Answered step by step

Verified Expert Solution

Question

1 Approved Answer

yes, it's income tax related Comprehensive Case (Chapters 1 To 6) Family Information Jamine Ramiz is 46 years old. She is married to Raul R

yes, it's income tax related

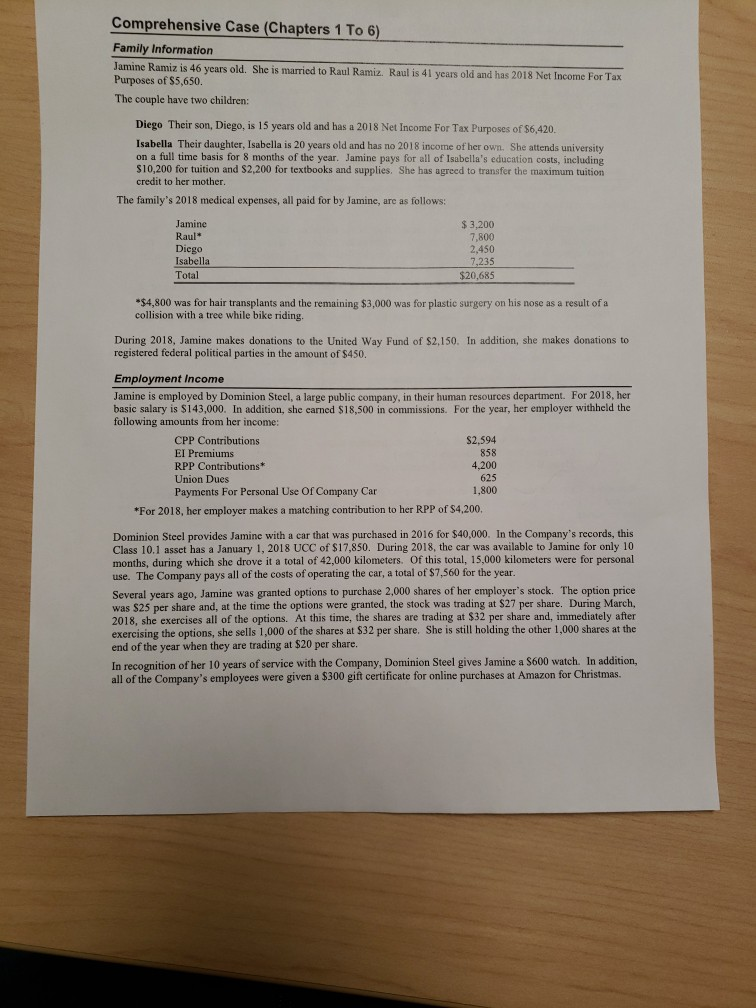

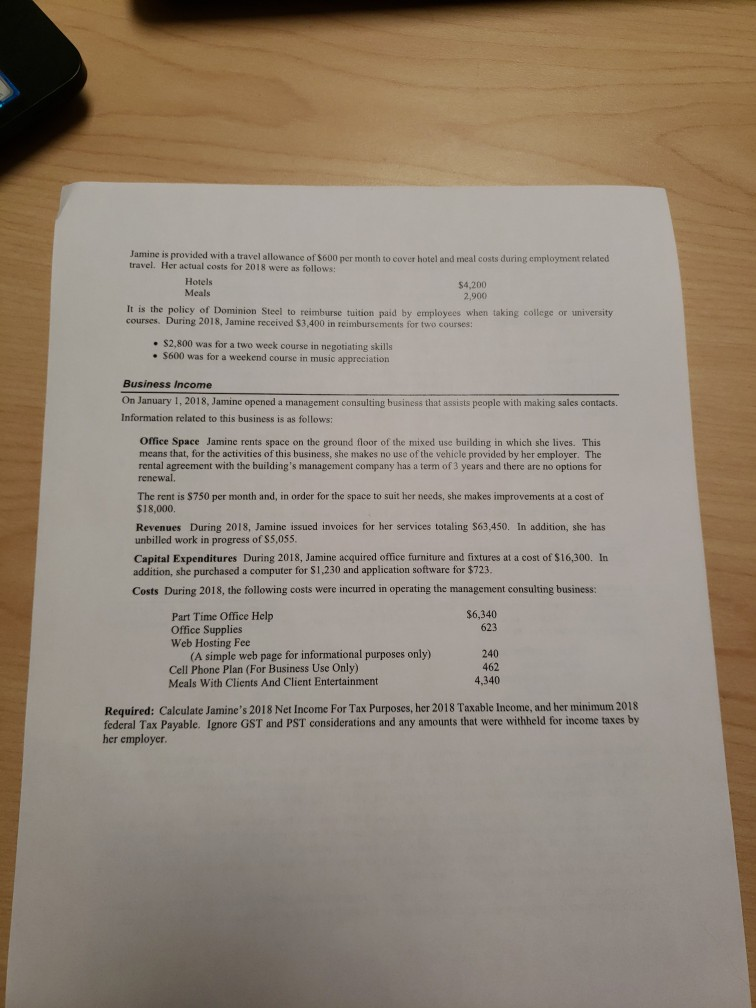

Comprehensive Case (Chapters 1 To 6) Family Information Jamine Ramiz is 46 years old. She is married to Raul R Purposes of S5,650. The couple have two children: amiz. Raul is 41 years old and has 2018 Net Income For Tax Diego Their son, Diego, is 15 years old and has a 2018 Net Income For Tax Purposes of $6,420. Isabella Their daughter, Isabella is 20 years old and has no 2018 income of her own. She attends university on a full time basis for 8 months of the year. Jamine pays for all of Isabella's education costs, including S10,200 for tuition and S2,200 for textbooks and supplies. She has agreed to transfer the maximum tuition credit to her mother. The family's 2018 medical expenses, all paid for by Jamine, are as follows: amine Raul* Diego Isabella Total $3,200 7,800 2,450 $20,685 $4,800 was for hair transplants and the remaining $3,000 was for plastic surgery on his nose as a result of a collision with a tree while bike riding During 2018. Jamine makes donations to the United Way Fund of $2,150. In addition, she makes donations to registered federal political parties in the amount of $450 Employment Income Jamine is employed by Dominion Steel, a large public company, in their human resources department. For 2018, her basic salary is $143,000. In addition, she earned $18,500 in commissions. For the year, her employer withheld the following amounts from her income: CPP Contributions El Premiums RPP Contributions* Union Dues Payments For Personal Use Of Company Car $2,594 858 4,200 625 1,800 *For 2018, her employer makes a matching contribution to her RPP of $4,200. Dominion Steel provides Jamine with a car that was purchased in 2016 for $40,000. In the Company's records, this Class 10.1 asset has a January 1, 2018 UCC of $17,850. During 2018, the car was available to Jamine for only 10 months, during which she drove it a total of 42,000 kilometers. Of this total, 15,000 kilometers were for personal use. The Company pays all of the costs of operating the car, a total of $7,560 for the year Several years ago, Jamine was granted options to purchase 2,000 shares of her employer's stock. The option price was S25 per share and, at the time the options were granted, the stock was trading at $27 per share. During March, 2018, she exercises all of the options. At this time, the shares are trading at $32 per share and, immediately after exercising the options, she sells 1,000 of the shares at $32 per share. She is still holding the other 1,000 shares at the end of the year when they are trading at $20 per share. In recognition of her 10 years of service with the Company, Dominion Steel gives Jamine a S600 watch. In addition, all of the Company's employees were given a $300 gift certificate for online purchases at Amazon for Christmas. Comprehensive Case (Chapters 1 To 6) Family Information Jamine Ramiz is 46 years old. She is married to Raul R Purposes of S5,650. The couple have two children: amiz. Raul is 41 years old and has 2018 Net Income For Tax Diego Their son, Diego, is 15 years old and has a 2018 Net Income For Tax Purposes of $6,420. Isabella Their daughter, Isabella is 20 years old and has no 2018 income of her own. She attends university on a full time basis for 8 months of the year. Jamine pays for all of Isabella's education costs, including S10,200 for tuition and S2,200 for textbooks and supplies. She has agreed to transfer the maximum tuition credit to her mother. The family's 2018 medical expenses, all paid for by Jamine, are as follows: amine Raul* Diego Isabella Total $3,200 7,800 2,450 $20,685 $4,800 was for hair transplants and the remaining $3,000 was for plastic surgery on his nose as a result of a collision with a tree while bike riding During 2018. Jamine makes donations to the United Way Fund of $2,150. In addition, she makes donations to registered federal political parties in the amount of $450 Employment Income Jamine is employed by Dominion Steel, a large public company, in their human resources department. For 2018, her basic salary is $143,000. In addition, she earned $18,500 in commissions. For the year, her employer withheld the following amounts from her income: CPP Contributions El Premiums RPP Contributions* Union Dues Payments For Personal Use Of Company Car $2,594 858 4,200 625 1,800 *For 2018, her employer makes a matching contribution to her RPP of $4,200. Dominion Steel provides Jamine with a car that was purchased in 2016 for $40,000. In the Company's records, this Class 10.1 asset has a January 1, 2018 UCC of $17,850. During 2018, the car was available to Jamine for only 10 months, during which she drove it a total of 42,000 kilometers. Of this total, 15,000 kilometers were for personal use. The Company pays all of the costs of operating the car, a total of $7,560 for the year Several years ago, Jamine was granted options to purchase 2,000 shares of her employer's stock. The option price was S25 per share and, at the time the options were granted, the stock was trading at $27 per share. During March, 2018, she exercises all of the options. At this time, the shares are trading at $32 per share and, immediately after exercising the options, she sells 1,000 of the shares at $32 per share. She is still holding the other 1,000 shares at the end of the year when they are trading at $20 per share. In recognition of her 10 years of service with the Company, Dominion Steel gives Jamine a S600 watch. In addition, all of the Company's employees were given a $300 gift certificate for online purchases at Amazon for ChristmasStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started