Question: Bolack is single and earned $140,000 this year as a TV actor. Bojack's friend, Todd, is 24 years old and unemployed. Todd has lived

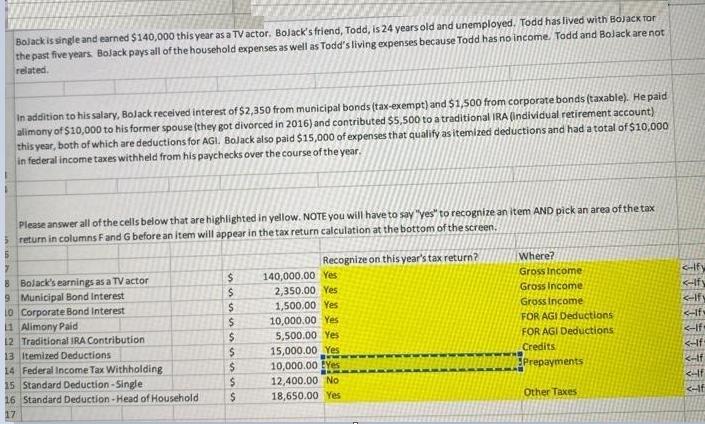

Bolack is single and earned $140,000 this year as a TV actor. Bojack's friend, Todd, is 24 years old and unemployed. Todd has lived with BoJaCK Tor the past five years. Bolack pays all of the household expenses as well as Todd's living expenses because Todd has no income. Todd and Bojack are not related. In addition to his salary, Bolack received interest of $2,350 from municipal bonds (tax-exempt) and $1,500 from corporate bonds (taxable). He paid alimony of $10,000 to his former spouse (they got divorced in 2016) and contributed $5,500 to a traditional IRA (individual retirement account) this year, both of which are deductions for AGI. Bolack also paid $15,000 of expenses that qualify as itemized deductions and had a total of $10,000 in federal income taxes withheld from his paychecks over the course of the year. Please answer all of the cells below that are highlighted in yellow. NOTE you will have to say "yes" to recognize an item AND pick an area of the tax 5 return in columns Fand G before an item will appear in the tax return calculation at the bottom of the screen. Recognize on this year's tax return? Where? 8 Bolack's earnings as a TV actor 9 Municipal Bond Interest Lo Corporate Bond Interest 1 Alimony Paid 12 Traditional IRA Contribution 13 Itemized Deductions 14 Federal Income Tax Withholding 15 Standard Deduction-Single 16 Standard Deduction -Head of Household 17 140,000.00 Yes 2,350.00 Yes Gross Income Ify

Step by Step Solution

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Particular Recgnize on this years tax return Where ... View full answer

Get step-by-step solutions from verified subject matter experts