Answered step by step

Verified Expert Solution

Question

1 Approved Answer

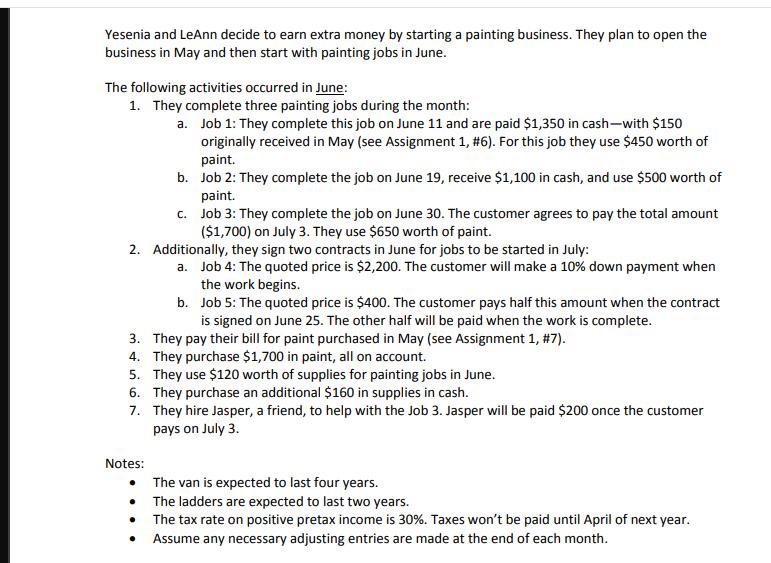

Yesenia and LeAnn decide to earn extra money by starting a painting business. They plan to open the business in May and then start

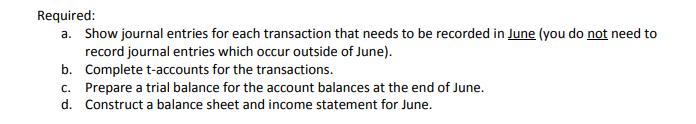

Yesenia and LeAnn decide to earn extra money by starting a painting business. They plan to open the business in May and then start with painting jobs in June. The following activities occurred in June: 1. They complete three painting jobs during the month: a. 2. Additionally, they sign two contracts in June for jobs to be started in July: a. Job 4: The quoted price is $2,200. The customer will make a 10% down payment when the work begins. b. Job 5: The quoted price is $400. The customer pays half this amount when the contract Job 1: They complete this job on June 11 and are paid $1,350 in cash-with $150 originally received in May (see Assignment 1, #6). For this job they use $450 worth of paint. b. Job 2: They complete the job on June 19, receive $1,100 in cash, and use $500 worth of paint. c. Job 3: They complete the job on June 30. The customer agrees to pay the total amount ($1,700) on July 3. They use $650 worth of paint. Notes: 3. They pay their bill for paint purchased in May (see Assignment 1, #7). 4. They purchase $1,700 in paint, all on account. 5. They use $120 worth of supplies for painting jobs in June. 6. They purchase an additional $160 in supplies in cash. 7. They hire Jasper, a friend, to help with the Job 3. Jasper will be paid $200 once the customer pays on July 3. is signed on June 25. The other half will be paid when the work is complete. . The van is expected to last four years. The ladders are expected to last two years. The tax rate on positive pretax income is 30%. Taxes won't be paid until April of next year. Assume any necessary adjusting entries are made at the end of each month. Required: a. Show journal entries for each transaction that needs to be recorded in June (you do not need to record journal entries which occur outside of June). b. Complete t-accounts for the transactions. c. Prepare a trial balance for the account balances at the end of June. d. Construct a balance sheet and income statement for June.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Journal Entries for June 1 Job 1 Debit Cash 1350 Debit Accounts Receivable 1200 1350 150 due in July Debit Cost of Goods Sold 450 Paint used Credit ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started