ Corp. (XYZ) to create an Excel spreadsheet that calculates the average returns over the 10-year period for portfolios comprised of A and XYZ using the following, respective, weightings: 1.0, 0.0), (0.9, 0.1), (0.8, 0.2), (0.7, 0.3), (0.6, 0.4), (0.5, 0.5), (0.4 0.6), (0.3, 0.7), (0.2, 0.8), (0.1, 0.9), and (0.0, 1.0). The average annual returns over the 10-year period for A and XYZ are 5.38% and 11.77% respectively. Also calculate the portfolio standard deviation over the 10-year period associated with each portfolio composition. The standard deviation over the 10-year period for Company A and XYZ Corp. and their correlation coefficient are 30.73%, 26.67%, and 0.34398 respectively. (Hint Review Table 5.2) (Click on the icon located on the top-right coner of the data table below in order to copy its contents into a spreadsheet.) Company A -52.2% 48.4% 21.7% XYZ Corp Year 2002 2003 2004 2005 11 .9% 41.4% 35.9% Enter the average retum and standard deviation for a portfolio with 100% Company A and 0% XYZ Corp. in the table below. (Round to two decimal places.) Portfolio Average Returm A5.38 Portfolio Weights Portfolio Standard Deviation Wxyz XYZ = 1 1 .77 1.0 0.0 Enter your answer in the edit fields and then click Check Answer Clear All Check Answer remainingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started