Answered step by step

Verified Expert Solution

Question

1 Approved Answer

+ Year Proposal A ($) Proposal B ($) Proposal C ($) Proposal D ($) 0 -540,000 -250,000 -640,000 -310,000 1 150,000 100,000 220,000 130,000

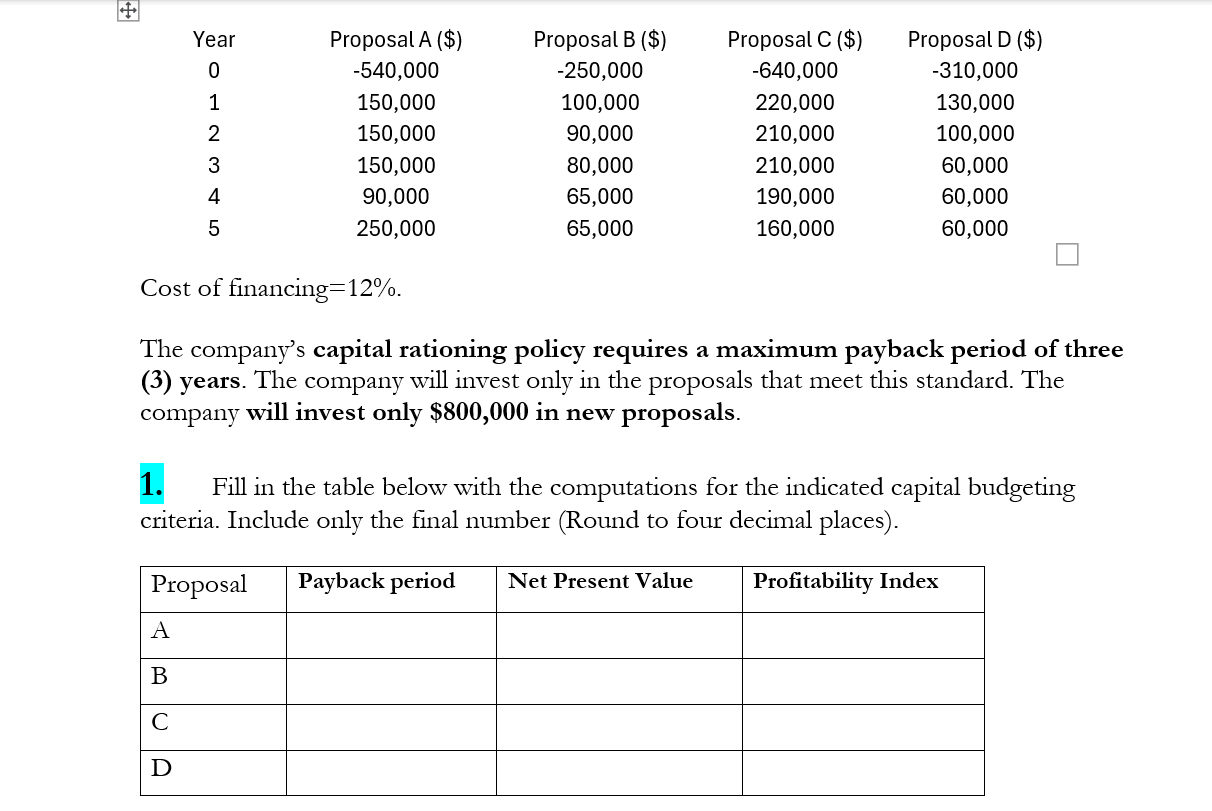

+ Year Proposal A ($) Proposal B ($) Proposal C ($) Proposal D ($) 0 -540,000 -250,000 -640,000 -310,000 1 150,000 100,000 220,000 130,000 2 150,000 90,000 210,000 100,000 3 150,000 80,000 210,000 60,000 4 90,000 65,000 190,000 60,000 5 250,000 65,000 160,000 60,000 Cost of financing=12%. The company's capital rationing policy requires a maximum payback period of three (3) years. The company will invest only in the proposals that meet this standard. The will invest only $800,000 in new proposals. company 1. Fill in the table below with the computations for the indicated capital budgeting criteria. Include only the final number (Round to four decimal places). Proposal A B C D Payback period Net Present Value Profitability Index

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started