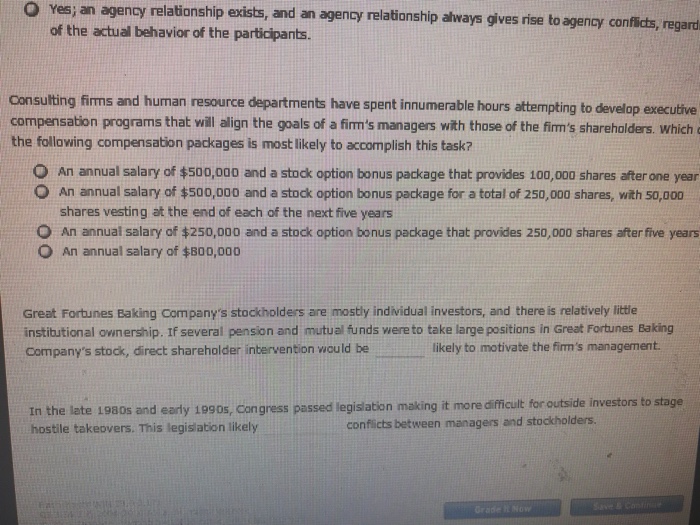

Yesj an agency relationship exists, and an agency relationship always gives rise to agency conficts, regard of the actual behavior of the participants. Consulting firms and human resource departments have spent innumerable hours attempting to develop executive compensation programs that vwill align the goals of a firm's managers with those of the fim's shareholders. which the follawing compensation packages is most likely to accomplish this task? O An annual salary of $500,000 and a stock option bonus package that provides 100,000 shares after one year O An annual salary of $500,000 and a stock option bonus package for a total of 250,000 shares, with 50,000 shares vesting at the end of each of the next five years O An annual salary of $250,000 and a stock option bonus package that provides 250,000 shares after five years O An annual salary of $800,000 Great Fortunes Baking Company's stockholders are mostly individual investors, and there is relatively little instibutional ownership. If several pension and mutual funds were to take large positions in Great Fortunes Baking Company's stock, direct shareholder intervention would be likely to motivate the firm's management In the late 1980s and early 19905, Congress passed legislation making it more difficult hostile takeovers. This legislation likely for outside investors to stage conflicts between managers and stockholders. Yesj an agency relationship exists, and an agency relationship always gives rise to agency conficts, regard of the actual behavior of the participants. Consulting firms and human resource departments have spent innumerable hours attempting to develop executive compensation programs that vwill align the goals of a firm's managers with those of the fim's shareholders. which the follawing compensation packages is most likely to accomplish this task? O An annual salary of $500,000 and a stock option bonus package that provides 100,000 shares after one year O An annual salary of $500,000 and a stock option bonus package for a total of 250,000 shares, with 50,000 shares vesting at the end of each of the next five years O An annual salary of $250,000 and a stock option bonus package that provides 250,000 shares after five years O An annual salary of $800,000 Great Fortunes Baking Company's stockholders are mostly individual investors, and there is relatively little instibutional ownership. If several pension and mutual funds were to take large positions in Great Fortunes Baking Company's stock, direct shareholder intervention would be likely to motivate the firm's management In the late 1980s and early 19905, Congress passed legislation making it more difficult hostile takeovers. This legislation likely for outside investors to stage conflicts between managers and stockholders