Answered step by step

Verified Expert Solution

Question

1 Approved Answer

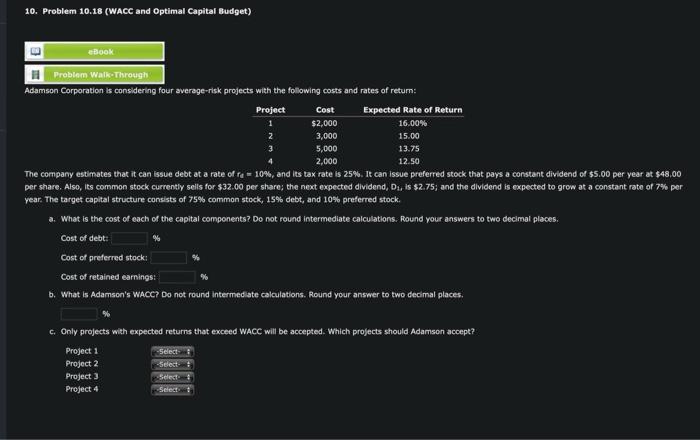

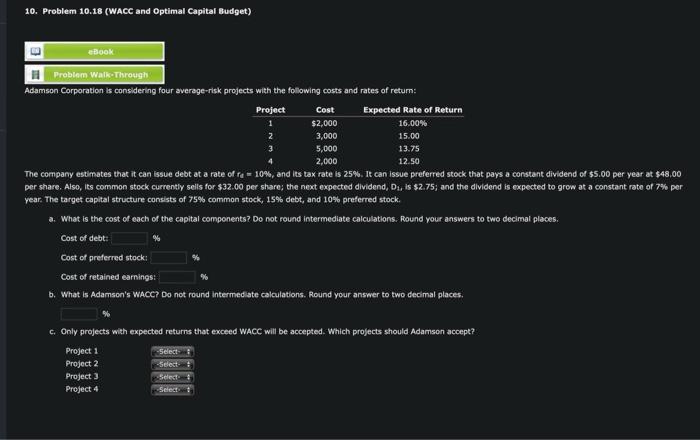

yet to find anyone that can get this 100% right. 10. Problem 10.18 (WAcC and Optimal Capital Eudget) Adamson Corporation is considering four average-risk projects

yet to find anyone that can get this 100% right.

10. Problem 10.18 (WAcC and Optimal Capital Eudget) Adamson Corporation is considering four average-risk projects with the following costs and rates of retum: \begin{tabular}{ccc} Project & Cost & Expected Rate of Return \\ \hline 1 & $2,000 & 16.00% \\ 2 & 3,000 & 15.00 \\ 3 & 5,000 & 13.75 \\ 4 & 2,000 & 12.50 \end{tabular} year. The target caplital structure consists of 75% common stock, 15% debt, and 10% preferred stock. a. What is the cost of each of the eapital components? Do not found intermediate calculations. Round your answers to two decimal places. b. What is Adamson's WACC? Do not round intermed ite calculations. Round your answer to two decimal places. c. Only projects with expected returns that exceed WAcC will be accepted. Which projects should Adamson accept? Projest 1 Project 2 Project 3 Project 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started