Answered step by step

Verified Expert Solution

Question

1 Approved Answer

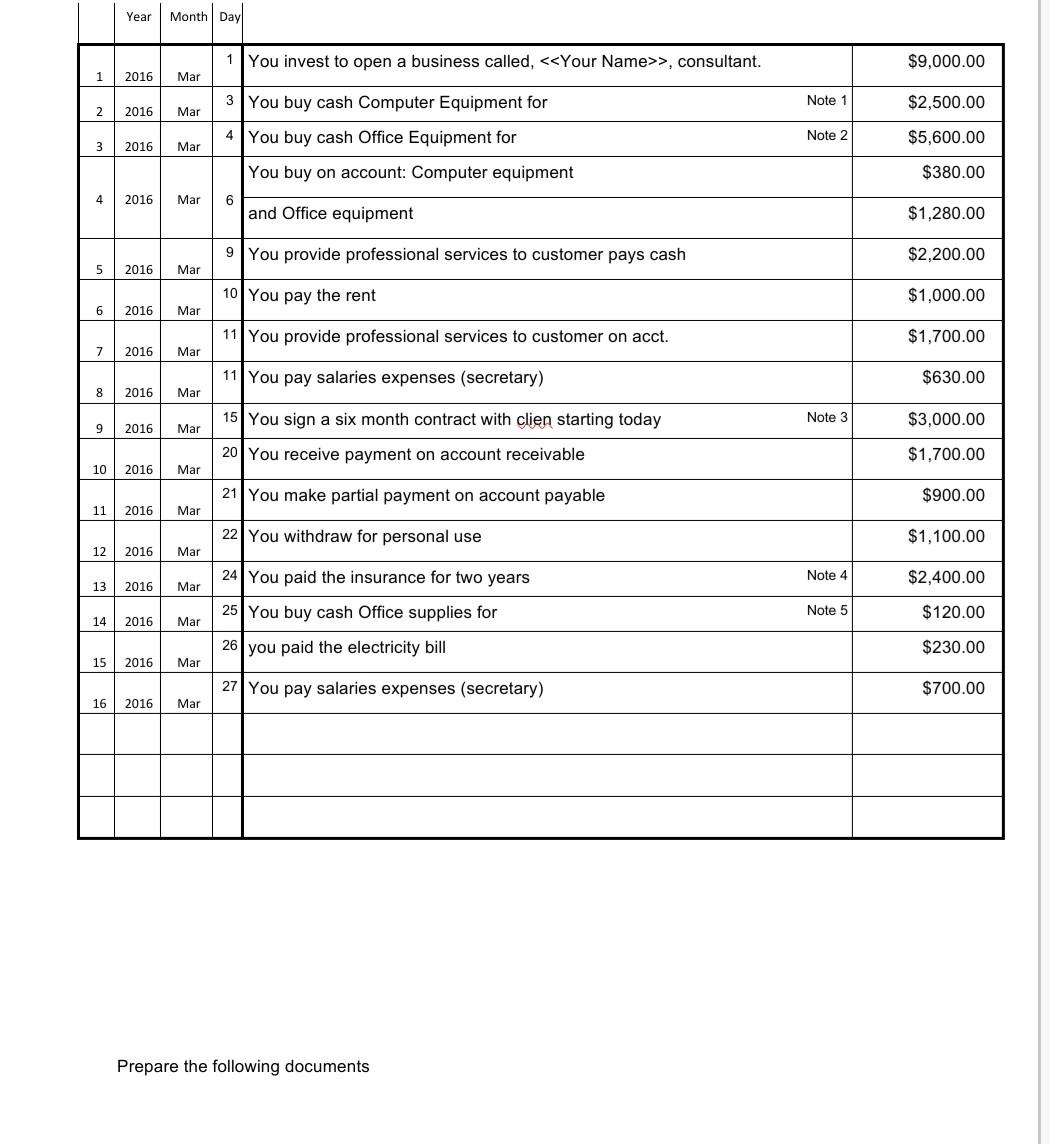

Year Month Day 1 You invest to open a business called, >, consultant. $9,000.00 1 2016 Mar 3 You buy cash Computer Equipment for Note

Year Month Day 1 You invest to open a business called, >, consultant. $9,000.00 1 2016 Mar 3 You buy cash Computer Equipment for Note 1 $2,500.00 2 2016 Mar 4 You buy cash Office Equipment for Note 2 $5,600.00 3 2016 Mar $380.00 4 2016 You buy on account: Computer equipment 6 and Office equipment Mar $1,280.00 9 You provide professional services to customer pays cash $2,200.00 5 2016 Mar 10 You pay the rent $1,000.00 6 2016 Mar 11 You provide professional services to customer on acct. $1,700.00 7 2016 Mar 11 You pay salaries expenses (secretary) $630.00 8 2016 Mar Note 3 $3,000.00 9 2016 Mar 15 You sign a six month contract with clien starting today 20 You receive payment on account receivable $1,700.00 10 2016 Mar 21 You make partial payment on account payable $900.00 11 2016 Mar 22 You withdraw for personal use $1,100.00 12 2016 Mar Note 4 $2,400.00 13 2016 Mar 24 You paid the insurance for two years 25 You buy cash Office supplies for Note 5 2016 14 $120.00 Mar 26 you paid the electricity bill $230.00 15 2016 Mar 27 You pay salaries expenses (secretary) $700.00 16 2016 Mar Prepare the following documents 1. Entries in general journal 2 Post entries in General Ledger 4. Prepare the Trial Balance 5 Prepare the statement of Owner's Equity Prepare the Income statement 6 Prepare the Balance Sheet $480.00 $3,130.00 1 Computer Equipment linear depreciation on 30 months, residual of 2 Office Equipment linear depreciation on 30 months, residual of 3 The contract start on the 15 for 6 months 4 The insurance is a 24 months contract. 5 The Office Supplies used for the month is Note $45.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started