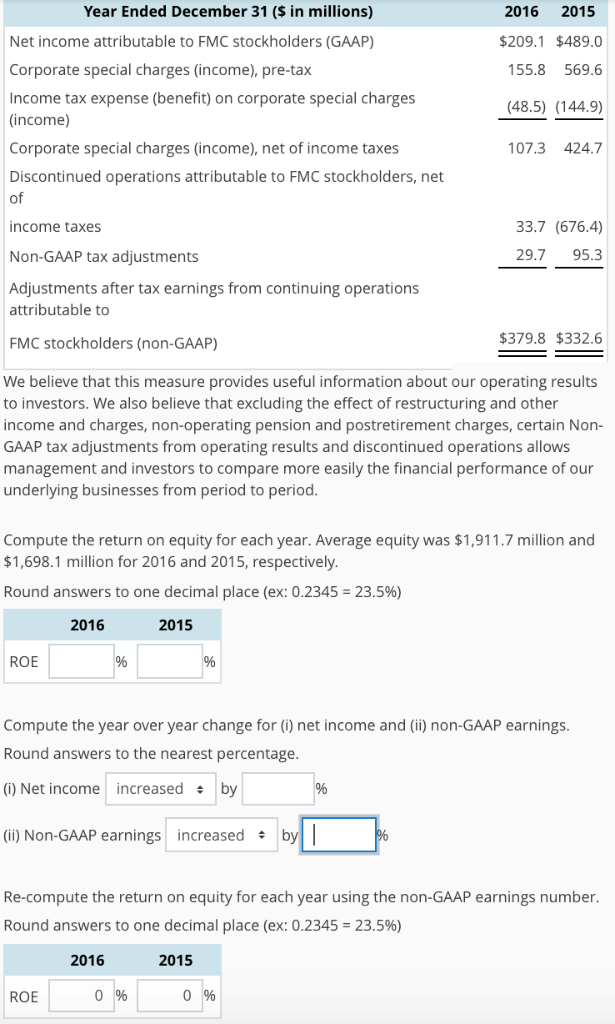

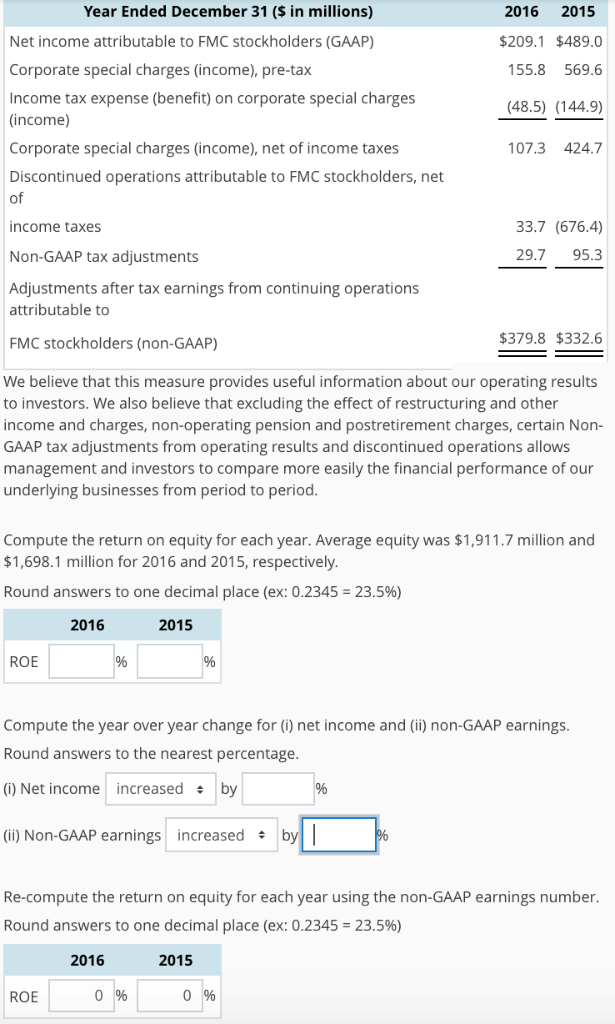

Year Ended December 31 (S in millions) Net income attributable to FMC stockholders (GAAP) Corporate special charges (income), pre-tax Income tax expense (benefit) on corporate special charges (income) Corporate special charges (income), net of income taxes Discontinued operations attributable to FMC stockholders, net of income taxes 2016 2015 $209.1 $489.0 155.8 569.6 (48.5) (144.9) 07.3 424.7 33.7 (676.4) 9.7 95.3 Non-GAAP tax adjustments Adjustments after tax earnings from continuing operation:s attributable to FMC stockholders (non-GAAP) 379.8 $332.6 We believe that this measure provides useful information about our operating results to investors. We also believe that excluding the effect of restructuring and other income and charges, non-operating pension and postretirement charges, certain Non- GAAP tax adjustments from operating results and discontinued operations allows management and investors to compare more easily the financial performance of our underlying businesses from period to period Compute the return on equity for each year. Average equity was $1,911.7 million and $1,698.1 million for 2016 and 2015, respectively Round answers to one decimal place (ex: 0.2345-23.5%) 2015 ROE Compute the year over year change for (i) net income and (ii) non-GAAP earnings. Round answers to the nearest percentage (i) Net income increasedby (ii) Non-GAAP earnings increased by Re-compute the return on equity for each year using the non-GAAP earnings number Round answers to one decimal place (ex: 0.2345-23.5%) 2016 2015 ROE 0% 0% Year Ended December 31 (S in millions) Net income attributable to FMC stockholders (GAAP) Corporate special charges (income), pre-tax Income tax expense (benefit) on corporate special charges (income) Corporate special charges (income), net of income taxes Discontinued operations attributable to FMC stockholders, net of income taxes 2016 2015 $209.1 $489.0 155.8 569.6 (48.5) (144.9) 07.3 424.7 33.7 (676.4) 9.7 95.3 Non-GAAP tax adjustments Adjustments after tax earnings from continuing operation:s attributable to FMC stockholders (non-GAAP) 379.8 $332.6 We believe that this measure provides useful information about our operating results to investors. We also believe that excluding the effect of restructuring and other income and charges, non-operating pension and postretirement charges, certain Non- GAAP tax adjustments from operating results and discontinued operations allows management and investors to compare more easily the financial performance of our underlying businesses from period to period Compute the return on equity for each year. Average equity was $1,911.7 million and $1,698.1 million for 2016 and 2015, respectively Round answers to one decimal place (ex: 0.2345-23.5%) 2015 ROE Compute the year over year change for (i) net income and (ii) non-GAAP earnings. Round answers to the nearest percentage (i) Net income increasedby (ii) Non-GAAP earnings increased by Re-compute the return on equity for each year using the non-GAAP earnings number Round answers to one decimal place (ex: 0.2345-23.5%) 2016 2015 ROE 0% 0%