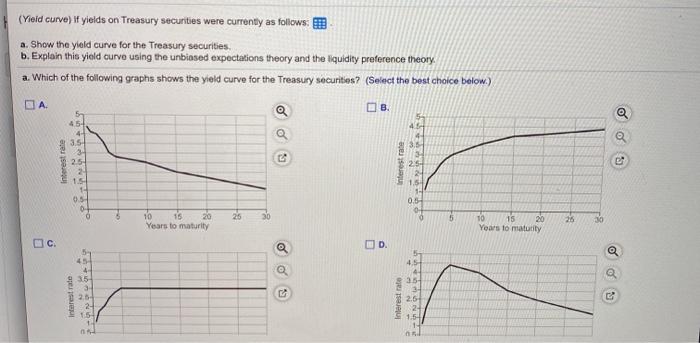

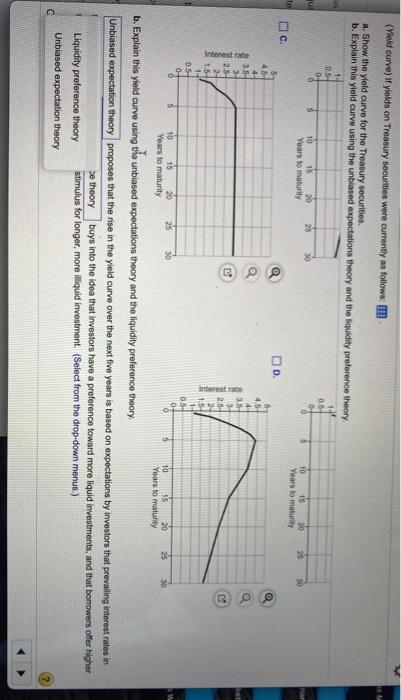

(Yield Curvo) if yields on Treasury securities were currenty as follows: a. Show the yield curve for the Treasury securities, b. Explain this yield curve using the unbiased expectations theory and the liquidity preference theory. a. Which of the following graphs shows the yield curve for the Treasury securities ? (Select the best choice below.) BA DB 5- 46 o o 3.5 Interest rate 4 3.5 3 25 2 1 1- 0.5 0 0 Bessa 25 1.5 1 0.5 25 30 O 5 25 10 10 15 20 Years to maturity 10 15 20 Years to maturity C. D. Q 5 45 4 35- 4 35- Interest rate 25 2- 15 1 Interest rate 1.57 (Mold curvo) If yields on Treasury securities were currently as follows: 10 15 20 Years to maturity 26 50 nar te a. Show the yield curve for the Treasury securities b. Explain this yield curve using the unbiased expectations theory and the liquidity preference theory 1 0.5 0 0.5 TO 15 20 2 0 Years to maturity 0 c. D 45 14 45 35 4 3- 3.5 2.5- 2.5- 24 1.5- 1.54 05 1 0- 054 0 10 15 20 25 30 Years to maturity Interest rate Interest rate 10 15 20 Years to maturity b. Explain this yield curve using the unbiased expectations theory and the liquidity preferenow theory. Unbiased expectation theory proposes that the rise in the yield curve over the next five years is based on expectations by investors that prevailing interest rates in se theory buys into the idea that investors have a preference toward more liquid investments, and that borrowers offer higher Liquidity preference theory stimulus for longer, more illiquid investment. (Select from the drop-down menus.) Unbiased expectation theory (Yield Curvo) if yields on Treasury securities were currenty as follows: a. Show the yield curve for the Treasury securities, b. Explain this yield curve using the unbiased expectations theory and the liquidity preference theory. a. Which of the following graphs shows the yield curve for the Treasury securities ? (Select the best choice below.) BA DB 5- 46 o o 3.5 Interest rate 4 3.5 3 25 2 1 1- 0.5 0 0 Bessa 25 1.5 1 0.5 25 30 O 5 25 10 10 15 20 Years to maturity 10 15 20 Years to maturity C. D. Q 5 45 4 35- 4 35- Interest rate 25 2- 15 1 Interest rate 1.57 (Mold curvo) If yields on Treasury securities were currently as follows: 10 15 20 Years to maturity 26 50 nar te a. Show the yield curve for the Treasury securities b. Explain this yield curve using the unbiased expectations theory and the liquidity preference theory 1 0.5 0 0.5 TO 15 20 2 0 Years to maturity 0 c. D 45 14 45 35 4 3- 3.5 2.5- 2.5- 24 1.5- 1.54 05 1 0- 054 0 10 15 20 25 30 Years to maturity Interest rate Interest rate 10 15 20 Years to maturity b. Explain this yield curve using the unbiased expectations theory and the liquidity preferenow theory. Unbiased expectation theory proposes that the rise in the yield curve over the next five years is based on expectations by investors that prevailing interest rates in se theory buys into the idea that investors have a preference toward more liquid investments, and that borrowers offer higher Liquidity preference theory stimulus for longer, more illiquid investment. (Select from the drop-down menus.) Unbiased expectation theory