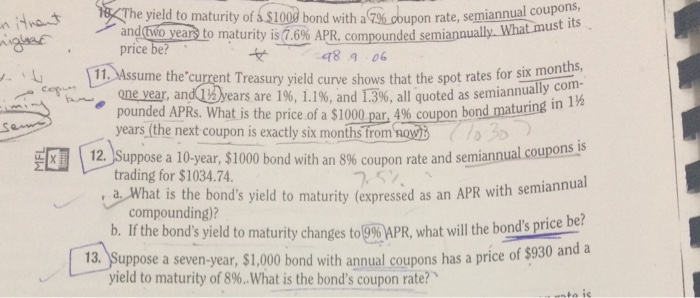

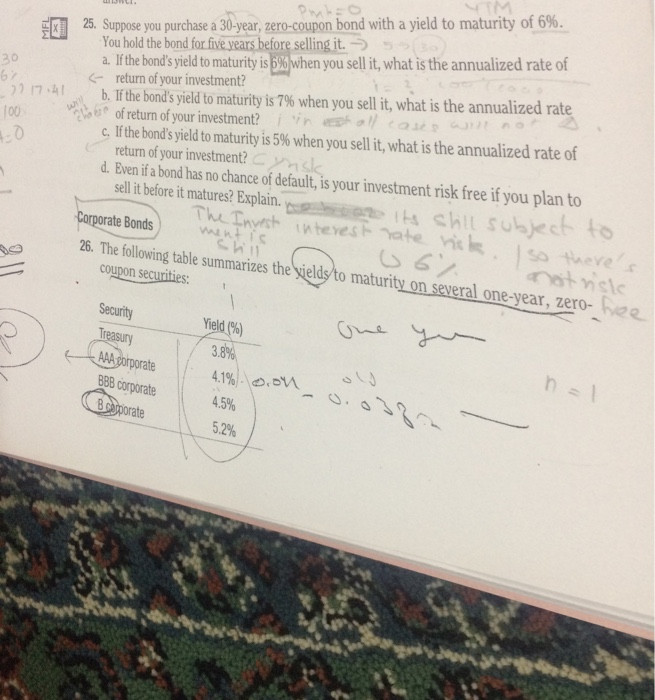

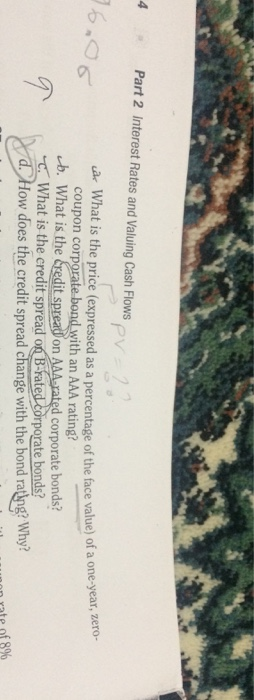

yield to maturity ofAS1000bond with aG96 obupon rate, semiannualaupoits andfwoven to maturity is 7.6% APR, compo price be? unded semia 48 06 the spot rates for six months, ears are 1%, 1.1%, and 13%, all quoted as semiannually in 1% 11. Assume the current Treasu e pounded APRs. What is the price of a$1000 par 4% coupon bon maturing in eer he one year, and ly years (the next coupon is exactly six months from sowi trading for $1034.74. l ( 12. Suppose a 10-year, $1000 bond with an 8% cou pon rate and semiannual coupons is What is the bond's yield to maturity (expressed as an APR with semiannua compounding)? b. Ifthebond''syieldtomaturityChanges to 0%APR whatwillthebond'spricebe? 13. Suppose a seven-year, $1,000 bond with annual coupons has a price of $930 a yield to maturity of 8%.What is the bond's-coupon rate?" 25, Suppse you purchase a 30 year, zero- coupon bond with a yield to maturity of 6% You hold the bond for five years before selling it.5 a. If the bond's yield to maturity is B9o when you sellit, what is the annualized rate of return of your investment? b. If the bond's yield to maturity is 7% when you sell it, what is the annualized rate ) ) 17-41- 100. .0 ,,restal/ en,, no v/ese, ofreturn ofyour investment? ca, C. If the bond's yield to maturity is 5% when you sell it, what is the annualized rate of return of your investment? d. Eveni a bond has no chance of default, is your investment risk free if you plan to ESate-vis k. ate Bonds so +heve ..c 26. The following table summarizes the sields to maturity on several one-year, zero- held(%) Yie BB corporate 45% 52% 4 Part 2 Iinterest Rates and Valuing Cash Flows pv ar What is the price (expressed as a percentage of the face value) of a one-year, zero- coupon corporate bond with an AAA rating? b. What is the Credit spreation What is the credit spread o B-ratedcorporate bonds d corporate bonds? How does the credit spread change with the bond raing? Why? n rate of 8% 10. The yield to maturity of a $1000 bond with a 7% coupon rate, semiannual coupons. and two years to maturity is 7.6% APR, compounded semiannually. What must its price be? 11. Assume the current Treasury yield curve shows that the spot rates for six months, one year, and 1 years are 1%, 1.1%, and 1.3%, all quoted as semiannually com- pounded APRs. What is the price of a $1000 par, 4% coupon bond maturing in l years (the next coupon is exactly six months from now) Suppose a 10-year, $1000 bond with an 8% coupon rate and semiannual coupons is trading for $1034 74 a. What is the bond's yield to maturity (expressed as an APR with semiannual 12. b. If the bond's yield to maturity changes to 9% APR, what will the bond's price be? Suppose a seven-year, $1,000 bond with annual coupons has a price of $930 and a yield to maturity of 8%, what is the bond's coupon rate? 13