Question

Yellow plc revalues its plant and equipment (P&E) every two years. It is company policy to charge a full year's depreciation in the year

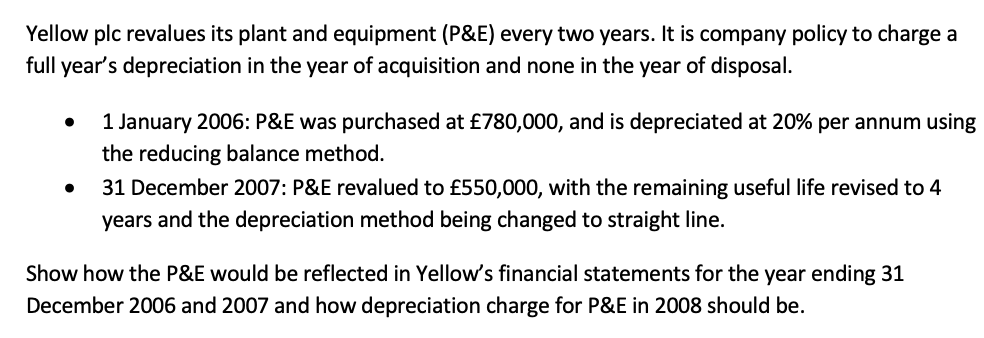

Yellow plc revalues its plant and equipment (P&E) every two years. It is company policy to charge a full year's depreciation in the year of acquisition and none in the year of disposal. 1 January 2006: P&E was purchased at 780,000, and is depreciated at 20% per annum using the reducing balance method. 31 December 2007: P&E revalued to 550,000, with the remaining useful life revised to 4 years and the depreciation method being changed to straight line. Show how the P&E would be reflected in Yellow's financial statements for the year ending 31 December 2006 and 2007 and how depreciation charge for P&E in 2008 should be.

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Extract of balance sheet Particulars Amount 31 Dec 2016 extract PE cost 780000 Less20 deprecia...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting Reporting and Analysis

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach

2nd edition

9781305727557, 1285453824, 9781337116619, 130572755X, 978-1285453828

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App