Answered step by step

Verified Expert Solution

Question

1 Approved Answer

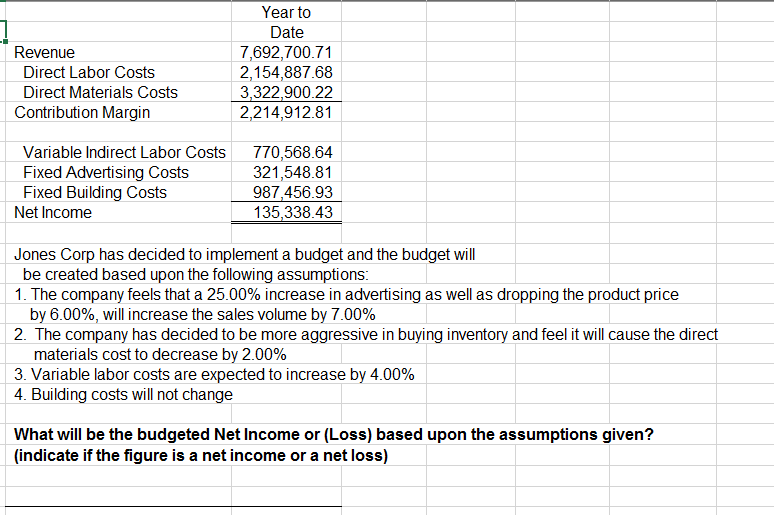

Year to Date Revenue 7,692,700.71 Direct Labor Costs 2,154,887.68 Direct Materials Costs 3,322,900.22 Contribution Margin 2,214,912.81 Variable Indirect Labor Costs 770,568.64 Fixed Advertising Costs

Year to Date Revenue 7,692,700.71 Direct Labor Costs 2,154,887.68 Direct Materials Costs 3,322,900.22 Contribution Margin 2,214,912.81 Variable Indirect Labor Costs 770,568.64 Fixed Advertising Costs 321,548.81 Fixed Building Costs 987,456.93 Net Income 135,338.43 Jones Corp has decided to implement a budget and the budget will be created based upon the following assumptions: 1. The company feels that a 25.00% increase in advertising as well as dropping the product price by 6.00%, will increase the sales volume by 7.00% 2. The company has decided to be more aggressive in buying inventory and feel it will cause the direct materials cost to decrease by 2.00% 3. Variable labor costs are expected to increase by 4.00% 4. Building costs will not change What will be the budgeted Net Income or (Loss) based upon the assumptions given? (indicate if the figure is a net income or a net loss)

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the budgeted Net Income or Loss based on the given assumptions we need to adjust the re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started