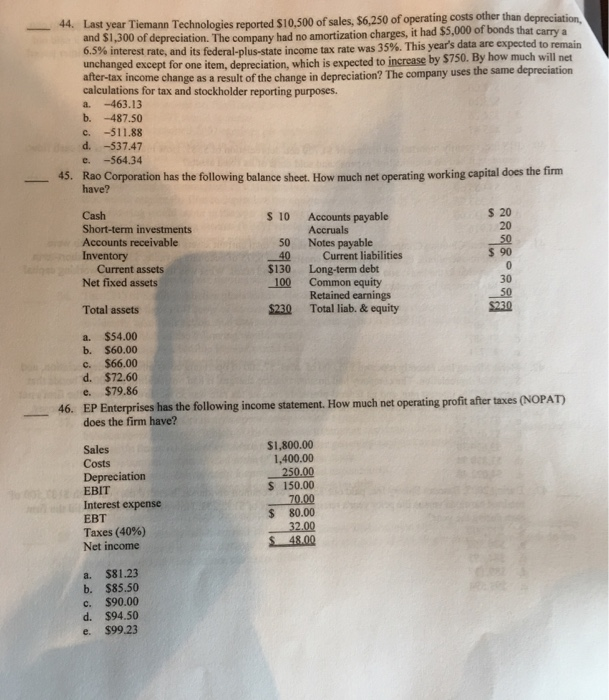

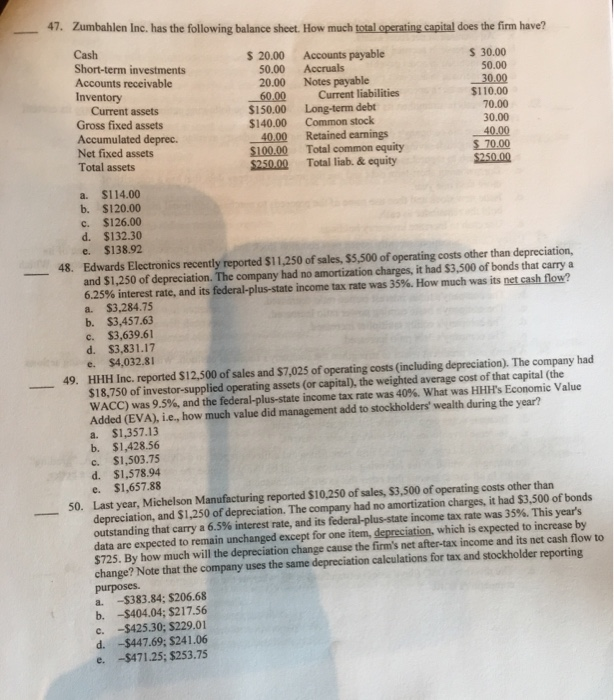

year Tiemann Technologies reported $10,500 of sales, $6,250 of operating costs other 1,300 of depreciation. The company had no amortization charges, it had $5,000 of bonds that carry a than depreciation, -44 Last 35%. This year's data are ex pected to remain 6.5% interest rate, and its federal-plus-state income tax rate was anged except for one item, depreciation, which is expected to increase by $750. By how much will net after-tax income change as a result of the change in depreciation? The company uses the same depreciation calculations for tax and stockholder reporting purposes. a. -463.13 b. -487.50 c. -511.88 d. -537.47 e. -564.34 45. Rao Corporation has the following balance sheet. How much net operating working capital does the fim have? Short-term investments Accounts receivable Inventory S 10 Accounts payable Accruals 50 Notes payable S 20 20 50 $ 90 40 Current liabilities Current assets Net fixed assets $130 Long-term debt 100 Common equity 30 50 $230 Retained earnings Total assets $230 Total liab. & equity a. $54.00 b. $60.00 c. $66.00 d. $72.60 e. $79.86 46. EP Enterprises has the following income statement. How much net operating profit afer taxes (NOPAT) does the firm have? $1,800.00 Sales Costs Depreciation EBIT Interest expense EBT Taxes (40%) Net income 1,400.00 S 150.00 $ 80.00 48.00 a. $81.23 b. $85.50 c. $90.00 d. $94.50 e. $99.23 47. Zumbahlen Inc. has the following balance sheet. How much total operating capital does the firm have? s 20.00 Accounts payable Notes payable Long-term debt S 30.00 50.00 -30.00 $110.00 70.00 30.00 40.00 70.00 $250.00 Short-term investments Accounts receivable Inventory 50.00 Accruals 20.00 60.00 Current liabilities Current assets Gross fixed assets Accumulated deprec. Net fixed assets Total assets $150.00 $140.00 Common stock 40.00 Retained earnings S100.00 $250.00 Total common equity Total liab. & equity a. $114.00 b. $120.00 c. $126.00 d. $132.30 e. $138.92 48. Edwards Electronics recently reported $11,250 of sales, $5.500 of operating costs other than depreciation, and $1,250 of depreciation. The company had no amortization charges, it had $3,500 of bonds that carry a 6.25% interest rate, and its federal-plus-state income tax rate was 35%. How much was its net cashflow? a. $3,284.75 b. $3,457.63 c. $3,639.61 d. $3,831.17 e. $4,032.81 49. HHH Inc. reported $12,500 of sales and $7,025 of operating costs (including depreciation). The company had $18,750 of investor-supplied operating assets (or capital), the weighted average cost of that capital (the WACC) was 9.5%, and the federal-plus-state income tax rate was 40%. What was HHH's Economic Value Added (EVA), i.e., how much value did management add to stockholders' wealth during the year? a. $1,357.13 b. $1,428.56 c. $1,503.75 d. $1,578.94 e. $1,657.88 Last year, Michelson Manufacturing reported S10,250 of sales, $3,500 of operating costs other than depreciation, and $1,250 of depreciation. The company had no amortization charges, it had $3,500 of bonds outstanding that carry a 6.5% interest rate, and its fedenklus-state income tax rate was 35%. This year's data are expected to remain unchanged except for one item, depreciation, which is expected to increase by $725. By how much will the depreciation change cause the firm's net after-tax income and its net cash flow to change? Note that the company uses the same depreciation calculations for tax and stockholder reporting 50. es. a. -$383.84; $206.68 b. -$404.04; $217.56 c. -$425.30; $229.01 d. -$447.69; $241.06 e. -$471.25; $253.75