Answered step by step

Verified Expert Solution

Question

1 Approved Answer

yes or no Ansel sells 400 shares of Sharpe, Inc, common stock on October 12, 2017, for $12.500 and pays s6oo in commissions on the

yes or no

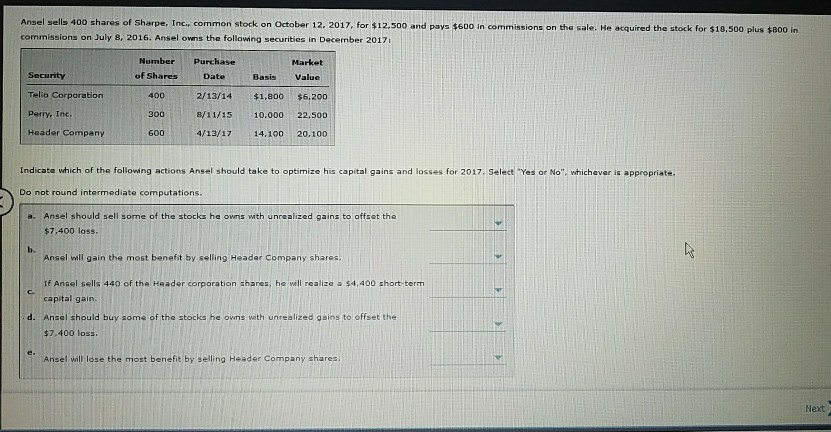

Ansel sells 400 shares of Sharpe, Inc, common stock on October 12, 2017, for $12.500 and pays s6oo in commissions on the sale. He acquired the stock for $18,500 plus $800 in commissions on July 8, 2016. Ansel owns the following securities in December 2017 Number Purchase of Shares DateBasis Value Market Security Telio Corporation Perry. Inc Header Company 400 2/13/14 $1,800 $6,200 300 600 8/11/15 10,000 22,500 4/13/17 14,100 20.100 Indicate which of the folloing actions Ansel should take to optimize his capital gains and losses for 2017. Select "Yes or No", whichever is app Do not round intermediate computations a. Ansel should sell some of the stocks he owns with unrealized gains to offeet the $7,400 loss. b. Ansel will gain the most benefit by selling Header Company shares. If Ansel sells 440 of the Header corporation shares, he wall realize a $4,400 short-term capital gain. d. Ansel should buy some of the stocks he owns with unrealized gains to offset the $7.400 loss Ansel will lose the most benefit by selling Header Company shares. NextStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started