Answered step by step

Verified Expert Solution

Question

1 Approved Answer

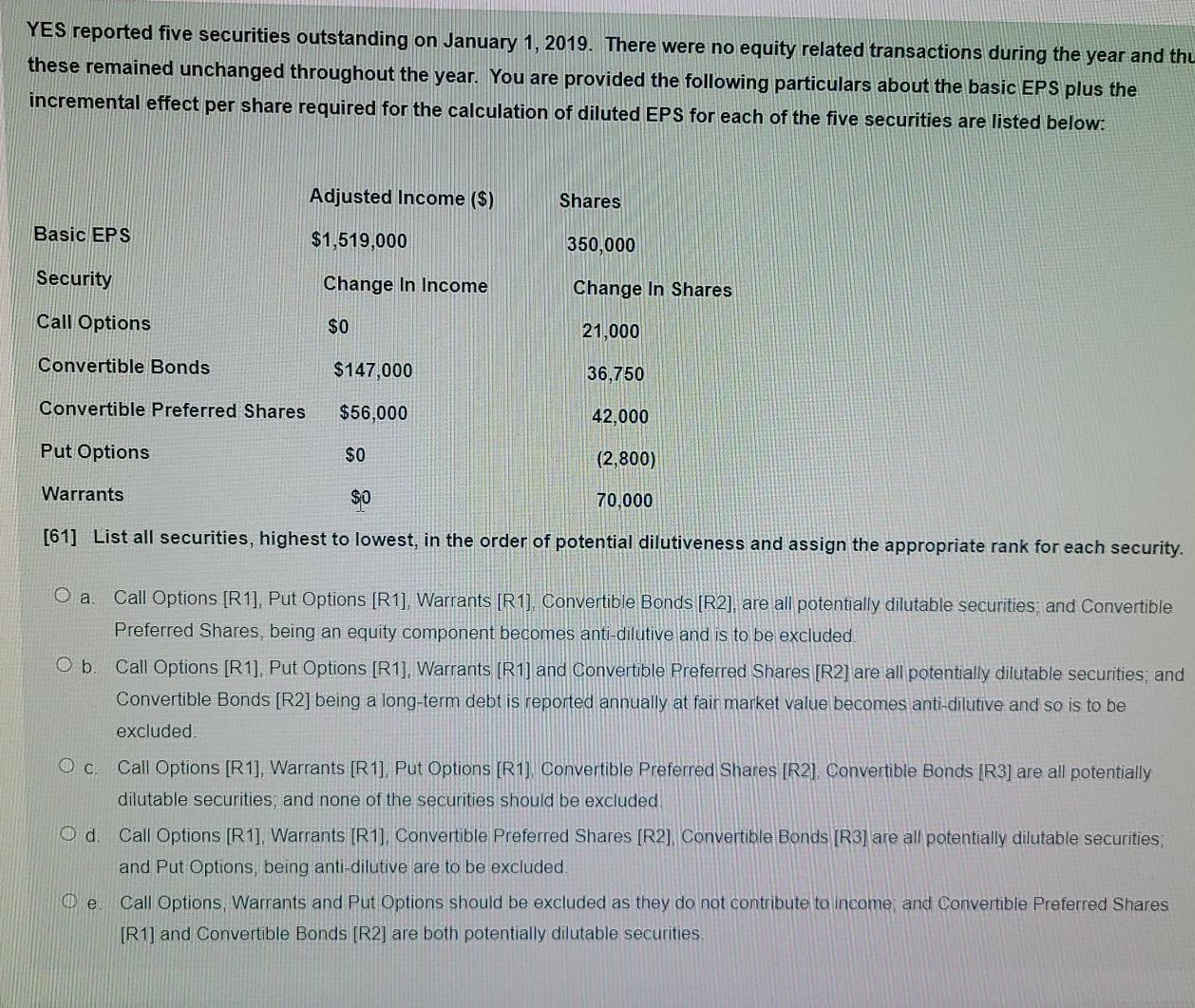

YES reported five securities outstanding on January 1, 2019. There were no equity related transactions during the year and the these remained unchanged throughout the

YES reported five securities outstanding on January 1, 2019. There were no equity related transactions during the year and the these remained unchanged throughout the year. You are provided the following particulars about the basic EPS plus the incremental effect per share required for the calculation of diluted EPS for each of the five securities are listed below: Adjusted Income ($) Shares Basic EPS $1,519,000 350,000 Security Change In Income Change In Shares Call Options $0 21,000 Convertible Bonds $147,000 36,750 Convertible Preferred Shares $56,000 42,000 Put Options $0 (2,800) Warrants $0 70,000 [61] List all securities, highest to lowest, in the order of potential dilutiveness and assign the appropriate rank for each security. . ob. Call Options [R1], Put Options (R1), Warrants (R1). Convertible Bonds (R2), are all potentially dilutable securities and Convertible Preferred Shares, being an equity component becomes anti-dilutive and is to be excluded Call Options [R1], Put Options (R1), Warrants (R1] and Convertible Preferred Shares [R2] are all potentially dilutable securities, and Convertible Bonds [R2] being a long-term debt is reported annually at fair market value becomes anti-dilutive and so is to be excluded . Call Options [R1], Warrants (R1). Put Options [R1] Convertible Preferred Shares (R2), Convertible Bonds [R3] are all potentially dilutable securities, and none of the securities should be excluded O d. Call Options (R1], Warrants (R1). Convertible Preferred Shares [R2), Convertible Bonds (R3) are all potentially dilutable securities, and Put Options, being anti-dilutive are to be excluded. Call Options, Warrants and Put Options should be excluded as they do not contribute to income, and Convertible Preferred Shares [R1] and Convertible Bonds [R2] are both potentially dilutable securities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started