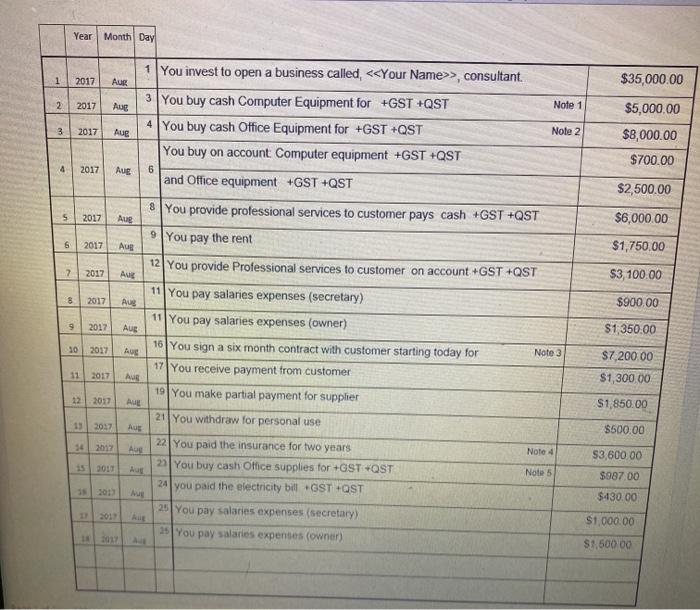

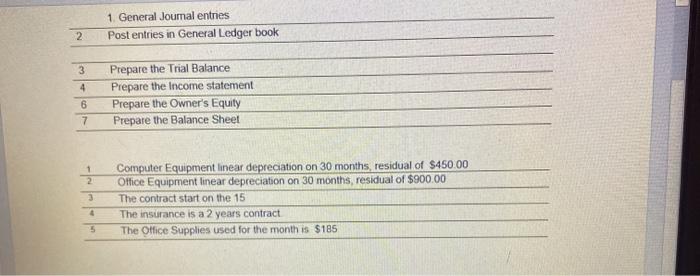

Year Month Day 1 2017 Aug $35,000.00 2017 Aug Note 1 2 3 1 You invest to open a business called, >, consultant 3 You buy cash Computer Equipment for +GST +QST 4 You buy cash Office Equipment for +GST +QST You buy on account Computer equipment +GST +QST 2017 Aug Note 2 $5,000.00 $8,000.00 $700.00 4 2017 Aug 6 and Office equipment +GST +QST $2,500.00 5 $6,000.00 $1,750.00 $3,100.00 AUS $900.00 $1,350.00 2017 You provide professional services to customer pays cash +GST +QST 2017 Aug 9 You pay the rent 2017 Aug 12 You provide Professional services to customer on account *GST *QST 7 2017 Aug 11 You pay salaries expenses (secretary) 8 2017 11 You pay salaries expenses (owner) 9 2017 Aug 30 16 You sign a six month contract with customer starting today for Aue Note 3 17 You receive payment from customer 2017 Aug 19 You make partial payment for supplier 12 2017 21 You withdraw for personal use 13 2017 Aug 22 You paid the insurance for two years A Note 4 153011 hu 20You buy cash Office supplies for GST *QST Note 5 24you paid the electricity bill GST OST 2011 25 You pay salaries expenses (secretary) 11 2012 25 You pay salaries expenses (owner) $7,200.00 $1,300.00 11 $1,850.00 $500.00 $3,600.00 $987.00 $430.00 $1,000.00 $1,500.00 1 General Journal entries Post entries in General Ledger book 2 3 4 6 Prepare the Trial Balance Prepare the income statement Prepare the Owner's Equity Prepare the Balance Sheet 7 1 2 3 Computer Equipment linear depreciation on 30 months residual of $450.00 Office Equipment linear depreciation on 30 months, residual of $900.00 The contract start on the 15 The insurance is a 2 years contract The Office Supplies used for the month is $185 4 5 Year Month Day 1 2017 Aug $35,000.00 2017 Aug Note 1 2 3 1 You invest to open a business called, >, consultant 3 You buy cash Computer Equipment for +GST +QST 4 You buy cash Office Equipment for +GST +QST You buy on account Computer equipment +GST +QST 2017 Aug Note 2 $5,000.00 $8,000.00 $700.00 4 2017 Aug 6 and Office equipment +GST +QST $2,500.00 5 $6,000.00 $1,750.00 $3,100.00 AUS $900.00 $1,350.00 2017 You provide professional services to customer pays cash +GST +QST 2017 Aug 9 You pay the rent 2017 Aug 12 You provide Professional services to customer on account *GST *QST 7 2017 Aug 11 You pay salaries expenses (secretary) 8 2017 11 You pay salaries expenses (owner) 9 2017 Aug 30 16 You sign a six month contract with customer starting today for Aue Note 3 17 You receive payment from customer 2017 Aug 19 You make partial payment for supplier 12 2017 21 You withdraw for personal use 13 2017 Aug 22 You paid the insurance for two years A Note 4 153011 hu 20You buy cash Office supplies for GST *QST Note 5 24you paid the electricity bill GST OST 2011 25 You pay salaries expenses (secretary) 11 2012 25 You pay salaries expenses (owner) $7,200.00 $1,300.00 11 $1,850.00 $500.00 $3,600.00 $987.00 $430.00 $1,000.00 $1,500.00 1 General Journal entries Post entries in General Ledger book 2 3 4 6 Prepare the Trial Balance Prepare the income statement Prepare the Owner's Equity Prepare the Balance Sheet 7 1 2 3 Computer Equipment linear depreciation on 30 months residual of $450.00 Office Equipment linear depreciation on 30 months, residual of $900.00 The contract start on the 15 The insurance is a 2 years contract The Office Supplies used for the month is $185 4 5