Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Yes, it is proactive approach You are a manager at a startup company, which is specialized in designing and producing drone. You are considering two

Yes, it is proactive approach

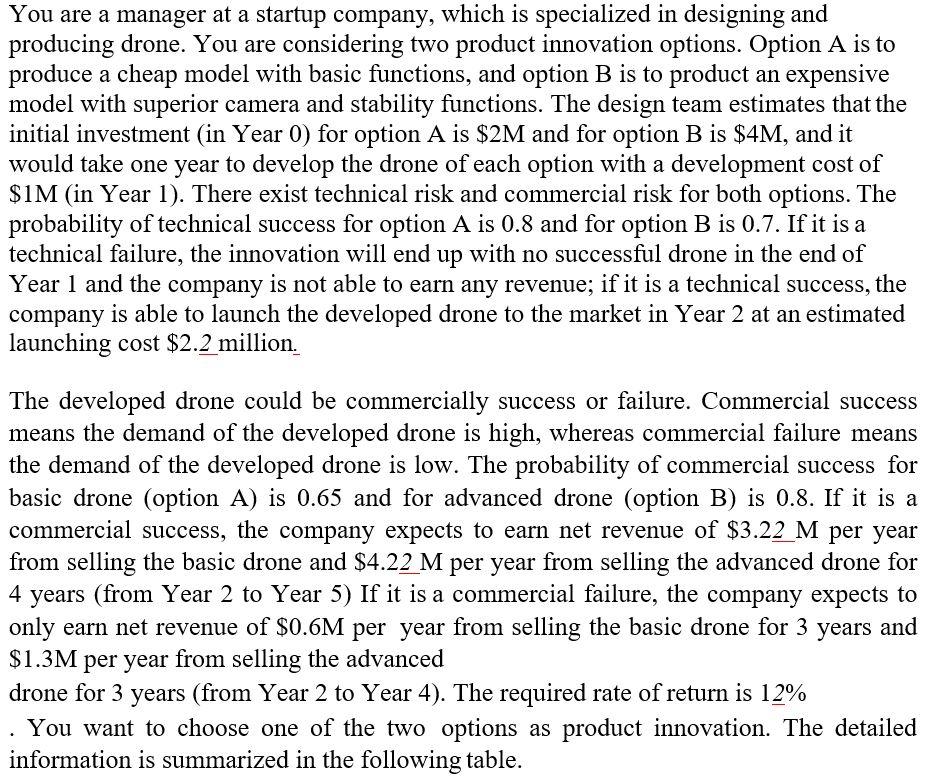

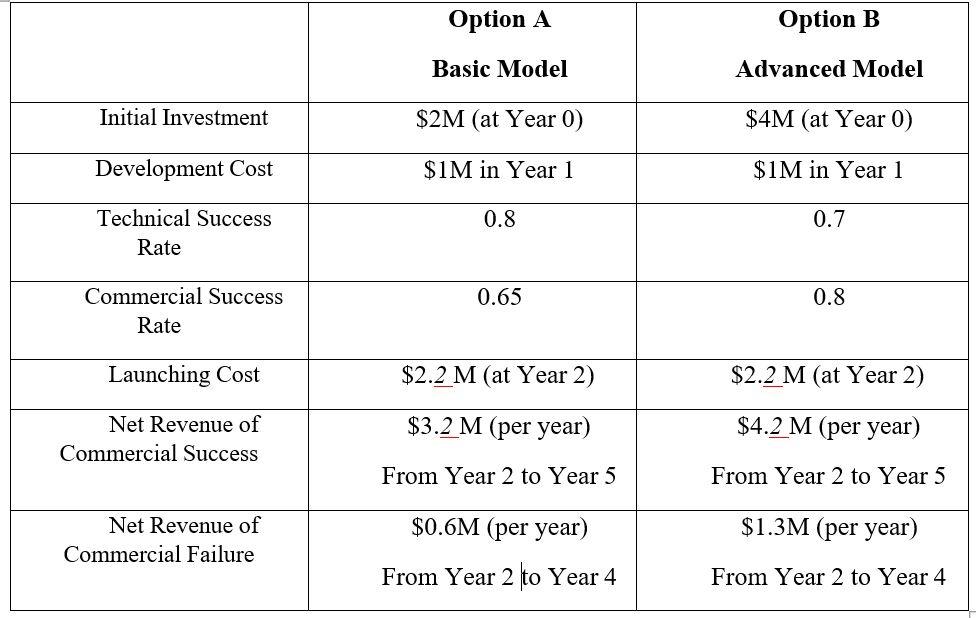

You are a manager at a startup company, which is specialized in designing and producing drone. You are considering two product innovation options. Option A is to produce a cheap model with basic functions, and option B is to product an expensive model with superior camera and stability functions. The design team estimates that the initial investment (in Year 0) for option A is $2M and for option B is $4M, and it would take one year to develop the drone of each option with a development cost of $1M (in Year 1). There exist technical risk and commercial risk for both options. The probability of technical success for option A is 0.8 and for option B is 0.7. If it is a technical failure, the innovation will end up with no successful drone in the end of Year 1 and the company is not able to earn any revenue; if it is a technical success, the company is able to launch the developed drone to the market in Year 2 at an estimated launching cost $2.2 million. The developed drone could be commercially success or failure. Commercial success means the demand of the developed drone is high, whereas commercial failure means the demand of the developed drone is low. The probability of commercial success for basic drone (option A) is 0.65 and for advanced drone (option B) is 0.8. If it is a commercial success, the company expects to earn net revenue of $3.22 M per year from selling the basic drone and $4.22 M per year from selling the advanced drone for 4 years (from Year 2 to Year 5) If it is a commercial failure, the company expects to only earn net revenue of $0.6M per year from selling the basic drone for 3 years and $1.3M per year from selling the advanced drone for 3 years (from Year 2 to Year 4). The required rate of return is 12% You want to choose one of the two options as product innovation. The detailed information is summarized in the following table. Option A Option B Basic Model Advanced Model Initial Investment $2M (at Year 0) $4M (at Year 0) Development Cost $1M in Year 1 $1M in Year 1 0.8 0.7 Technical Success Rate 0.65 0.8 Commercial Success Rate Launching Cost $2.2 M (at Year $2.2 M (at Year 2) Net Revenue of Commercial Success $3.2 M (per year) $4.2 M (per year) From Year 2 to Year 5 From Year 2 to Year 5 Net Revenue of Commercial Failure $1.3M (per year) $0.6M (per year) From Year 2 to Year 4 From Year 2 to Year 4 (a) Consider the case of making selection based on pre-active expected commercial value approach, under which you will for sure launch the drone regardless of whether it is a commercial success or failure. Based on the above financial information only, will you choose option A or option B? Why? Justify your answer. (b) Consider the case of making selection based on re-active real option approach, under which you are able to test the market response and know whether it is a commercial success or failure in the beginning of Year 2) before officially launching the drone and incurring the launching cost. That is, if you find out it will be a commercial failure, you have the option to decide whether to launch the drone or not. Based on the above financial information only, will you choose option A or option B? Why? Justify your answer. (c) It is argued that the real option approach (ROA) always leads to a weakly higher value assessment of innovation options, compared to that obtained via the expected commercial value (ECV) approach. Do you agree with this statement or not? Justify your answer. (d) Beyond the context of the above questions, discuss in general the advantages and disadvantages of using either the rationalist way or the incrementalist way to manage innovation, and their respective impacts on both the selection and implementation stages of innovation. Justify your answer. You are a manager at a startup company, which is specialized in designing and producing drone. You are considering two product innovation options. Option A is to produce a cheap model with basic functions, and option B is to product an expensive model with superior camera and stability functions. The design team estimates that the initial investment (in Year 0) for option A is $2M and for option B is $4M, and it would take one year to develop the drone of each option with a development cost of $1M (in Year 1). There exist technical risk and commercial risk for both options. The probability of technical success for option A is 0.8 and for option B is 0.7. If it is a technical failure, the innovation will end up with no successful drone in the end of Year 1 and the company is not able to earn any revenue; if it is a technical success, the company is able to launch the developed drone to the market in Year 2 at an estimated launching cost $2.2 million. The developed drone could be commercially success or failure. Commercial success means the demand of the developed drone is high, whereas commercial failure means the demand of the developed drone is low. The probability of commercial success for basic drone (option A) is 0.65 and for advanced drone (option B) is 0.8. If it is a commercial success, the company expects to earn net revenue of $3.22 M per year from selling the basic drone and $4.22 M per year from selling the advanced drone for 4 years (from Year 2 to Year 5) If it is a commercial failure, the company expects to only earn net revenue of $0.6M per year from selling the basic drone for 3 years and $1.3M per year from selling the advanced drone for 3 years (from Year 2 to Year 4). The required rate of return is 12% You want to choose one of the two options as product innovation. The detailed information is summarized in the following table. Option A Option B Basic Model Advanced Model Initial Investment $2M (at Year 0) $4M (at Year 0) Development Cost $1M in Year 1 $1M in Year 1 0.8 0.7 Technical Success Rate 0.65 0.8 Commercial Success Rate Launching Cost $2.2 M (at Year $2.2 M (at Year 2) Net Revenue of Commercial Success $3.2 M (per year) $4.2 M (per year) From Year 2 to Year 5 From Year 2 to Year 5 Net Revenue of Commercial Failure $1.3M (per year) $0.6M (per year) From Year 2 to Year 4 From Year 2 to Year 4 (a) Consider the case of making selection based on pre-active expected commercial value approach, under which you will for sure launch the drone regardless of whether it is a commercial success or failure. Based on the above financial information only, will you choose option A or option B? Why? Justify your answer. (b) Consider the case of making selection based on re-active real option approach, under which you are able to test the market response and know whether it is a commercial success or failure in the beginning of Year 2) before officially launching the drone and incurring the launching cost. That is, if you find out it will be a commercial failure, you have the option to decide whether to launch the drone or not. Based on the above financial information only, will you choose option A or option B? Why? Justify your answer. (c) It is argued that the real option approach (ROA) always leads to a weakly higher value assessment of innovation options, compared to that obtained via the expected commercial value (ECV) approach. Do you agree with this statement or not? Justify your answer. (d) Beyond the context of the above questions, discuss in general the advantages and disadvantages of using either the rationalist way or the incrementalist way to manage innovation, and their respective impacts on both the selection and implementation stages of innovation. Justify yourStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started