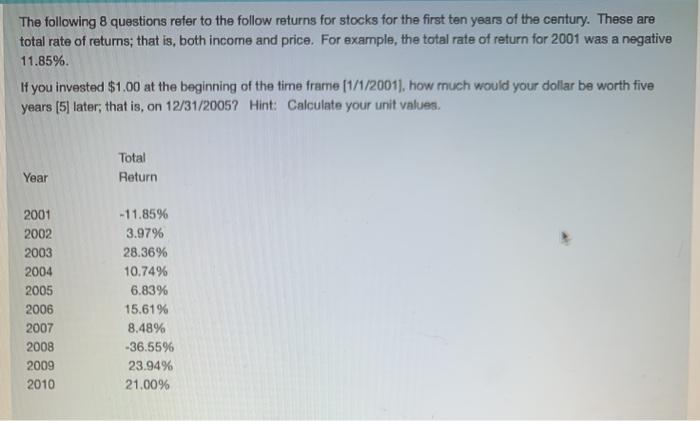

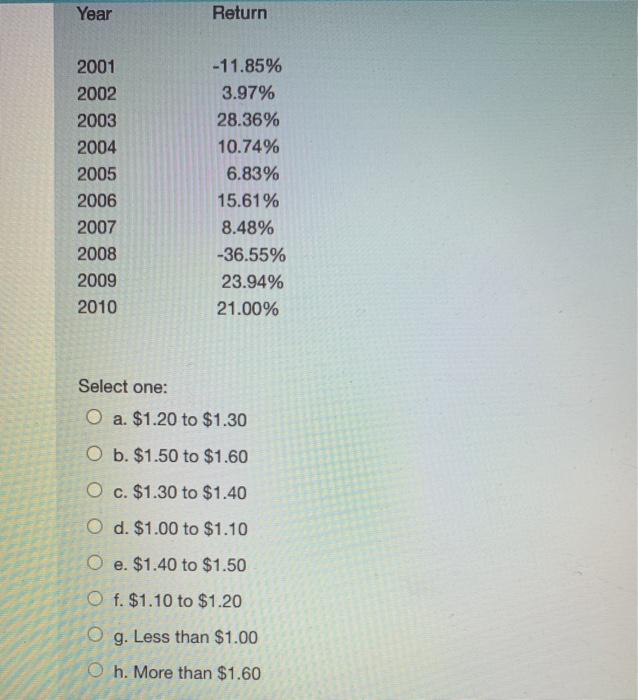

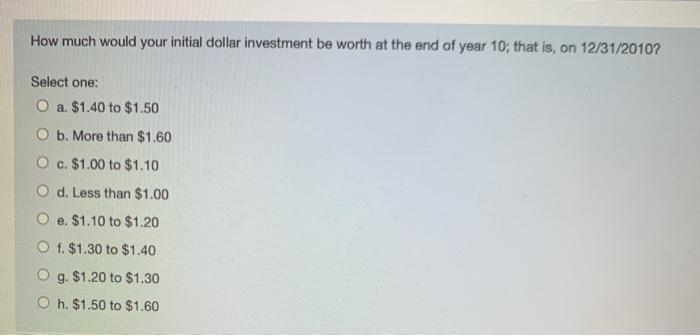

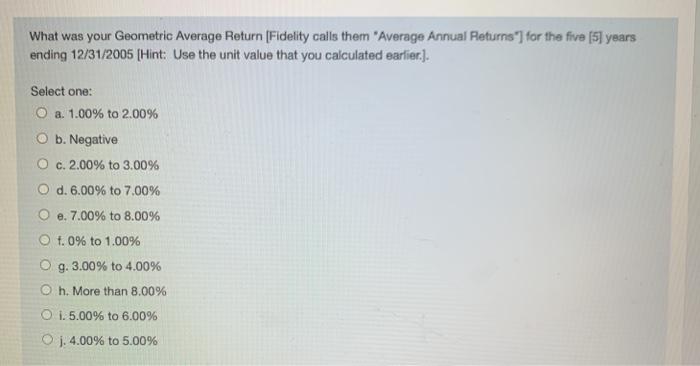

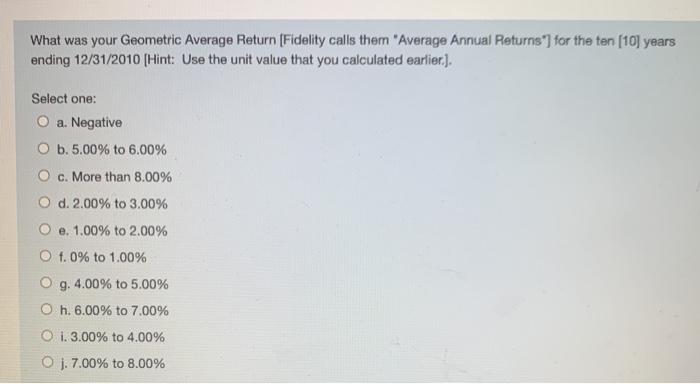

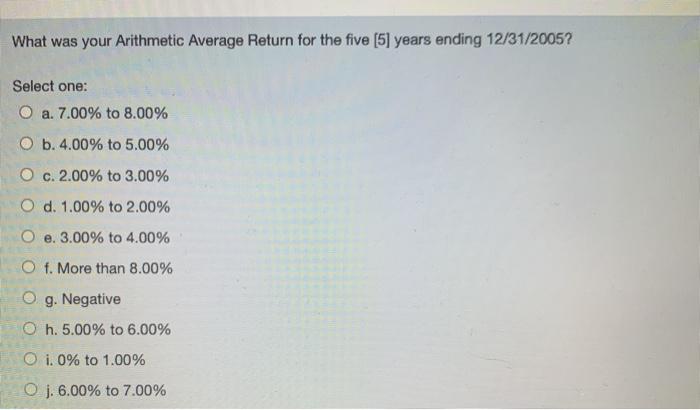

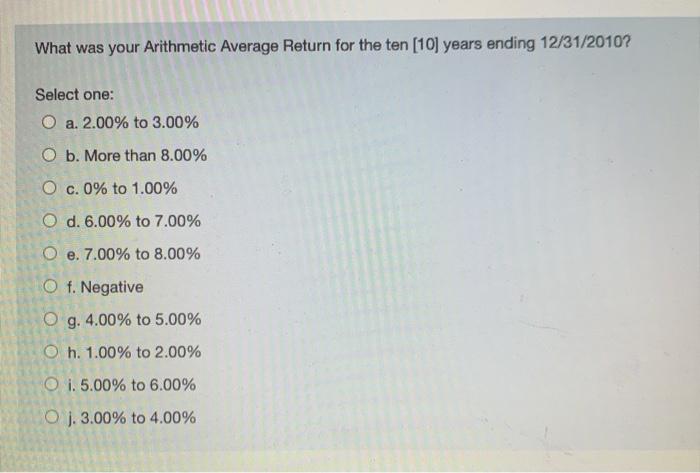

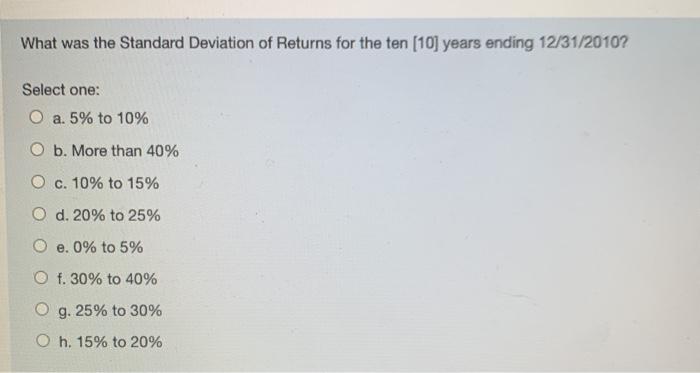

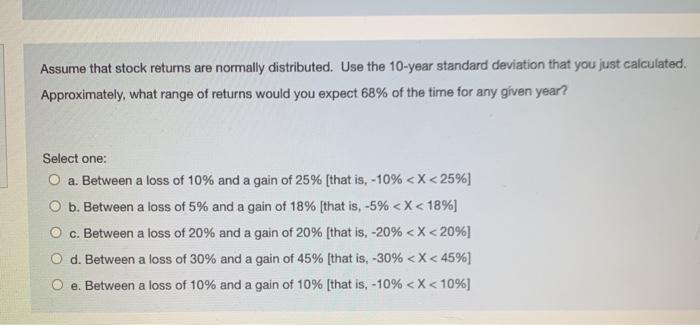

Year Return 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 -11.85% 3.97% 28.36% 10.74% 6.83% 15.61% 8.48% -36.55% 23.94% 21.00% Select one: O a. $1.20 to $1.30 O b. $1.50 to $1.60 O c. $1.30 to $1.40 O d. $1.00 to $1.10 O e. $1.40 to $1.50 O f. $1.10 to $1.20 O g. Less than $1.00 Oh. More than $1.60 How much would your initial dollar investment be worth at the end of year 10; that is, on 12/31/2010? Select one: O a. $1.40 to $1.50 O b. More than $1.60 O c. $1.00 to $1.10 O d. Less than $1.00 O e. $1.10 to $1.20 O f. $1.30 to $1.40 O g. $1.20 to $1.30 Oh. $1.50 to $1.60 What was your Geometric Average Return (Fidelity calls them "Average Annual Returns") for the five (5) years ending 12/31/2005 (Hint: Use the unit value that you calculated earlier.). Select one: O a 1.00% to 2.00% O b. Negative O c. 2.00% to 3.00% O d. 6.00% to 7.00% O e. 7.00% to 8.00% f. 0% to 1.00% O g. 3.00% to 4.00% Oh. More than 8.00% O 1. 5.00% to 6.00% O j. 4.00% to 5.00% What was your Geometric Average Return (Fidelity calls them "Average Annual Returns") for the ten [10] years ending 12/31/2010 (Hint: Use the unit value that you calculated earlier.). Select one: O a. Negative O b. 5.00% to 6.00% O c. More than 8.00% O d. 2.00% to 3.00% O e. 1.00% to 2.00% O f. 0% to 1.00% O g. 4.00% to 5.00% Oh. 6.00% to 7.00% O I. 3.00% to 4.00% O j. 7.00% to 8.00% What was your Arithmetic Average Return for the five (5) years ending 12/31/2005? Select one: O a. 7.00% to 8.00% O b.4.00% to 5.00% O c. 2.00% to 3.00% O d. 1.00% to 2.00% O e. 3.00% to 4.00% O f. More than 8.00% O g. Negative h. 5.00% to 6.00% O i. 0% to 1.00% O j. 6.00% to 7.00% What was your Arithmetic Average Return for the ten [10] years ending 12/31/2010? Select one: O a. 2.00% to 3.00% O b. More than 8.00% O c. 0% to 1.00% O d. 6.00% to 7.00% O e. 7.00% to 8.00% O f. Negative O g. 4.00% to 5.00% O h. 1.00% to 2.00% O i. 5.00% to 6.00% O ). 3.00% to 4.00% What was the Standard Deviation of Returns for the ten (10) years ending 12/31/2010? Select one: O a. 5% to 10% O b. More than 40% O c. 10% to 15% O d. 20% to 25% e. 0% to 5% O f. 30% to 40% O g. 25% to 30% O h. 15% to 20% Assume that stock returns are normally distributed. Use the 10-year standard deviation that you just calculated. Approximately, what range of returns would you expect 68% of the time for any given year? Select one: O a. Between a loss of 10% and a gain of 25% (that is, -10%