Answered step by step

Verified Expert Solution

Question

1 Approved Answer

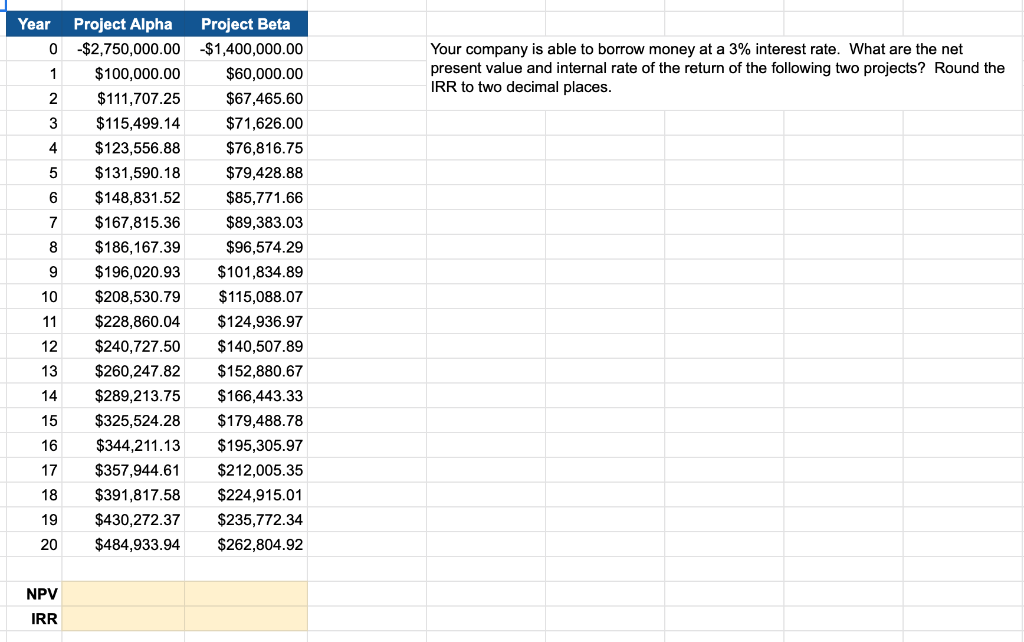

Year Project Alpha Project Beta 0 -$2,750,000.00 -$1,400,000.00 1 $100,000.00 $60,000.00 2 $111,707.25 $67,465.60 3 $115,499.14 $71,626.00 4 $123,556.88 $76,816.75 5 $131,590.18 $79,428.88 6 $148,831.52

| Year | Project Alpha | Project Beta |

| 0 | -$2,750,000.00 | -$1,400,000.00 |

| 1 | $100,000.00 | $60,000.00 |

| 2 | $111,707.25 | $67,465.60 |

| 3 | $115,499.14 | $71,626.00 |

| 4 | $123,556.88 | $76,816.75 |

| 5 | $131,590.18 | $79,428.88 |

| 6 | $148,831.52 | $85,771.66 |

| 7 | $167,815.36 | $89,383.03 |

| 8 | $186,167.39 | $96,574.29 |

| 9 | $196,020.93 | $101,834.89 |

| 10 | $208,530.79 | $115,088.07 |

| 11 | $228,860.04 | $124,936.97 |

| 12 | $240,727.50 | $140,507.89 |

| 13 | $260,247.82 | $152,880.67 |

| 14 | $289,213.75 | $166,443.33 |

| 15 | $325,524.28 | $179,488.78 |

| 16 | $344,211.13 | $195,305.97 |

| 17 | $357,944.61 | $212,005.35 |

| 18 | $391,817.58 | $224,915.01 |

| 19 | $430,272.37 | $235,772.34 |

| 20 | $484,933.94 | $262,804.92 |

| NPV | ||

| IRR |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started