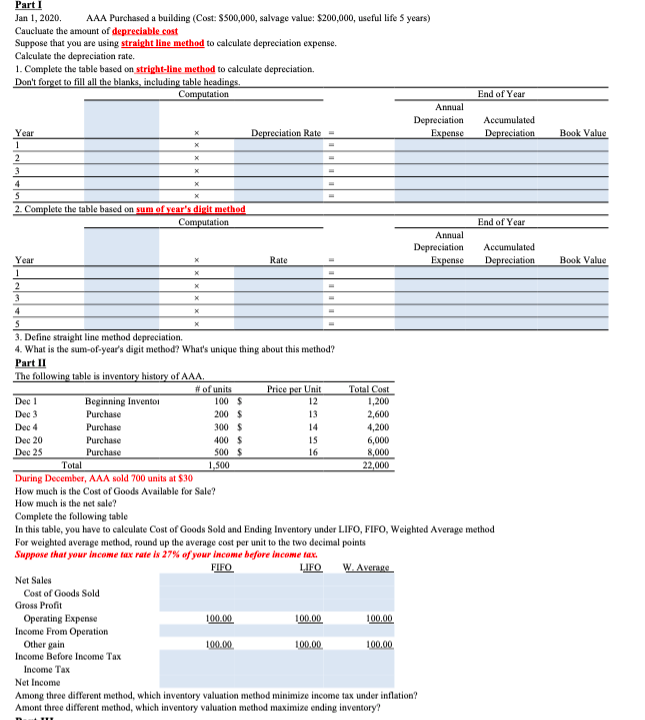

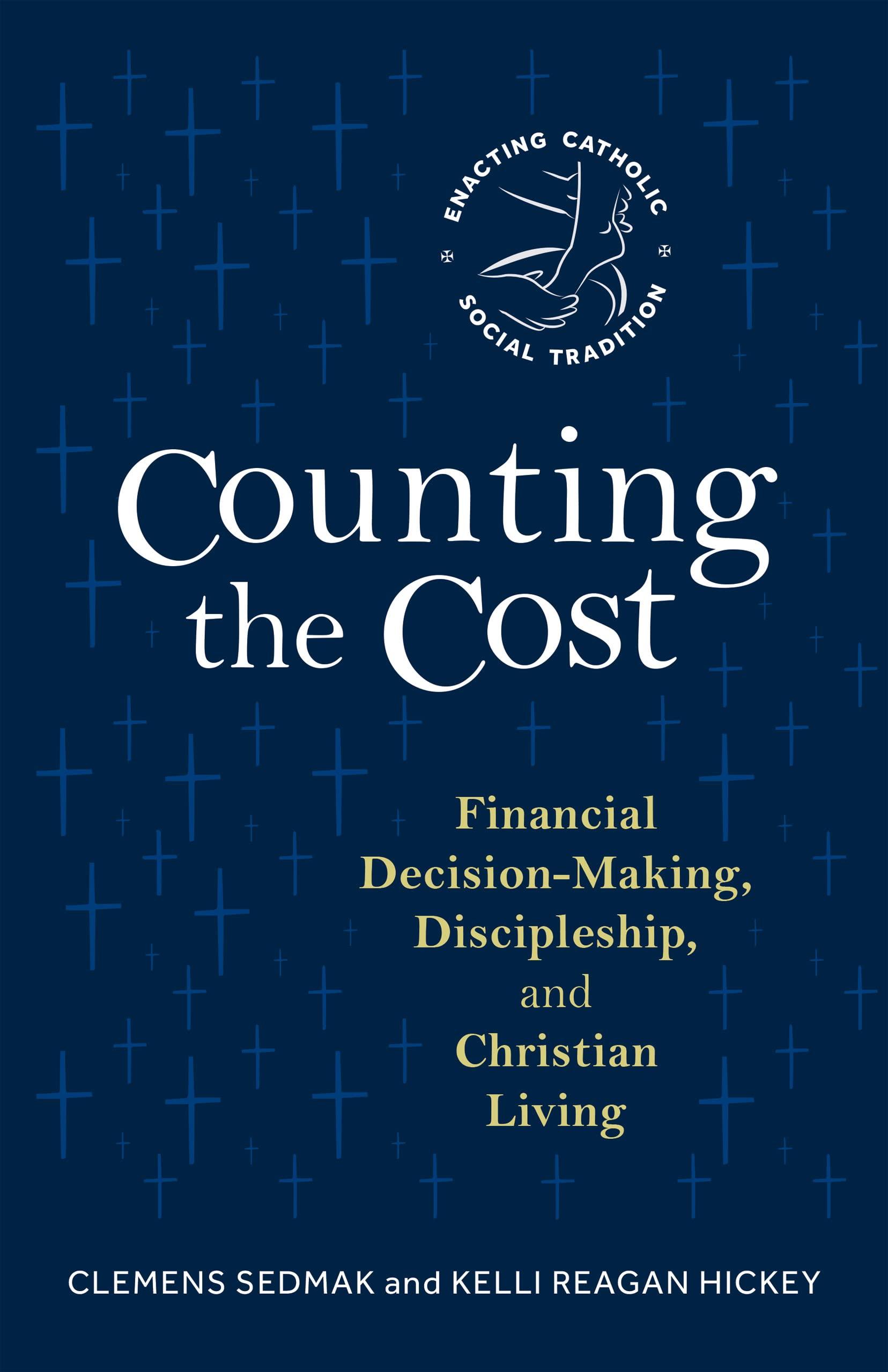

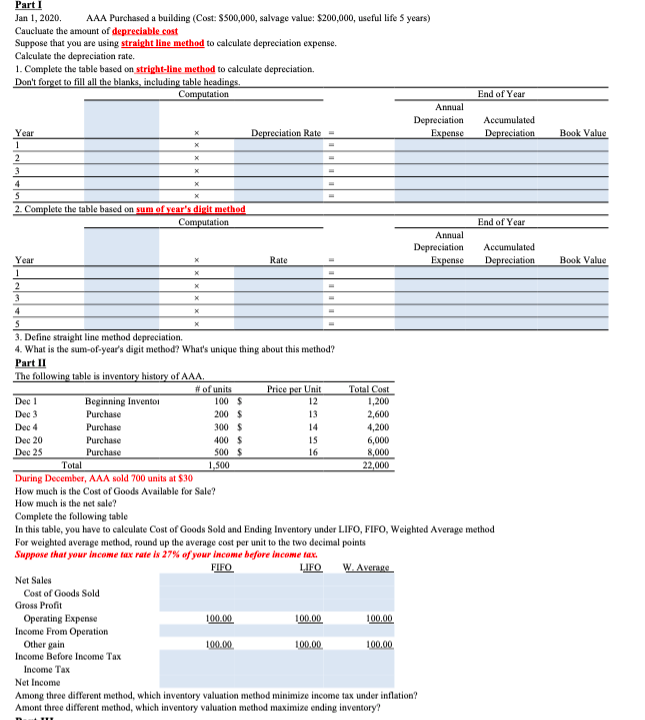

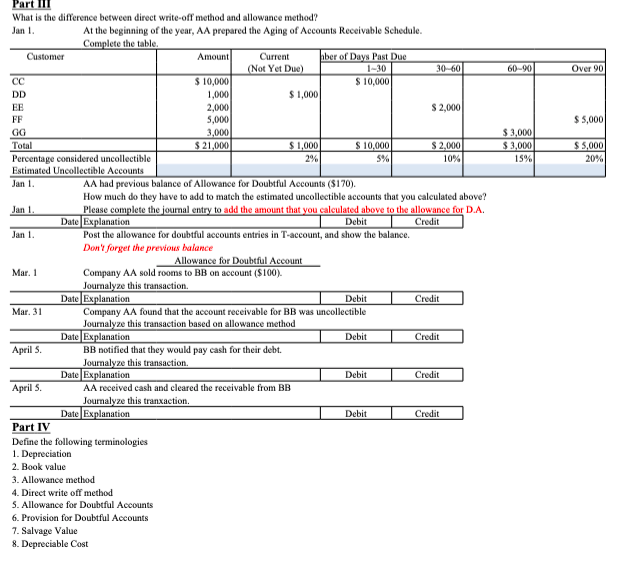

Year X Book Value X X Book Value Part ! Jan 1, 2020. AAA Purchased a building (Cost: $500,000, salvage value: $200,000, useful life 3 years) Caucluate the amount of depreciable cost Suppose that you are using straight line method to calculate depreciation expense. Calculate the depreciation rate. 1. Complete the table based on stright-line method to calculate depreciation, Don't forget to fill all the blanks, including table headings. Computation End of Year Annual Depreciation Accumulated Depreciation Rate - Expense Depreciation 1 2 3 4 S 2. Complete the table based on sum of year's dicit method Computation End of Year Annual Depreciation Accumulated Year Rate Expense Depreciation 1 2 3 4 S 3. Define straight line method depreciation. 4. What is the sum-of-year's digit method? What's unique thing about this method? Part II The following table is inventory history of AAA. # of units Price per Unit Total Cost Dec 1 Beginning Inventos 100 $ 12 1,200 Dec 3 Purchase 200 $ 13 2,600 Dec 4 Purchase 300 $ 14 4,200 Dec 20 Purchase 400 $ 15 6,000 Dec 25 Purchase 500 $ 16 8,000 1,500 22,000 During December, AAA sold 700 units at $30 How much is the Cost of Goods Available for Sale? How much is the net sale? Complete the following table In this table, you have to calculate Cost of Goods Sold and Ending Inventory under LIFO, FIFO, Weighted Average method For weighted average method, round up the average cost per unit to the two decimal points Suppose that your income tax rate is 27% of your Income before income tax. FIFO LIFO W. Average Net Sales Cost of Goods Sold Gross Profit Operating Expense 100.00 100.00 100,00 Income From Operation Other gain 100.00 100.00 100.00 Income Before Income Tax Income Tax Net Income Among three different method, which inventory valuation method minimize income tax under inflation? Amont three different method, which inventory valuation method maximize ending inventory? Total 60-90 Over 90 $5,000 $3,000 $3,000 15% $5,000 20% Part III What is the difference between direct write-off method and allowance method? Jan 1 At the beginning of the year, AA prepared the Aging of Accounts Receivable Schedule. Complete the table Customer Amount Current aber of Days Past Duc (Not Yet Due) 30-60 CC $ 10,000 $ 10,000 DD 1,000 $ 1,000 EE 2,000 $ 2,000 FF 5,000 GG 3,000 Total $ 21,000 $1,000 $ 10.000 $ 2,000 Percentage considered uncollectible 2% 5% 10% Estimated Uncollectible Accounts Jan 1 AA had previous balance of Allowance for Doubtful Accounts ($170). How much do they have to add to match the estimated uncollectible accounts that you calculated above? Jan 1 Please complete the journal entry to add the amount that you calculated above to the allowance for D.A. Date Explanation Debit Credit Jan 1 Post the allowance for doubtful accounts entries in T-account, and show the balance Don't forget the previous balance Allowance for Doubtful Account Mar. 1 Company AA sold rooms to BB on account ($100). Journalyze this transaction Date Explanation Debit Credit Mar. 31 Company AA found that the account receivable for BB was uncollectible Journalyze this transaction based on allowance method Date Explanation Debit Credit April BB notified that they would pay cash for their debt. Journalyze this transaction Date Explanation Debit Credit April AA received cash and cleared the receivable from BB Journalyze this tranxaction Date Explanation Debit Credit Part IV Define the following terminologies 1. Depreciation 2. Book value 3. Allowance method 4. Direct write off method S. Allowance for Doubtful Accounts 6. Provision for Doubtful Accounts 7. Salvage Value 8. Depreciable Cost