Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Yield to Maturity You are considering investing $1000 for a three year period... You are considering investing $1.000 for a three-year period, beginning January 1.19%

Yield to Maturity

You are considering investing $1000 for a three year period...

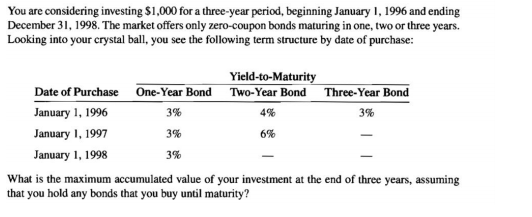

You are considering investing $1.000 for a three-year period, beginning January 1.19% and ending December 31. 1998. The market offers only zero-coupon bonds maturing in one. two or three years. Looking into your crystal ball, you see the following term structure by date of purchase: What is the maximum accumulated value of your investment at the end of three yean, assuming that you hold any bonds that you buy until maturity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started