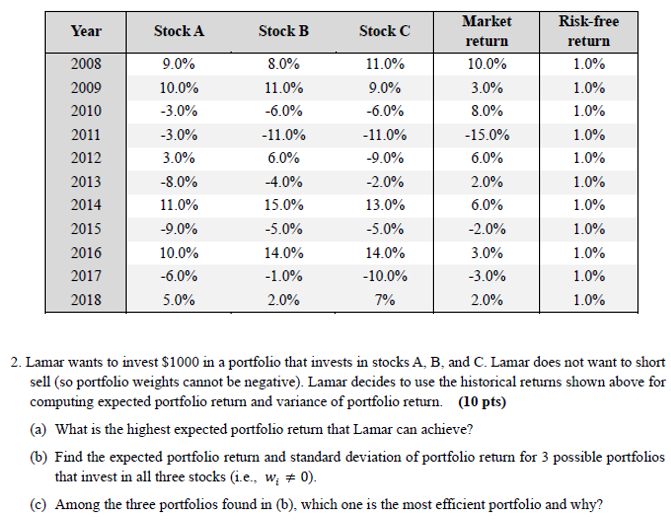

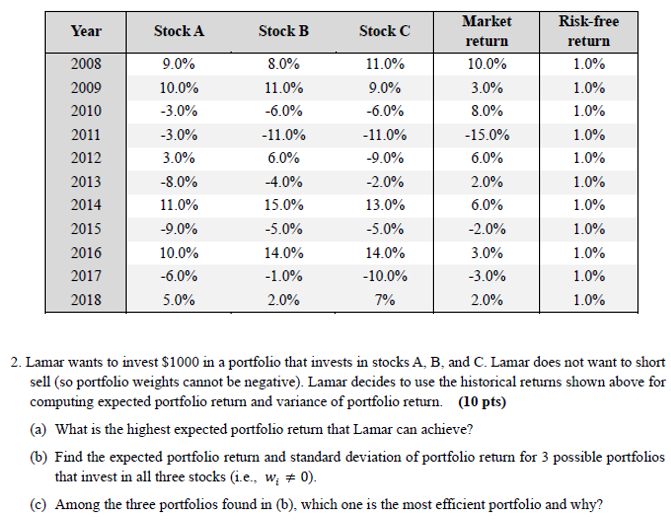

Year Stock A Stock B Stock C 2008 2009 2010 9.0% 10.0% -3.0% -3.0% 3.0% 8.0% 11.0% -6.0% -11.0% Market return 10.0% 3.0% 8.0% -15.0% 2011 2012 2013 6.0% 6.0% 11.0% 9.0% -6.0% -11.0% -9.0% -2.0% 13.0% -5.0% 14.0% -10.0% Risk-free return 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% -8.0% -4.0% 2014 2015 2016 11.0% -9.0% 10.0% -6.0% 5.0% 15.0% -5.0% 14.0% -1.0% 2.0% 2.0% 6.0% -2.0% 3.0% -3.0% 2.0% 2017 2018 7% 2. Lamar wants to invest $1000 in a portfolio that invests in stocks A, B, and C. Lamar does not want to short sell (so portfolio weights cannot be negative). Lamar decides to use the historical returns shown above for computing expected portfolio return and variance of portfolio return. (10 pts) (a) What is the highest expected portfolio return that Lamar can achieve? (b) Find the expected portfolio return and standard deviation of portfolio return for 3 possible portfolios that invest in all three stocks (i.e., W; 70). (c) Among the three portfolios found in (b), which one is the most efficient portfolio and why? Year Stock A Stock B Stock C 2008 2009 2010 9.0% 10.0% -3.0% -3.0% 3.0% 8.0% 11.0% -6.0% -11.0% Market return 10.0% 3.0% 8.0% -15.0% 2011 2012 2013 6.0% 6.0% 11.0% 9.0% -6.0% -11.0% -9.0% -2.0% 13.0% -5.0% 14.0% -10.0% Risk-free return 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% 1.0% -8.0% -4.0% 2014 2015 2016 11.0% -9.0% 10.0% -6.0% 5.0% 15.0% -5.0% 14.0% -1.0% 2.0% 2.0% 6.0% -2.0% 3.0% -3.0% 2.0% 2017 2018 7% 2. Lamar wants to invest $1000 in a portfolio that invests in stocks A, B, and C. Lamar does not want to short sell (so portfolio weights cannot be negative). Lamar decides to use the historical returns shown above for computing expected portfolio return and variance of portfolio return. (10 pts) (a) What is the highest expected portfolio return that Lamar can achieve? (b) Find the expected portfolio return and standard deviation of portfolio return for 3 possible portfolios that invest in all three stocks (i.e., W; 70). (c) Among the three portfolios found in (b), which one is the most efficient portfolio and why