Answered step by step

Verified Expert Solution

Question

1 Approved Answer

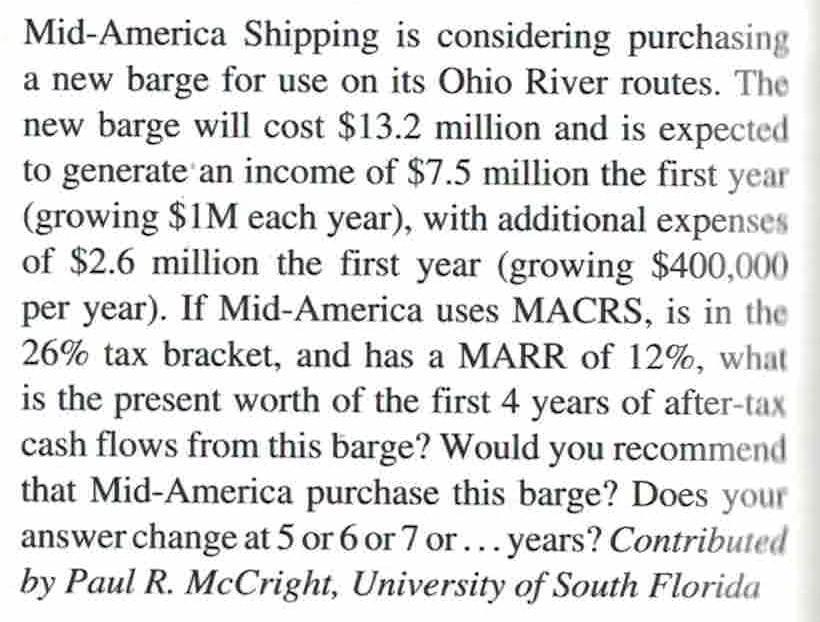

Mid-America Shipping is considering purchasing a new barge for use on its Ohio River routes. The new barge will cost $13.2 million and is

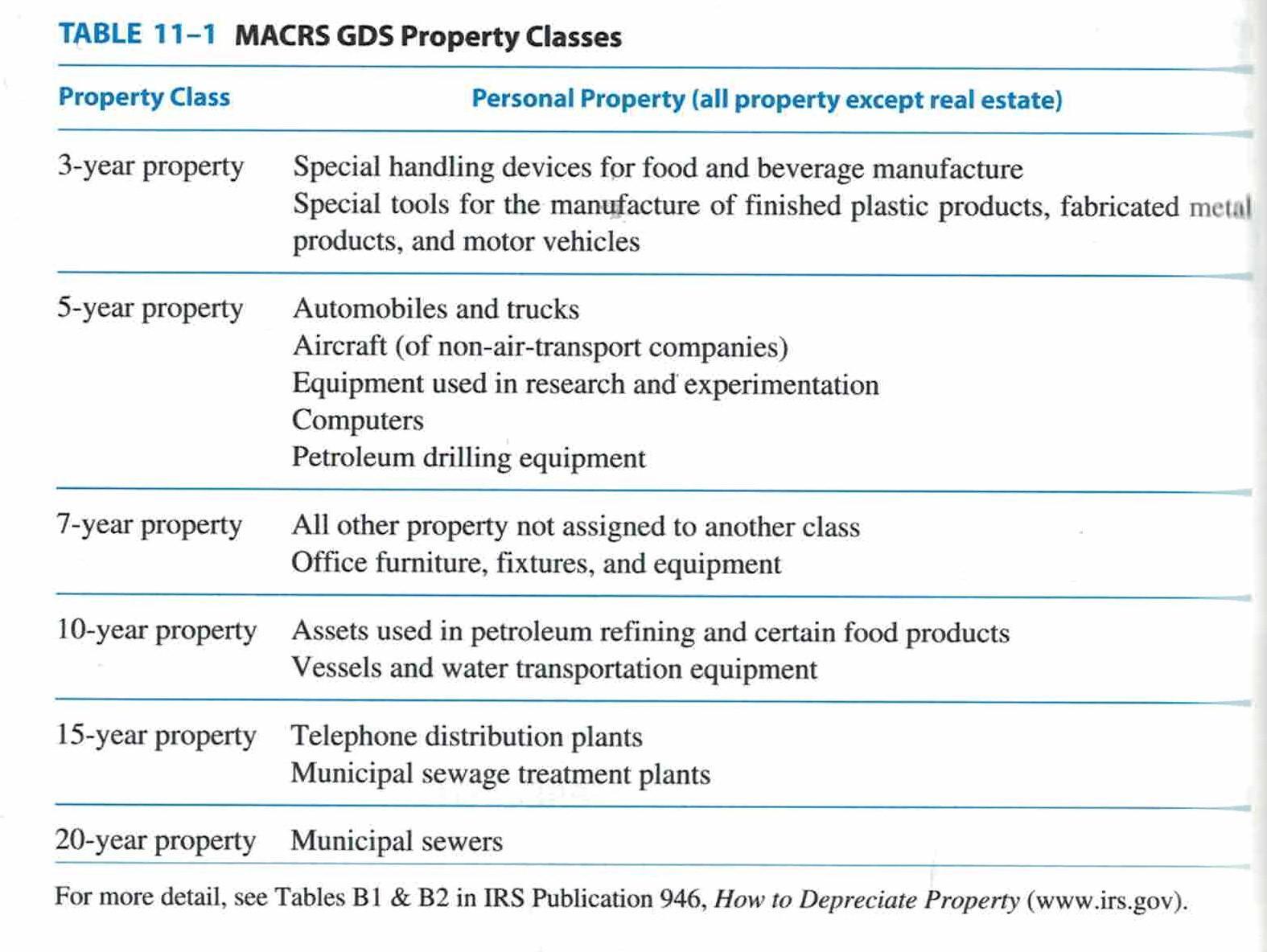

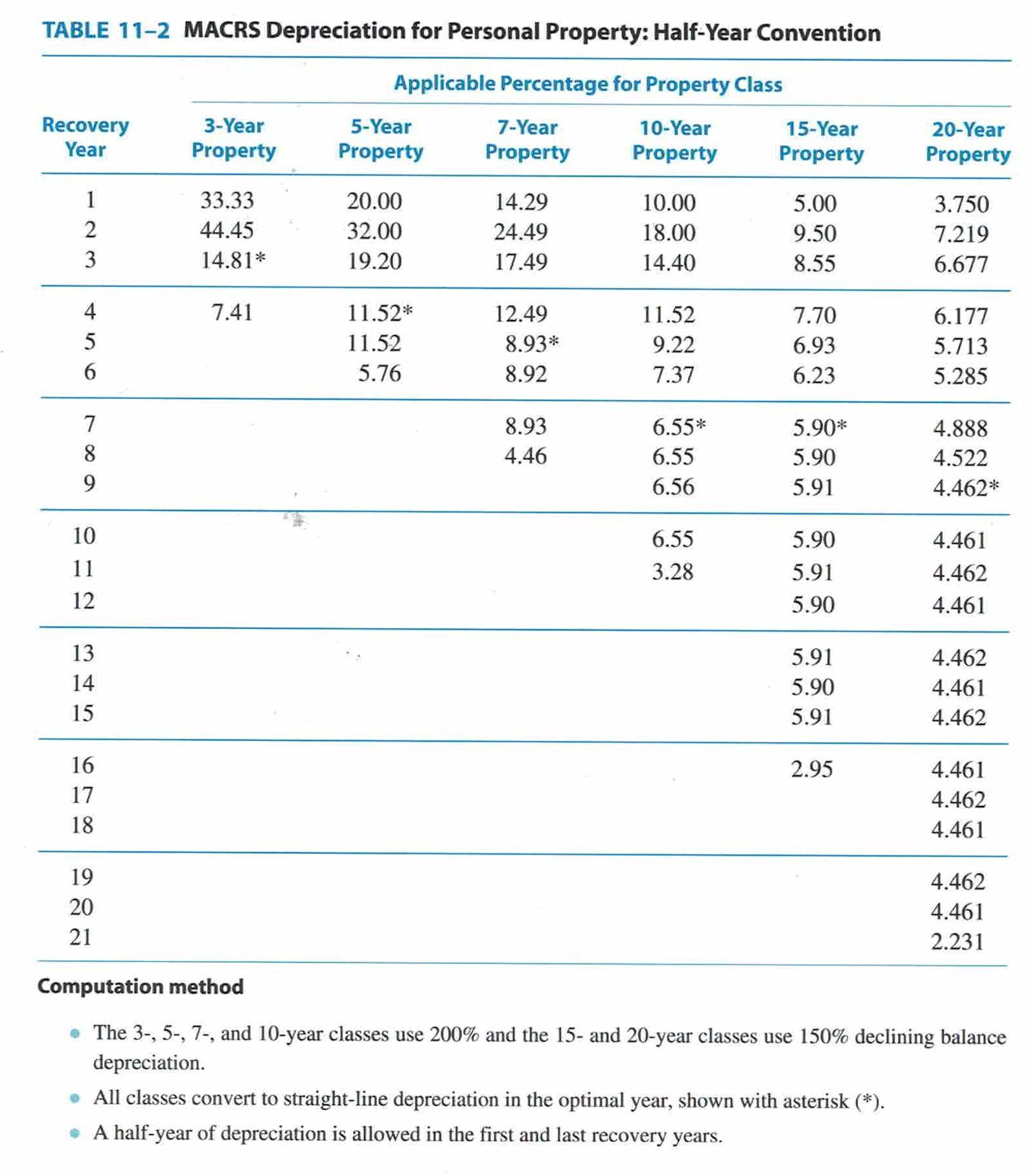

Mid-America Shipping is considering purchasing a new barge for use on its Ohio River routes. The new barge will cost $13.2 million and is expected to generate an income of $7.5 million the first year (growing $1M each year), with additional expenses of $2.6 million the first year (growing $400,000 per year). If Mid-America uses MACRS, is in the 26% tax bracket, and has a MARR of 12%, what is the present worth of the first 4 years of after-tax cash flows from this barge? Would you recommend that Mid-America purchase this barge? Does your answer change at 5 or 6 or 7 or... years? Contributed by Paul R. McCright, University of South Florida TABLE 11-1 MACRS GDS Property Classes Property Class Personal Property (all property except real estate) 3-year property Special handling devices for food and beverage manufacture Special tools for the manufacture of finished plastic products, fabricated metal products, and motor vehicles 5-year property Automobiles and trucks Aircraft (of non-air-transport companies) Equipment used in research and experimentation Computers Petroleum drilling equipment 7-year property All other property not assigned to another class Office furniture, fixtures, and equipment 10-year property Assets used in petroleum refining and certain food products Vessels and water transportation equipment 15-year property Telephone distribution plants Municipal sewage treatment plants 20-year property Municipal sewers For more detail, see Tables B1 & B2 in IRS Publication 946, How to Depreciate Property (www.irs.gov). TABLE 11-2 MACRS Depreciation for Personal Property: Half-Year Convention Applicable Percentage for Property Class Recovery Year 3-Year 5-Year 7-Year 10-Year 15-Year 20-Year Property Property Property Property Property Property 1 33.33 20.00 14.29 10.00 5.00 3.750 44.45 32.00 24.49 18.00 9.50 7.219 3 14.81* 19.20 17.49 14.40 8.55 6.677 4 7.41 11.52* 12.49 11.52 7.70 6.177 11.52 8.93* 9.22 6.93 5.713 6. 5.76 8.92 7.37 6.23 5.285 7 8.93 6.55* 5.90* 4.888 8 4.46 6.55 5.90 4.522 9. 6.56 5.91 4.462* 10 6.55 5.90 4.461 11 3.28 5.91 4.462 12 5.90 4.461 13 5.91 4.462 14 5.90 4.461 15 5.91 4.462 16 2.95 4.461 17 4.462 18 4.461 19 4.462 20 4.461 21 2.231 Computation method The 3-, 5-, 7-, and 10-year classes use 200% and the 15- and 20-year classes use 150% declining balance depreciation. All classes convert to straight-line depreciation in the optimal year, shown with asterisk (*). A half-year of depreciation is allowed in the first and last recovery years.

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Barge falls under 10 years class life The depreciation ra...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started